Irs Form 741 2022

What is the IRS Form 741?

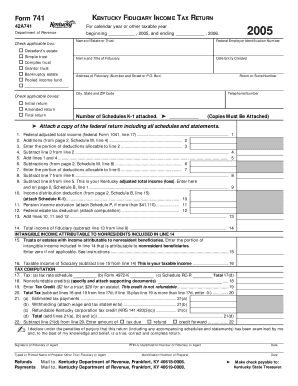

The IRS Form 741 is a tax form used by the state of Kentucky for reporting income from estates and trusts. This form is essential for fiduciaries who manage estates or trusts, ensuring that income generated is reported accurately to the state. It is specifically designed for the tax year 2016, capturing details about the income, deductions, and credits applicable to the estate or trust. Understanding this form is crucial for compliance with state tax regulations and for the proper management of estate assets.

How to Use the IRS Form 741

Using the IRS Form 741 involves several key steps to ensure accurate completion. First, gather all necessary financial documents related to the estate or trust, including income statements, expense receipts, and prior tax returns. Next, fill out the form by entering the required information, such as the name of the estate or trust, the fiduciary's details, and the income earned during the tax year. Be sure to follow the specific instructions provided with the form to avoid errors. Once completed, the form must be submitted to the appropriate state tax authority.

Steps to Complete the IRS Form 741

Completing the IRS Form 741 requires careful attention to detail. Here are the steps to follow:

- Obtain the 2016 Form 741 from the Kentucky Department of Revenue website or other authorized sources.

- Fill in the identifying information, including the name and address of the estate or trust and the fiduciary's contact details.

- Report all income received by the estate or trust, including dividends, interest, and rental income.

- List all applicable deductions, such as administrative expenses and distributions to beneficiaries.

- Calculate the taxable income and any tax owed or refund due.

- Review the completed form for accuracy before submission.

Legal Use of the IRS Form 741

The IRS Form 741 must be used in compliance with state tax laws. It is legally binding when filled out accurately and submitted on time. Failure to comply with the requirements can lead to penalties, including fines and interest on unpaid taxes. It is important for fiduciaries to understand their legal obligations when managing the income of estates and trusts. Utilizing digital tools for completion can enhance accuracy and ensure compliance with eSignature regulations.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 741 are crucial for maintaining compliance with tax regulations. For the 2016 tax year, the form typically must be filed by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Fiduciaries should be aware of these deadlines to avoid late fees and penalties. Keeping track of any changes in state tax law is also important to ensure timely filing.

Form Submission Methods

The IRS Form 741 can be submitted through various methods, including online submission, mail, or in-person delivery. For online submissions, ensure that the digital platform used is compliant with eSignature laws and provides a secure method for transmitting sensitive information. If submitting by mail, use a reliable postal service and consider tracking the submission to confirm delivery. In-person submissions may be made at designated tax offices. Each method has its own advantages, so choose the one that best suits your needs.

Quick guide on how to complete irs form 741

Effortlessly Prepare Irs Form 741 on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdups. Manage Irs Form 741 on any device using airSlate SignNow’s Android or iOS applications and enhance your document-driven processes today.

The Easiest Way to Alter and Electronically Sign Irs Form 741

- Locate Irs Form 741 and then click Get Form to commence.

- Make use of the available tools to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it onto your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors requiring new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Irs Form 741 and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 741

Create this form in 5 minutes!

How to create an eSignature for the irs form 741

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2016 Form 741 Kentucky and why is it important?

The 2016 Form 741 Kentucky is used to report the income and calculate the liability for corporations in Kentucky. It is essential for compliance with state tax regulations, helping businesses understand their tax obligations and ensuring timely filing to avoid penalties.

-

How can airSlate SignNow help me with the 2016 Form 741 Kentucky?

airSlate SignNow simplifies the process of filling out and submitting the 2016 Form 741 Kentucky. Our platform allows you to easily eSign the form and send it securely, streamlining your tax filing process for better efficiency and compliance.

-

Is airSlate SignNow a cost-effective solution for managing the 2016 Form 741 Kentucky?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage the 2016 Form 741 Kentucky. With competitive pricing plans, you can save time and reduce costs associated with traditional document management and eSigning.

-

What features does airSlate SignNow provide for the 2016 Form 741 Kentucky?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure eSigning specifically designed for the 2016 Form 741 Kentucky. These features ensure a streamlined process that enhances productivity and accuracy.

-

Can airSlate SignNow integrate with other software for handling the 2016 Form 741 Kentucky?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software to facilitate the completion of the 2016 Form 741 Kentucky. This integration helps consolidate your tools, ensuring a single platform for all your document needs.

-

What are the benefits of using airSlate SignNow for the 2016 Form 741 Kentucky?

Using airSlate SignNow for the 2016 Form 741 Kentucky offers numerous benefits, including reduced turnaround time and increased security for your sensitive tax documents. Additionally, our user-friendly interface enhances the overall filing experience, allowing for faster completion.

-

How secure is the eSigning process for the 2016 Form 741 Kentucky with airSlate SignNow?

Security is a priority at airSlate SignNow. Our eSigning process for the 2016 Form 741 Kentucky employs advanced encryption methods and complies with legal standards, ensuring that your documents are safe and securely handled throughout the entire signing process.

Get more for Irs Form 741

Find out other Irs Form 741

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed