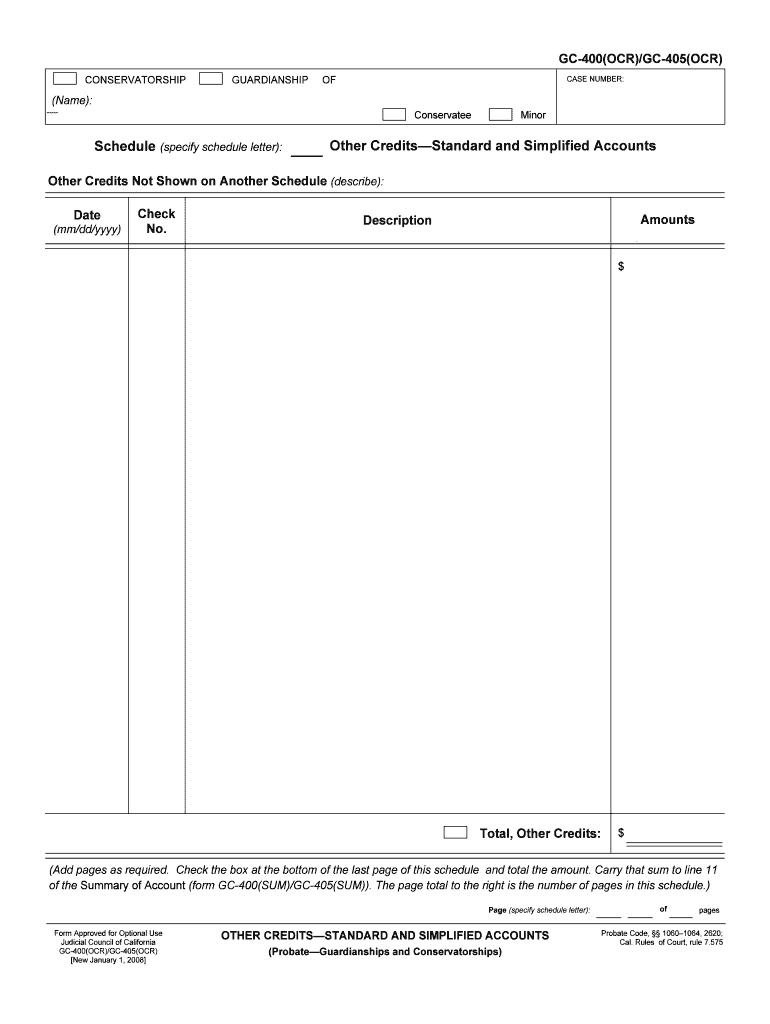

Total, Other Credits Form

What is the Total, Other Credits

The Total, Other Credits form is a crucial document used primarily for tax purposes in the United States. It allows taxpayers to report various credits that they may be eligible for, which can reduce their overall tax liability. These credits can include educational credits, energy-efficient home credits, and other specific deductions that the IRS recognizes. Understanding this form is essential for individuals and businesses seeking to maximize their tax benefits.

How to use the Total, Other Credits

Using the Total, Other Credits form involves accurately reporting your eligible credits on your tax return. Begin by gathering all necessary documentation related to the credits you plan to claim. This may include receipts, tax forms from educational institutions, or proof of energy-efficient improvements made to your home. Once you have this information, you can fill out the form, ensuring that each credit is clearly documented and justified. This process can be completed digitally, making it easier to manage and submit.

Steps to complete the Total, Other Credits

Completing the Total, Other Credits form requires careful attention to detail. Follow these steps:

- Gather all relevant documents that support your claims for credits.

- Access the Total, Other Credits form through your preferred tax preparation software or download it from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- List each credit you are claiming, providing the necessary details and documentation for each.

- Review your entries for accuracy before submission.

Legal use of the Total, Other Credits

The legal use of the Total, Other Credits form is governed by IRS regulations. To ensure compliance, taxpayers must only claim credits they are eligible for and maintain proper documentation to support their claims. E-signatures can be used for electronic submissions, provided they meet the criteria set forth by the ESIGN Act and other relevant laws. It is essential to understand the legal implications of claiming credits to avoid potential penalties or audits.

IRS Guidelines

The IRS provides specific guidelines for completing the Total, Other Credits form. Taxpayers should refer to the latest IRS publications and instructions related to the form to ensure compliance. Guidelines include eligibility criteria for each credit, required documentation, and any changes to tax laws that may impact the credits available. Staying informed about these guidelines is crucial for accurate filing and maximizing potential refunds.

Filing Deadlines / Important Dates

Filing deadlines for the Total, Other Credits form align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their returns by April 15 each year, unless an extension is requested. It is important to be aware of any changes to these deadlines, especially in light of special circumstances such as natural disasters or legislative changes that may affect filing dates.

Examples of using the Total, Other Credits

Examples of using the Total, Other Credits form include claiming the American Opportunity Tax Credit for qualified education expenses or the Residential Energy Efficient Property Credit for solar panel installations. These credits can significantly reduce tax liability and encourage taxpayers to take advantage of available benefits. Each example illustrates the importance of understanding eligibility and proper documentation to support claims.

Quick guide on how to complete total other credits

Effortlessly Prepare Total, Other Credits on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without interruptions. Manage Total, Other Credits on any device with the airSlate SignNow apps for Android or iOS and enhance your document-oriented processes today.

How to Edit and eSign Total, Other Credits with Ease

- Locate Total, Other Credits and then select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight key sections of your documents or obscure sensitive details using tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your adjustments.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow manages all your document management needs in just a few clicks from your selected device. Edit and eSign Total, Other Credits to ensure outstanding communication at every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Total, Other Credits in airSlate SignNow?

Total, Other Credits within airSlate SignNow refer to additional credits available for users to utilize when signing or sending documents through the platform. These credits enhance your ability to manage many documents simultaneously, making it easier for businesses to fulfill their signing needs efficiently.

-

How can I purchase Total, Other Credits?

You can purchase Total, Other Credits directly through your airSlate SignNow account. Simply navigate to the billing section, where you'll find options to add more credits as needed. This allows you to scaling your usage based on your document signing requirements.

-

Are there any limits on Total, Other Credits?

Yes, there are specific limits on the Total, Other Credits that can be accumulated or utilized within a certain period based on your subscription type. It’s crucial to monitor your credits usage to optimize your experience with airSlate SignNow and ensure that you have the resources needed for your document signing tasks.

-

What features are included with Total, Other Credits?

When you purchase Total, Other Credits with airSlate SignNow, you unlock features that expedite document workflows, such as bulk sending, advanced tracking, and custom reminders. These features allow you to maximize the efficiency of your signing processes, ultimately saving time for your business.

-

How do Total, Other Credits benefit my business?

Total, Other Credits provide a flexible resource that allows your business to manage document signing without interruption. By leveraging these credits, you can enhance your team's productivity and maintain timely operations without the stress of hitting usage limits.

-

Can Total, Other Credits be shared among team members?

Yes, Total, Other Credits can be shared among team members within your airSlate SignNow account. This functionality promotes collaboration and ensures that all members can access the credits they need for signing and sending documents, maximizing your team's efficiency.

-

Is there a trial for Total, Other Credits?

While airSlate SignNow does not specifically offer a trial for Total, Other Credits, you can explore the platform's features and see how it fits your needs with a free trial of the primary service. This allows you to evaluate the overall capabilities of the platform prior to investing in additional credits.

Get more for Total, Other Credits

Find out other Total, Other Credits

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template