New Jersey Tax Payment Plan Form

What is the New Jersey Tax Payment Plan

The New Jersey Tax Payment Plan is a structured program designed to assist taxpayers in managing their state tax obligations. It allows individuals and businesses to pay their taxes in installments rather than in a lump sum, making it easier to handle financial responsibilities. This plan is particularly beneficial for those who may be facing financial difficulties or unexpected expenses, enabling them to stay compliant with state tax laws while avoiding penalties.

How to use the New Jersey Tax Payment Plan

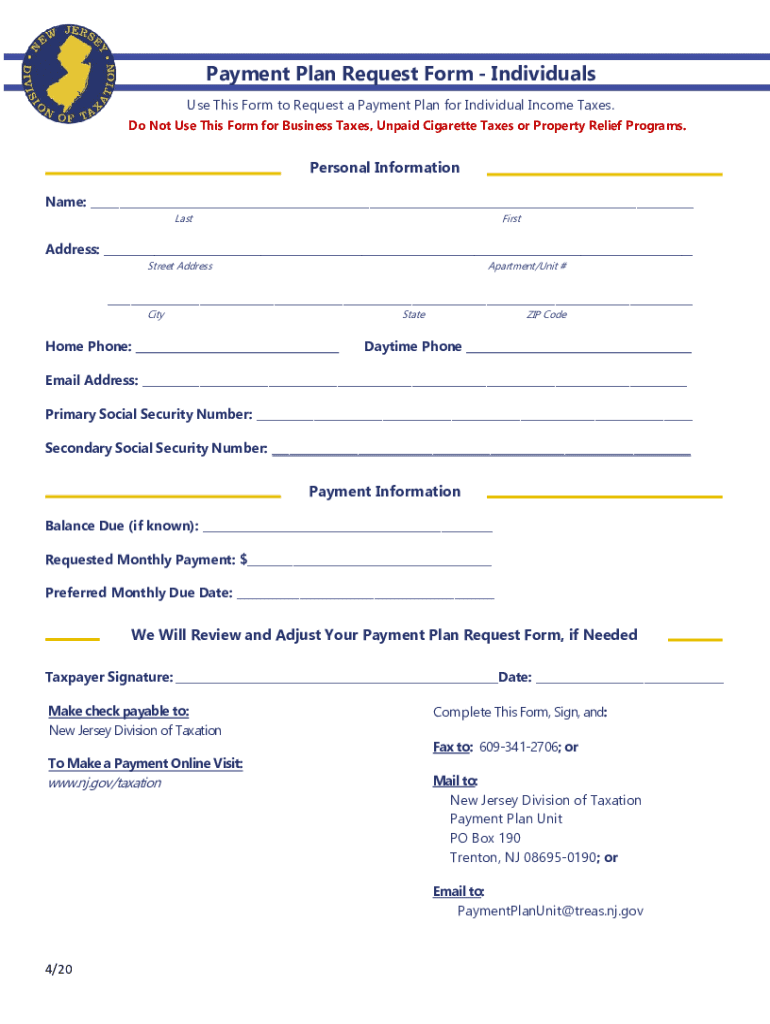

Utilizing the New Jersey Tax Payment Plan involves several straightforward steps. First, taxpayers must assess their outstanding tax liabilities to determine the total amount owed. Next, they can fill out the nj payment plan request form, which outlines the payment terms and conditions. Once submitted, the New Jersey Division of Taxation reviews the request and notifies the taxpayer of approval or any necessary adjustments. Upon acceptance, taxpayers can begin making scheduled payments according to the agreed-upon plan.

Steps to complete the New Jersey Tax Payment Plan

Completing the New Jersey Tax Payment Plan requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including previous tax returns and current income statements.

- Calculate the total amount owed in state taxes.

- Fill out the nj payment plan request form accurately, ensuring all information is correct.

- Submit the form through the designated method, either online, by mail, or in-person.

- Await confirmation from the New Jersey Division of Taxation regarding the approval of the payment plan.

- Begin making payments as per the established schedule.

Legal use of the New Jersey Tax Payment Plan

The legal use of the New Jersey Tax Payment Plan is governed by state tax regulations. Taxpayers must adhere to the terms set forth in the payment plan to avoid penalties or legal repercussions. This includes making timely payments and maintaining communication with the tax authorities. If circumstances change, taxpayers may request modifications to their plan, but they must do so in accordance with the established legal framework.

Eligibility Criteria

To qualify for the New Jersey Tax Payment Plan, taxpayers must meet specific criteria set by the New Jersey Division of Taxation. Generally, eligibility includes having a valid tax liability, demonstrating financial hardship, and being in good standing with previous tax obligations. It is essential for applicants to provide accurate information on the nj payment plan request form to facilitate the review process.

Required Documents

When applying for the New Jersey Tax Payment Plan, certain documents are necessary to support the request. These may include:

- Recent tax returns

- Proof of income, such as pay stubs or bank statements

- Documentation of expenses, including bills and loan statements

- Any prior correspondence with the New Jersey Division of Taxation

Having these documents ready can expedite the application process and enhance the chances of approval.

Quick guide on how to complete nj state income tax payment plan form

Complete New Jersey Tax Payment Plan effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage New Jersey Tax Payment Plan on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and electronically sign New Jersey Tax Payment Plan with ease

- Obtain New Jersey Tax Payment Plan and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign New Jersey Tax Payment Plan and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

I worked in two different states this year (and two different companies), will I have to fill out state income tax forms for both?

A2A BUT We need more information to give you an accurate answer. There are 50 different states and 43 of them have some form of individual income tax laws, so that is 1,849 different possibilities of how to answer this question. That is before we even factor in that you did not tell us how long you lived in either state, which could be a day or 364 days.I can give you the probably answer which is yes you will most likely need to file with two states this year. Take a look at your two W2’s and at the bottom you will see what state(s) your earnings were reported to. If the W2’s have different states then absolutely you should file a return with both states, because what is on the W2 will be presumed to be accurate, even if your presence in the state did not actually rise to the level of needing to file. The biggest question will become if you are filing as a resident, non-resident or part-year resident. Your filing status can make a difference in how much tax you owe and unfortunately it is not as simple as just thinking you lived in a place for only part of the year so you were automatically a part-year resident.This is one of those situations where I would advise you that your taxes this year are complex enough that you really need to go to a professional to have your taxes done. That person should be able to review the specifics of your situation and advise you how to file.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

Create this form in 5 minutes!

How to create an eSignature for the nj state income tax payment plan form

How to make an eSignature for the Nj State Income Tax Payment Plan Form online

How to generate an eSignature for the Nj State Income Tax Payment Plan Form in Google Chrome

How to generate an electronic signature for putting it on the Nj State Income Tax Payment Plan Form in Gmail

How to generate an electronic signature for the Nj State Income Tax Payment Plan Form right from your smartphone

How to create an electronic signature for the Nj State Income Tax Payment Plan Form on iOS devices

How to create an electronic signature for the Nj State Income Tax Payment Plan Form on Android OS

People also ask

-

What is the nj payment plan request form?

The nj payment plan request form is a document designed to assist individuals and businesses in formally requesting a payment plan for outstanding obligations. By utilizing this form, you can clearly outline your payment intentions and facilitate smoother financial arrangements.

-

How do I access the nj payment plan request form?

You can easily access the nj payment plan request form through the airSlate SignNow platform. Simply navigate to our document template section and search for the nj payment plan request form, ensuring a quick and convenient process for your financial request.

-

What are the benefits of using the nj payment plan request form?

Using the nj payment plan request form streamlines your payment negotiations and provides clear documentation of your request. It enhances communication with creditors and keeps a record of your payment agreement, reducing misunderstandings and enhancing your financial management.

-

Is there a cost associated with using the nj payment plan request form?

The nj payment plan request form is part of the airSlate SignNow service, which offers various pricing plans to cater to different business needs. By choosing a plan, you gain access to this form along with other features that enhance document management and eSigning capabilities.

-

Can I customize the nj payment plan request form?

Yes, the nj payment plan request form can be customized to fit your specific needs. With airSlate SignNow, you can edit the form fields and add your branding, ensuring it meets your unique requirements while maintaining professionalism.

-

How secure is the nj payment plan request form?

AirSlate SignNow prioritizes security, providing a secure environment for your nj payment plan request form. All documents are protected with encryption and secure access controls, guaranteeing that your financial information remains confidential throughout the process.

-

Can I track the status of my nj payment plan request form?

Yes, airSlate SignNow allows you to track the status of your nj payment plan request form. You will receive notifications regarding the document's progress, making it easier to monitor when your request is viewed and signed by the relevant parties.

Get more for New Jersey Tax Payment Plan

- Welcome to the illinois state capitol cyberdrive illinois form

- Compilation of shellfish laws and regulations digital maine form

- Page 1 4 transplantrelay permit application august 11 form

- Fillable online behavioralhealthresources referral bformb

- Data use agreement for academic year 2019 20 form

- Pd 407 161 applicant record checkindd form

- Apd 29 form

- Application for license to carry a concealed umatilla county form

Find out other New Jersey Tax Payment Plan

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now