WG 022 EARNINGS HOLDIING ORDER for TAXES Wage Garnishment WG 022 982 512 Form

What is the WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512

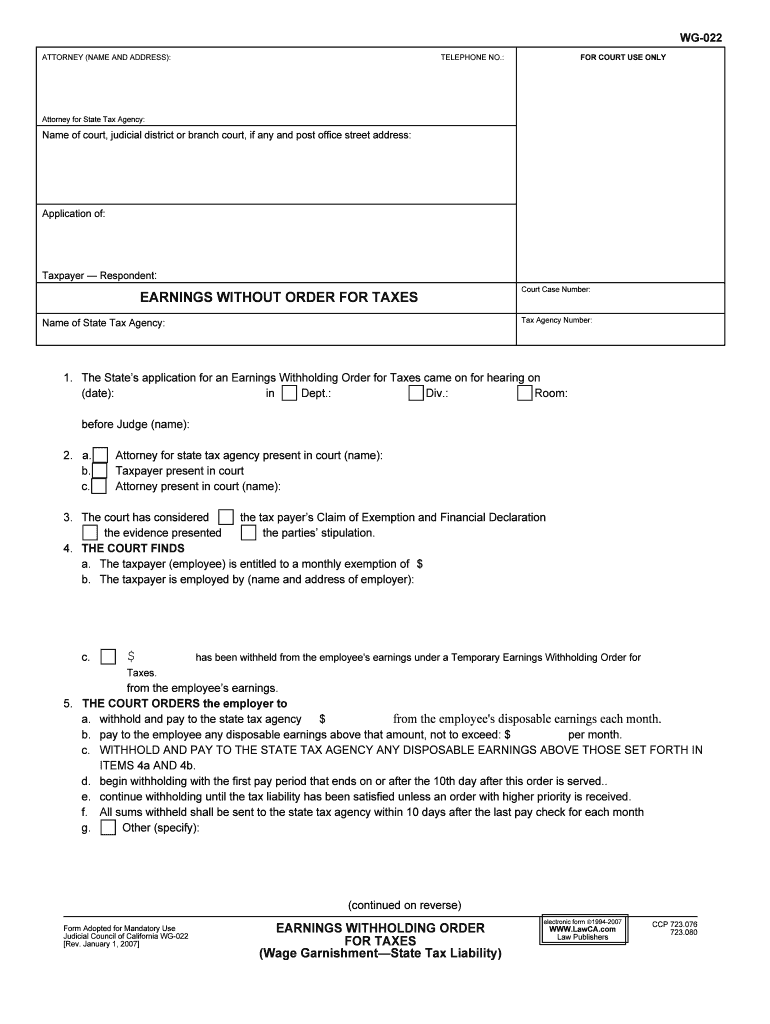

The WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512 is a legal document used to facilitate the garnishment of wages for tax debts. This form is typically issued by a court or tax authority when an individual has outstanding tax obligations. The purpose of the form is to ensure that a portion of the debtor's earnings is withheld and directed towards satisfying their tax liabilities. It serves as a formal order that outlines the specific amount to be garnished and the duration of the garnishment process.

Steps to complete the WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512

Completing the WG 022 EARNINGS HOLDIING ORDER involves several key steps to ensure accuracy and compliance with legal requirements:

- Gather necessary information, including the debtor's personal details, employer information, and the amount owed.

- Fill out the form accurately, ensuring all fields are completed, including the specific amount to be garnished from each paycheck.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the appropriate court or tax authority as directed, ensuring that copies are retained for personal records.

- Monitor the garnishment process and maintain communication with the employer to confirm the correct amounts are being withheld.

Legal use of the WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512

The legal use of the WG 022 form is governed by federal and state laws regarding wage garnishment. It is essential that the form is executed in accordance with these regulations to ensure it is enforceable. This includes adhering to limits on the amount that can be garnished, which is typically a percentage of disposable earnings. Additionally, the debtor must be notified of the garnishment and provided with an opportunity to contest it if applicable. Proper legal procedures must be followed to avoid potential penalties or disputes.

How to obtain the WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512

The WG 022 EARNINGS HOLDIING ORDER can typically be obtained through the local court or tax authority's website. In some cases, it may also be available at legal aid offices or through tax professionals. It is important to ensure that you are using the most current version of the form, as outdated forms may not be accepted. If assistance is needed, consulting with a legal professional can provide guidance on obtaining and completing the form correctly.

Key elements of the WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512

Key elements of the WG 022 form include:

- Debtor Information: Name, address, and Social Security number of the individual subject to garnishment.

- Creditor Information: Details of the tax authority or entity initiating the garnishment.

- Amount to be Garnished: Specific dollar amount or percentage of wages to be withheld.

- Duration of Garnishment: Time frame for which the garnishment will be in effect.

- Signature: Required signatures from the appropriate parties to validate the order.

Examples of using the WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512

Examples of situations where the WG 022 form may be utilized include:

- A taxpayer who has failed to pay federal income taxes and is subject to wage garnishment as a result.

- An individual who owes state taxes and has received a notice of garnishment from the state tax authority.

- Cases where a court has ordered garnishment due to unpaid child support or other legal obligations, in conjunction with tax debts.

Quick guide on how to complete wg 022 earnings holdiing order for taxes wage garnishment wg 022 982512

Effortlessly Prepare WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512 on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to Alter and eSign WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512 with Ease

- Find WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512 and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with the tools available from airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512?

The WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512 is a legal document used to notify employers about wage garnishment for specific tax obligations. This order ensures that a portion of an employee's earnings is withheld to satisfy outstanding tax debts. Understanding this document is crucial for both employers and employees when navigating wage garnishments.

-

How can airSlate SignNow assist with WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512?

airSlate SignNow simplifies the process of sending and signing WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512 documents. Our platform enables users to create, send, and track these orders effortlessly, ensuring compliance and timely processing. With our easy-to-use solution, businesses can manage wage garnishments efficiently.

-

What features does airSlate SignNow offer for managing wage garnishments?

AirSlate SignNow offers various features for managing wage garnishments, including templates for WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512, electronic signatures, and secure storage. These features help ensure that all documents are signed and stored securely, while also facilitating easy access and management for both employers and employees.

-

Is there a cost associated with using airSlate SignNow for WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. Pricing plans cater to different needs, allowing companies to choose a plan that fits their budget while still accessing features related to WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512. We provide transparent pricing to help businesses make informed decisions.

-

Can I integrate airSlate SignNow with other tools for managing wage garnishments?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications, enhancing your ability to manage WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512 efficiently. These integrations can help synchronize data and streamline the workflow, making it easier to handle garnishments and related processes.

-

What are the benefits of using airSlate SignNow for wage garnishment documents?

Using airSlate SignNow for wage garnishment documents, such as the WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512, provides numerous benefits. It ensures compliance with legal requirements, speeds up the signing process, and increases accuracy by minimizing errors. Additionally, the platform's user-friendly interface enhances productivity for teams managing garnishments.

-

Is airSlate SignNow secure for handling sensitive wage garnishment information?

Yes, airSlate SignNow prioritizes security when handling sensitive wage garnishment information, including WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512. We employ advanced security measures, including encryption and secure user authentication, to protect all documents processed through our platform. Thus, businesses can trust us with their confidential information.

Get more for WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512

Find out other WG 022 EARNINGS HOLDIING ORDER FOR TAXES Wage Garnishment WG 022 982 512

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will