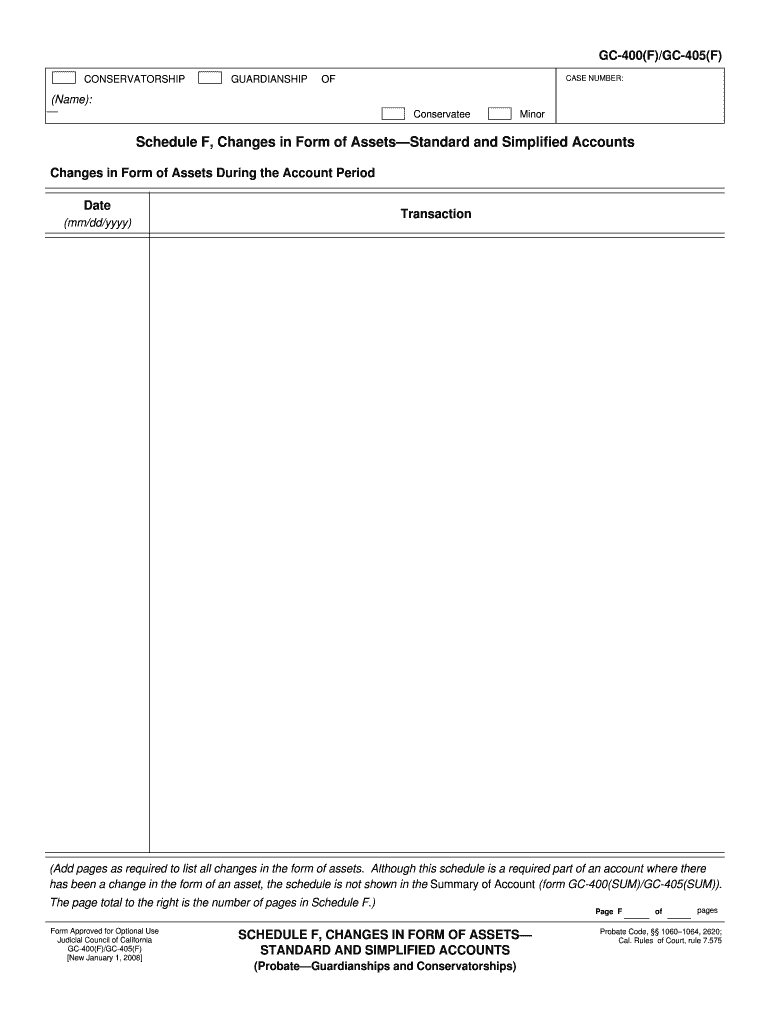

GC 400F GC 405F Schedule F, Changes in Form of

What is the GC 400F GC 405F Schedule F, Changes In Form Of

The GC 400F and GC 405F Schedule F forms are essential documents used in the context of tax reporting for specific types of income and deductions. These forms are primarily utilized by individuals and businesses to report changes in income or expenses related to farming and fishing activities. The changes in form of refer to any modifications or updates made to the information previously reported, ensuring compliance with current tax regulations.

How to use the GC 400F GC 405F Schedule F, Changes In Form Of

Using the GC 400F and GC 405F Schedule F forms involves several straightforward steps. Initially, gather all necessary financial records related to your farming or fishing activities. This includes income statements, expense receipts, and any prior versions of the forms. Next, carefully fill out the forms, ensuring all changes are accurately reflected. It is crucial to follow the guidelines provided by the IRS to avoid errors that could lead to penalties. Once completed, submit the forms as directed, either electronically or via traditional mail.

Steps to complete the GC 400F GC 405F Schedule F, Changes In Form Of

Completing the GC 400F and GC 405F Schedule F forms involves a systematic approach:

- Gather all relevant financial documents, including income and expense records.

- Review previous submissions to identify the changes that need to be reported.

- Accurately fill in the forms, ensuring all updated information is clearly stated.

- Double-check for any errors or omissions to ensure compliance with IRS regulations.

- Submit the completed forms through the appropriate channels, keeping copies for your records.

Legal use of the GC 400F GC 405F Schedule F, Changes In Form Of

The legal use of the GC 400F and GC 405F Schedule F forms is governed by IRS regulations. These forms must be filled out accurately to ensure they are legally binding. Any changes in the reported information should be documented correctly to avoid potential legal issues. It is essential to retain copies of submitted forms and any supporting documentation, as they may be required for future audits or inquiries by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the GC 400F and GC 405F Schedule F forms are critical to ensure compliance with tax regulations. Typically, these forms must be submitted by the annual tax filing deadline, which is usually April fifteenth for individual taxpayers. However, extensions may be available in certain circumstances. It is advisable to check the IRS website or consult with a tax professional for the most current deadlines and any changes that may affect your filing schedule.

Required Documents

To complete the GC 400F and GC 405F Schedule F forms, specific documents are required. These include:

- Income statements related to farming or fishing activities.

- Receipts for expenses incurred during the tax year.

- Previous versions of the GC 400F and GC 405F forms, if applicable.

- Any additional documentation that supports the reported changes.

Quick guide on how to complete gc 400f gc 405f schedule f changes in form of

Effortlessly Prepare GC 400F GC 405F Schedule F, Changes In Form Of on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without hassles. Manage GC 400F GC 405F Schedule F, Changes In Form Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign GC 400F GC 405F Schedule F, Changes In Form Of with Ease

- Locate GC 400F GC 405F Schedule F, Changes In Form Of and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that require reprinting new document copies. airSlate SignNow takes care of all your document management needs in a few clicks from any device you choose. Edit and eSign GC 400F GC 405F Schedule F, Changes In Form Of and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of GC 400F GC 405F Schedule F, Changes In Form Of?

The GC 400F GC 405F Schedule F, Changes In Form Of offers essential features such as customizable templates, real-time collaboration, and secure document storage. These functionalities streamline workflow and enhance productivity, making it easier for businesses to manage their documents efficiently.

-

How does airSlate SignNow support the GC 400F GC 405F Schedule F, Changes In Form Of?

airSlate SignNow provides a user-friendly interface allowing businesses to effortlessly create, sign, and manage their GC 400F GC 405F Schedule F, Changes In Form Of documents. With integrated eSignature capabilities, users can ensure that their documents are legally binding and secure.

-

Is there a pricing plan specific for the GC 400F GC 405F Schedule F, Changes In Form Of?

Yes, airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses utilizing the GC 400F GC 405F Schedule F, Changes In Form Of. These plans are designed for affordability without compromising functionality, ensuring that even small businesses can benefit from our solutions.

-

What advantages does using GC 400F GC 405F Schedule F, Changes In Form Of provide?

Utilizing the GC 400F GC 405F Schedule F, Changes In Form Of allows businesses to improve document accuracy and efficiency. The streamlined process reduces the likelihood of errors and speeds up transactions, leading to heightened customer satisfaction and increased operational effectiveness.

-

Can GC 400F GC 405F Schedule F, Changes In Form Of be integrated with other software?

Absolutely! The GC 400F GC 405F Schedule F, Changes In Form Of can integrate seamlessly with various third-party applications, enhancing your workflow. This means you can connect the solution with your existing tools for improved data management and collaboration.

-

How secure is the GC 400F GC 405F Schedule F, Changes In Form Of process?

Security is a top priority for airSlate SignNow. Our GC 400F GC 405F Schedule F, Changes In Form Of process uses industry-standard encryption and various security measures to ensure that your documents are protected from unauthorized access.

-

What types of businesses can benefit from GC 400F GC 405F Schedule F, Changes In Form Of?

The GC 400F GC 405F Schedule F, Changes In Form Of is suitable for businesses of all sizes—be it small startups or large enterprises. Any organization that relies on document management and electronic signatures can leverage this tool to simplify and enhance their operations.

Get more for GC 400F GC 405F Schedule F, Changes In Form Of

- Recertification update spectrum enterprises form

- Music therapy intake form

- Indian passport surrender certificate sample form

- Ponyexpressbsa form

- Tceq large construction site notice form

- Title order number form

- All coast guard military personnel shall complete sections 1 5 read instructions on back before starting and submit to form

- Frozen mini pizza score sheet exhibitor name form

Find out other GC 400F GC 405F Schedule F, Changes In Form Of

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF