535 N Form

What is the 535 N

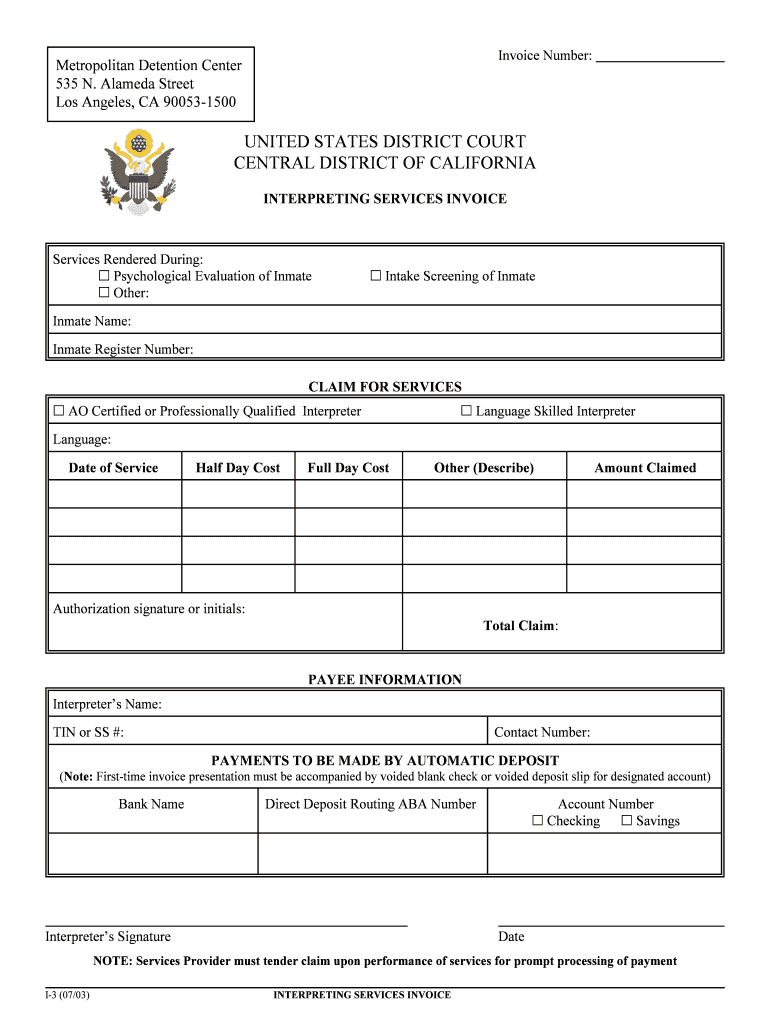

The 535 N form is a specific document used primarily for tax purposes in the United States. It serves as a declaration for certain tax-related transactions and is often required by the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for individuals and businesses alike, as it ensures compliance with federal tax regulations.

How to use the 535 N

Using the 535 N form involves several key steps. First, ensure you have the correct version of the form, as updates may occur. Next, gather all necessary information, including personal identification details and any relevant financial data. Carefully fill out each section of the form, ensuring accuracy to avoid issues with tax processing. Once completed, the form can be submitted to the IRS either electronically or via traditional mail, depending on your preference and the requirements for your specific situation.

Steps to complete the 535 N

Completing the 535 N form requires attention to detail. Here are the steps to follow:

- Download the latest version of the 535 N form from the IRS website.

- Read the instructions thoroughly to understand what information is required.

- Fill in your personal information, including name, address, and Social Security number.

- Provide any necessary financial information related to the tax declaration.

- Review the form for accuracy and completeness.

- Sign and date the form to validate it.

- Submit the form according to the specified submission methods.

Legal use of the 535 N

The legal use of the 535 N form is governed by IRS regulations. It is essential to ensure that the form is filled out correctly and submitted within the designated timelines to avoid penalties. The form must be signed by the appropriate parties, and any electronic submissions must comply with eSignature laws to be considered valid. Understanding these legal requirements helps maintain compliance and protects against potential legal issues.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 535 N form. These guidelines include instructions on eligibility, required documentation, and deadlines for filing. It is important to consult these guidelines to ensure that all necessary information is included and that the form is submitted correctly. Adhering to IRS guidelines helps facilitate a smooth processing of your tax declaration.

Form Submission Methods

The 535 N form can be submitted through various methods. Individuals have the option to file electronically, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address or submitted in person at designated IRS offices. Each submission method has its own requirements and timelines, so it is advisable to choose the one that best fits your needs.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the 535 N form can result in penalties. These may include fines, interest on unpaid taxes, or additional scrutiny from the IRS. It is crucial to understand the implications of non-compliance and to ensure that all forms are submitted accurately and on time to avoid these potential consequences.

Quick guide on how to complete 535 n

Prepare 535 N effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 535 N on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign 535 N without any hassle

- Locate 535 N and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign 535 N and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 535 N.?

airSlate SignNow is a digital signature platform that enables businesses to send, sign, and manage documents efficiently. Specifically, at 535 N., we focus on providing an easy-to-use and cost-effective solution for all your eSigning needs. With airSlate SignNow, you can streamline your document workflow and enhance productivity in your organization.

-

What features does airSlate SignNow offer for users at 535 N.?

At 535 N., airSlate SignNow includes a variety of features designed to help businesses operate smoothly. Users can enjoy features such as customizable templates, real-time collaboration, and automated reminders. These tools help optimize the eSigning process and ensure that all documents are signed promptly.

-

How much does airSlate SignNow cost at 535 N.?

Pricing for airSlate SignNow at 535 N. is designed to be flexible and budget-friendly for businesses of all sizes. We offer different pricing plans based on features and user needs, allowing you to choose a plan that best fits your budget. For a detailed breakdown, please visit our pricing page or contact our sales team for a personalized quote.

-

Is airSlate SignNow secure for sensitive documents at 535 N.?

Yes, airSlate SignNow takes security seriously, ensuring that your sensitive documents are well protected at 535 N. Our platform is compliant with industry standards such as GDPR and HIPAA, and includes advanced security features like encryption and multi-factor authentication. You can trust that your documents are safe while using our eSigning solution.

-

What integrations does airSlate SignNow support at 535 N.?

AirSlate SignNow offers seamless integrations with various applications to enhance functionality at 535 N. You can integrate with popular tools such as Google Drive, Salesforce, and Dropbox to streamline your document management process. This flexibility allows you to use airSlate SignNow in conjunction with your existing workflows effortlessly.

-

How does airSlate SignNow improve workflow efficiency at 535 N.?

airSlate SignNow enhances workflow efficiency at 535 N. by automating the document signing process. With features like bulk sending, automated notifications, and real-time tracking, you can signNowly reduce the time it takes to complete transactions. This efficiency allows your team to focus on more critical tasks rather than getting bogged down by paperwork.

-

Can I access airSlate SignNow from multiple devices at 535 N.?

Absolutely! At 535 N., airSlate SignNow is designed to be accessible across various devices, ensuring that you can manage your documents anytime and anywhere. Whether you’re using a desktop, tablet, or smartphone, our cloud-based platform allows you to send and sign documents on the go without any disruptions.

Get more for 535 N

Find out other 535 N

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation