SUM 110 Form

What is the SUM 110

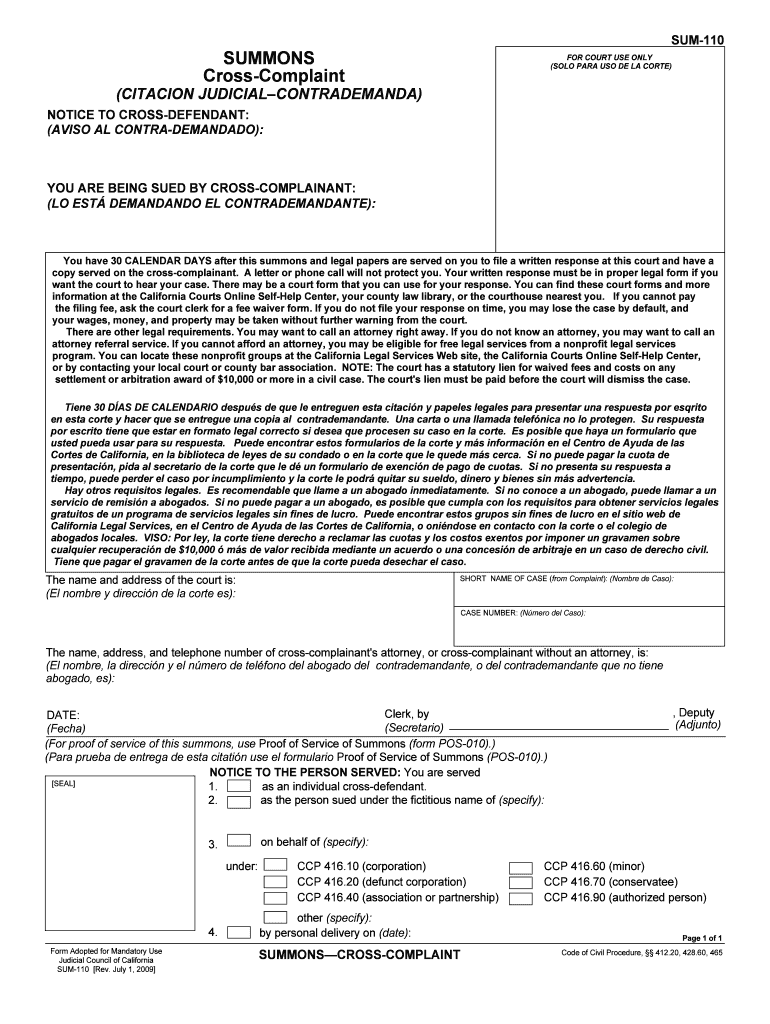

The SUM 110 form is a crucial document used for specific tax reporting purposes in the United States. It is designed to collect essential information from taxpayers, ensuring compliance with federal tax regulations. This form is typically utilized by individuals or businesses that need to report certain types of income or deductions that may not be captured through standard tax forms. Understanding the SUM 110 is vital for accurate tax filing and avoiding potential penalties.

How to use the SUM 110

Using the SUM 110 form involves several steps to ensure that all required information is accurately reported. First, gather all necessary documentation related to your income or deductions. This may include W-2 forms, 1099s, or receipts for deductible expenses. Next, carefully fill out the form, ensuring that each section is completed with accurate data. After completing the form, review it for any errors or omissions before submission. It is advisable to keep a copy of the filled form for your records.

Steps to complete the SUM 110

Completing the SUM 110 form requires a systematic approach. Follow these steps:

- Gather relevant financial documents, such as income statements and deduction receipts.

- Access the SUM 110 form, which can be obtained from the IRS or authorized tax preparation software.

- Fill in personal information, including your name, address, and Social Security number.

- Detail your income sources and applicable deductions in the designated sections.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the SUM 110

The SUM 110 form is legally recognized for tax reporting in the United States, provided it is filled out correctly and submitted within the designated timelines. Compliance with IRS guidelines ensures that the information reported is valid and can be used for tax assessment purposes. Utilizing a reliable eSignature solution, such as airSlate SignNow, can enhance the legal standing of your completed form, ensuring that it meets the necessary electronic signature requirements.

Filing Deadlines / Important Dates

Filing deadlines for the SUM 110 form vary depending on the specific tax year and the taxpayer's circumstances. Generally, individual taxpayers must submit their forms by April 15 of the following year. However, extensions may be available under certain conditions. It is essential to stay informed about any changes to deadlines, as late submissions can result in penalties and interest on unpaid taxes.

Examples of using the SUM 110

There are various scenarios in which the SUM 110 form may be applicable. For instance, freelancers may use this form to report income earned from multiple clients. Small business owners might also utilize it to detail business expenses that qualify for deductions. Understanding these examples can help taxpayers recognize when the SUM 110 is necessary for their specific financial situations.

Quick guide on how to complete sum 110

Effortlessly Prepare SUM 110 on Any Device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Manage SUM 110 on any device with the airSlate SignNow applications for Android or iOS and enhance your document-oriented processes today.

The Easiest Way to Alter and Electronically Sign SUM 110 Effortlessly

- Obtain SUM 110 and click on Get Form to begin.

- Utilize our provided tools to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools available from airSlate SignNow specifically designed for this function.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form hunting, or mistakes requiring new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign SUM 110 and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is SUM 110 in relation to airSlate SignNow?

SUM 110 refers to the comprehensive functionalities offered by airSlate SignNow that streamline the electronic signing and document management process. This user-friendly and efficient solution allows businesses to manage their documents effectively, ensuring that they can send, sign, and store documents securely.

-

How much does airSlate SignNow cost under the SUM 110 plan?

The pricing for airSlate SignNow under the SUM 110 plan is designed to accommodate businesses of all sizes. With affordable subscription options, companies can choose a plan that best fits their budget and usage needs. Check the official website for the most accurate and up-to-date pricing information.

-

What are the key features included in the SUM 110 package?

The SUM 110 package includes a variety of crucial features such as document templates, advanced security protocols, unlimited signing, and custom branding options. These features enable users to manage their eSigning tasks efficiently while maintaining a professional appearance and strong security.

-

What benefits does SUM 110 offer for businesses?

SUM 110 empowers businesses by enhancing document workflows, reducing turnaround time, and increasing security with digital signatures. This solution not only saves time and resources but also ensures compliance with legal standards for electronic signatures, giving businesses peace of mind.

-

Can I integrate airSlate SignNow with other tools under the SUM 110 plan?

Yes, the SUM 110 plan allows seamless integration with various business applications such as CRM systems, project management tools, and cloud storage services. This flexibility ensures that your eSigning processes can be tailored to fit within your existing workflows.

-

Is there a free trial available for SUM 110?

Yes, airSlate SignNow offers a free trial for the SUM 110 plan, allowing potential customers to explore the features and benefits of the platform risk-free. This trial period provides an excellent opportunity to assess how SUM 110 can meet your business's eSigning needs.

-

How secure is the SUM 110 solution for electronic signatures?

The SUM 110 solution prioritizes security by utilizing advanced encryption and security measures to protect your documents and signatures. Compliance with regulations such as the ESIGN Act and eIDAS ensures that your eSignatures are legally binding and secure.

Get more for SUM 110

Find out other SUM 110

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure