GC 400C9 Schedule C, Disbursements, Property Sale Form

What is the GC 400C9 Schedule C, Disbursements, Property Sale

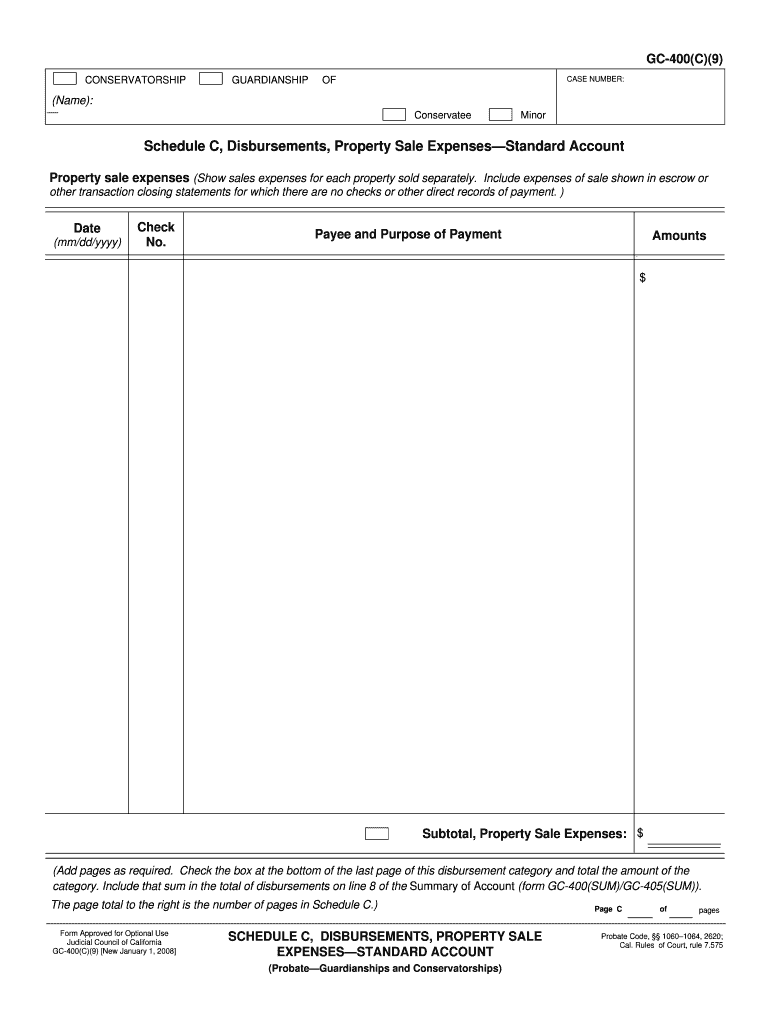

The GC 400C9 Schedule C, Disbursements, Property Sale is a specific form used primarily for reporting disbursements related to property sales. This form is essential for individuals or businesses that have engaged in real estate transactions and need to accurately report their financial activities to the IRS. It helps in detailing the income and expenses associated with property sales, ensuring compliance with tax regulations.

Steps to complete the GC 400C9 Schedule C, Disbursements, Property Sale

Completing the GC 400C9 Schedule C involves several key steps:

- Gather all necessary financial documents related to the property sale, including purchase agreements and closing statements.

- Fill in the identification section with your name, address, and tax identification number.

- Detail the disbursements associated with the property sale, ensuring to categorize them accurately.

- Calculate the total income from the property sale and subtract the total disbursements to determine your net gain or loss.

- Review the completed form for accuracy before submission.

Legal use of the GC 400C9 Schedule C, Disbursements, Property Sale

The GC 400C9 Schedule C is legally binding when completed accurately and submitted to the IRS. It must comply with relevant tax laws and regulations to ensure that the information provided is valid. This includes adhering to the guidelines set forth by the IRS regarding property sales and disbursements. Proper completion of this form helps avoid potential legal issues and penalties associated with inaccurate reporting.

Examples of using the GC 400C9 Schedule C, Disbursements, Property Sale

Common scenarios for using the GC 400C9 Schedule C include:

- A homeowner selling a property and needing to report the sale and related costs.

- A real estate investor documenting expenses incurred during the sale of investment properties.

- A business entity selling commercial real estate and detailing the financial transactions for tax purposes.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the GC 400C9 Schedule C. Typically, the form must be submitted alongside your annual tax return, which is due on April fifteenth each year. If you require an extension, ensure that you file the appropriate forms to avoid penalties.

Required Documents

To complete the GC 400C9 Schedule C accurately, you will need the following documents:

- Closing statements from the property sale.

- Receipts for any disbursements incurred during the sale.

- Previous tax returns, if applicable, to reference prior financial information.

Quick guide on how to complete gc 400c9 schedule c disbursements property sale

Complete GC 400C9 Schedule C, Disbursements, Property Sale effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, alter, and eSign your documents promptly without interruptions. Handle GC 400C9 Schedule C, Disbursements, Property Sale on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to alter and eSign GC 400C9 Schedule C, Disbursements, Property Sale without any hassle

- Find GC 400C9 Schedule C, Disbursements, Property Sale and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text (SMS), invitation link, or download it to your computer.

Forget about misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign GC 400C9 Schedule C, Disbursements, Property Sale and ensure reliable communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is GC 400C9 Schedule C, Disbursements, Property Sale?

GC 400C9 Schedule C, Disbursements, Property Sale is a crucial document that outlines the financial aspects of property transactions, including disbursements related to sales. This schedule plays a vital role in tax reporting and ensures compliance with regulations. Understanding this schedule can signNowly enhance your property sale processes.

-

How does airSlate SignNow facilitate the completion of GC 400C9 Schedule C?

airSlate SignNow provides an intuitive platform that simplifies the creation and signing of the GC 400C9 Schedule C, Disbursements, Property Sale. Users can easily fill out, eSign, and share documents, ensuring a streamlined workflow. This helps in managing disbursements efficiently and accurately.

-

Is airSlate SignNow cost-effective for managing GC 400C9 Schedule C?

Yes, airSlate SignNow offers a cost-effective solution for managing all aspects of the GC 400C9 Schedule C, Disbursements, Property Sale. With various pricing plans, businesses can choose the package that best fits their budget while still gaining access to powerful document management features. This ensures that you can manage property sales without breaking the bank.

-

Can I integrate airSlate SignNow with other software for GC 400C9 Schedule C processes?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, enhancing your workflows related to the GC 400C9 Schedule C, Disbursements, Property Sale. Whether you’re using CRM systems, accounting software, or project management tools, these integrations allow for better data management and communication.

-

What are the key features of airSlate SignNow that support GC 400C9 Schedule C transactions?

Key features of airSlate SignNow include customizable templates, electronic signatures, and document sharing, all tailored for GC 400C9 Schedule C, Disbursements, Property Sale. These functionalities enable users to expedite the property sale process while maintaining accuracy and legal compliance. Robust security measures also ensure that sensitive information is protected.

-

How does airSlate SignNow enhance collaboration for GC 400C9 Schedule C documentation?

airSlate SignNow enhances collaboration for GC 400C9 Schedule C, Disbursements, Property Sale by allowing multiple users to work on documents simultaneously. Team members can leave comments, track changes, and eSign directly within the platform. This collaborative approach saves time and aligns all parties involved in the property sale process.

-

What benefits does using airSlate SignNow provide for handling GC 400C9 Schedule C?

Using airSlate SignNow to handle GC 400C9 Schedule C, Disbursements, Property Sale offers numerous benefits, including time savings, reduced errors, and improved compliance. The user-friendly interface ensures that anyone can quickly learn to use it effectively. Additionally, the digital format streamlines record-keeping and tracking of disbursements.

Get more for GC 400C9 Schedule C, Disbursements, Property Sale

Find out other GC 400C9 Schedule C, Disbursements, Property Sale

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free