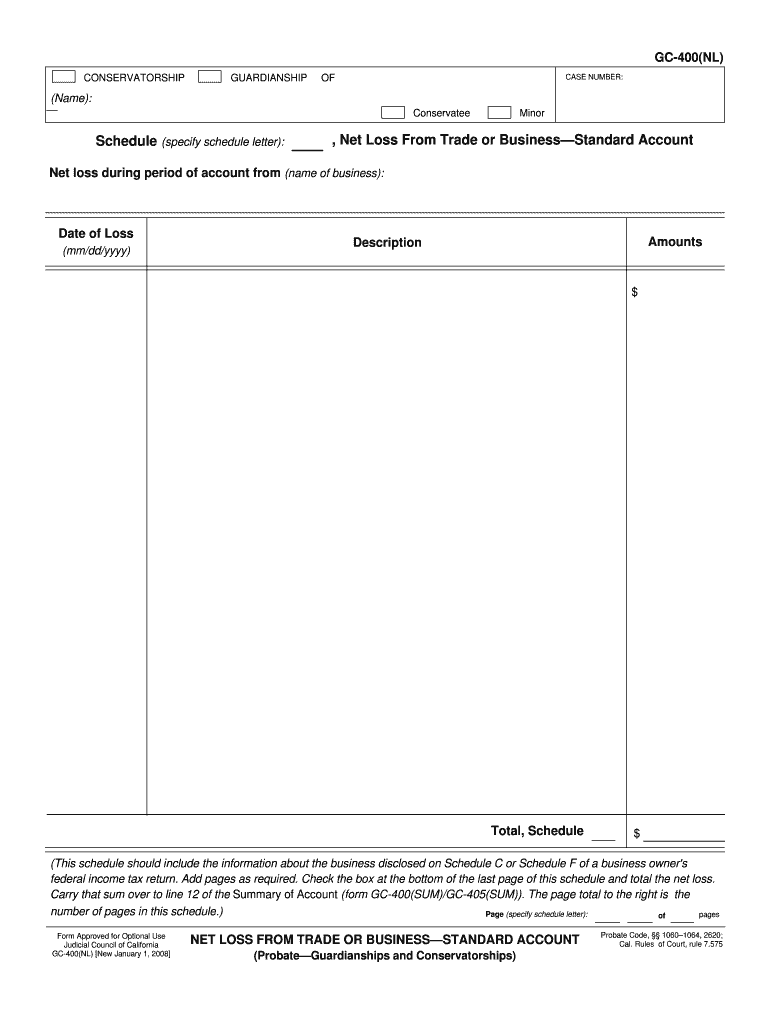

, Net Loss from Trade or BusinessStandard Account Form

What is the Net Loss From Trade Or Business Standard Account

The Net Loss From Trade Or Business Standard Account form is a tax document used primarily by individuals and businesses to report losses incurred from their trade or business activities. This form is crucial for taxpayers who need to offset their taxable income with losses, thereby potentially reducing their overall tax liability. Understanding this form is essential for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the Net Loss From Trade Or Business Standard Account

Completing the Net Loss From Trade Or Business Standard Account involves several key steps:

- Gather all relevant financial documents, including income statements and expense records.

- Calculate total income from your trade or business activities.

- Determine total expenses and losses incurred during the tax year.

- Subtract total expenses from total income to ascertain the net loss.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for accuracy before submission.

Legal Use of the Net Loss From Trade Or Business Standard Account

The legal use of the Net Loss From Trade Or Business Standard Account is governed by IRS guidelines. This form must be completed in accordance with federal tax laws to ensure that the reported losses are legitimate and justifiable. Proper documentation and record-keeping are essential to support the claims made on this form, as failure to comply with IRS regulations can result in penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Net Loss From Trade Or Business Standard Account typically align with the overall tax filing deadlines set by the IRS. Generally, individual taxpayers must file their returns by April fifteenth of each year. If additional time is needed, taxpayers may request an extension, but it is crucial to understand that any taxes owed must still be paid by the original deadline to avoid penalties.

Examples of Using the Net Loss From Trade Or Business Standard Account

Examples of using the Net Loss From Trade Or Business Standard Account include:

- A self-employed individual who incurs significant expenses in starting a new business may report these losses to offset other income.

- A small business that experiences a downturn due to market conditions can use this form to report losses and reduce taxable income.

- Investors in real estate who face losses due to property depreciation can also utilize this form to claim their losses.

Required Documents

When completing the Net Loss From Trade Or Business Standard Account, several documents are typically required to substantiate the claims made on the form:

- Income statements detailing revenue generated from business activities.

- Expense receipts and invoices that outline costs incurred during the tax year.

- Bank statements that reflect business transactions.

- Any previous tax returns that may help in calculating current losses.

Who Issues the Form

The Net Loss From Trade Or Business Standard Account form is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and tax law enforcement in the United States. Taxpayers must ensure they are using the most current version of the form as provided by the IRS to maintain compliance with tax regulations.

Quick guide on how to complete net loss from trade or businessstandard account

Complete , Net Loss From Trade Or BusinessStandard Account seamlessly on any device

Managing documents online has gained immense popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage , Net Loss From Trade Or BusinessStandard Account on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest method to edit and eSign , Net Loss From Trade Or BusinessStandard Account effortlessly

- Locate , Net Loss From Trade Or BusinessStandard Account and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure confidential information with features that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your preference. Modify and eSign , Net Loss From Trade Or BusinessStandard Account and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Net Loss From Trade Or BusinessStandard Account?

A Net Loss From Trade Or BusinessStandard Account refers to the financial status where the expenses of running a business exceed its revenues. This can occur for various reasons, including operational challenges or market conditions. Understanding your net loss is crucial for making informed decisions about your business strategies.

-

How does airSlate SignNow help manage documents related to Net Loss From Trade Or BusinessStandard Account?

airSlate SignNow allows businesses to efficiently prepare, send, and eSign documents that track expenses and revenues related to a Net Loss From Trade Or BusinessStandard Account. The platform simplifies documentation, ensuring you have all the necessary records for financial assessments. Tracking these documents digitally enhances accuracy and saves time.

-

What are the pricing options for businesses managing a Net Loss From Trade Or BusinessStandard Account?

airSlate SignNow offers flexible pricing plans suitable for businesses dealing with a Net Loss From Trade Or BusinessStandard Account. Whether you are a small startup or an established corporation, you can choose a plan that meets your budget and needs. This cost-effective solution helps you streamline documentation processes without straining your finances.

-

What features of airSlate SignNow are beneficial for addressing a Net Loss From Trade Or BusinessStandard Account?

Key features of airSlate SignNow include document templates, customizable workflows, and secure eSigning options, all of which are beneficial when managing a Net Loss From Trade Or BusinessStandard Account. These features facilitate efficient workflows and reduce errors, thereby enhancing your business's overall financial management. Keeping accurate records digitally helps mitigate losses.

-

What are the advantages of using airSlate SignNow for businesses facing Net Loss From Trade Or BusinessStandard Account?

Using airSlate SignNow provides signNow advantages, such as increased efficiency, cost savings, and better document management for businesses facing a Net Loss From Trade Or BusinessStandard Account. The platform allows for fast document processing and easy collaboration, which can be vital in cost-sensitive situations. Empowering teams with these tools enhances productivity during challenging financial periods.

-

Can airSlate SignNow integrate with accounting software to track Net Loss From Trade Or BusinessStandard Account?

Yes, airSlate SignNow seamlessly integrates with various accounting software to help track your Net Loss From Trade Or BusinessStandard Account. This integration allows for real-time updates and more accurate financial reporting. By syncing documents and data across platforms, you can manage your financials more effectively, streamlining the process.

-

Is airSlate SignNow suitable for small businesses dealing with Net Loss From Trade Or BusinessStandard Account?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it a great fit for small businesses managing a Net Loss From Trade Or BusinessStandard Account. The platform offers essential features without overwhelming complexity, enabling small businesses to maintain their documentation needs efficiently. This accessibility is vital for businesses striving to recover and stabilize.

Get more for , Net Loss From Trade Or BusinessStandard Account

Find out other , Net Loss From Trade Or BusinessStandard Account

- Can I Sign Presentation

- eSign PDF Easy

- eSign PDF Safe

- eSign Word Online

- How To eSign PDF

- How Do I eSign PDF

- Help Me With eSign PDF

- Can I eSign PDF

- eSign Word Computer

- How To eSign Word

- Can I eSign Word

- eSign Document Online

- eSign Document Computer

- eSign Word Free

- eSign Document Mobile

- eSign Document Free

- eSign Document Secure

- eSign Document Simple

- eSign Document Easy

- How To eSign Document