California Form 100

What is the California Form 100

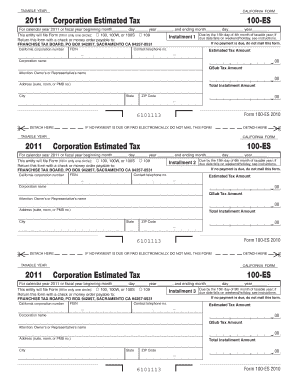

The California Form 100, also known as the California Corporation Franchise or Income Tax Return, is a crucial document for corporations operating in California. This form is used by C corporations to report their income, calculate their tax liability, and provide necessary information to the Franchise Tax Board (FTB). It serves as a means for the state to assess taxes based on a corporation's earnings and activities within California.

How to use the California Form 100

To effectively use the California Form 100, corporations must first gather all relevant financial information, including income statements, balance sheets, and any supporting documentation. The form requires detailed reporting of income, deductions, and credits. After completing the form, corporations must ensure that all information is accurate and complies with California tax laws before submitting it to the FTB.

Steps to complete the California Form 100

Completing the California Form 100 involves several key steps:

- Gather financial records, including revenue, expenses, and tax documents.

- Fill out the form with accurate income and deduction figures.

- Calculate the total tax liability based on the provided information.

- Review the form for any errors or omissions.

- Submit the completed form to the Franchise Tax Board by the due date.

Key elements of the California Form 100

The California Form 100 includes several important sections that corporations must complete:

- Business Information: This section requires the corporation's name, address, and federal employer identification number (FEIN).

- Income Reporting: Corporations must report total income, including gross receipts and other income sources.

- Deductions: This section allows corporations to claim various deductions, such as business expenses and losses.

- Tax Calculation: Corporations must calculate their tax liability based on the income reported and applicable tax rates.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines associated with the California Form 100. The standard filing deadline is the 15th day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. Extensions may be available, but corporations must file for an extension before the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The California Form 100 can be submitted through various methods to accommodate different preferences:

- Online: Corporations can file electronically through the California Franchise Tax Board's e-file system.

- Mail: The completed form can be printed and mailed to the designated address provided by the FTB.

- In-Person: Corporations may also deliver the form in person at designated FTB offices, though this option is less common.

Quick guide on how to complete california form 100

Complete California Form 100 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents promptly without any hold-ups. Manage California Form 100 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign California Form 100 effortlessly

- Find California Form 100 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign California Form 100 to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 100 and how can airSlate SignNow help me with it?

Form 100 is a crucial document for various business processes, and airSlate SignNow simplifies its management by allowing users to send, eSign, and store documents securely. With our platform, you can streamline the preparation and execution of Form 100, saving you time and enhancing productivity.

-

What features does airSlate SignNow offer for managing Form 100?

airSlate SignNow provides robust features for managing Form 100, including customizable templates, easy eSigning capabilities, and tracking tools. These features ensure that you can handle Form 100 efficiently while maintaining compliance and security.

-

Is there a cost associated with using airSlate SignNow for Form 100?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when working with Form 100. Our cost-effective solutions ensure that even small businesses can access the necessary tools to manage Form 100 without breaking the bank.

-

Can I integrate airSlate SignNow with other tools to manage Form 100?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, making it easy to manage Form 100 alongside your favorite business tools. This integration helps you automate workflows and reduce manual input, streamlining your processes.

-

How does airSlate SignNow ensure security for my Form 100 documents?

Security is a top priority at airSlate SignNow. We implement robust encryption and authentication measures to safeguard your Form 100 documents, ensuring your sensitive information remains protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for Form 100 over traditional methods?

Using airSlate SignNow for Form 100 offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced accessibility. Digital signatures not only streamline the process but also improve accuracy, allowing for an efficient workflow.

-

Can I track the status of my Form 100 documents with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your Form 100 documents. You can monitor the status of sent documents, ensuring you stay updated on who has signed and when, thus enhancing your document management efficiency.

Get more for California Form 100

- Schenectady county pistol permit letter to judge example form

- Guardian life jamaica online form

- Pir formulier pdf

- How to use a cane for back pain form

- Saltzer patient portal form

- Icam malawi examination fees form

- Form 4101 refund request check one revised 3202010

- South carolina department of probation parole ampamp dppps sc form

Find out other California Form 100

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now