I Believe the Following Property is Exempt Form

What is the I Believe The Following Property Is Exempt

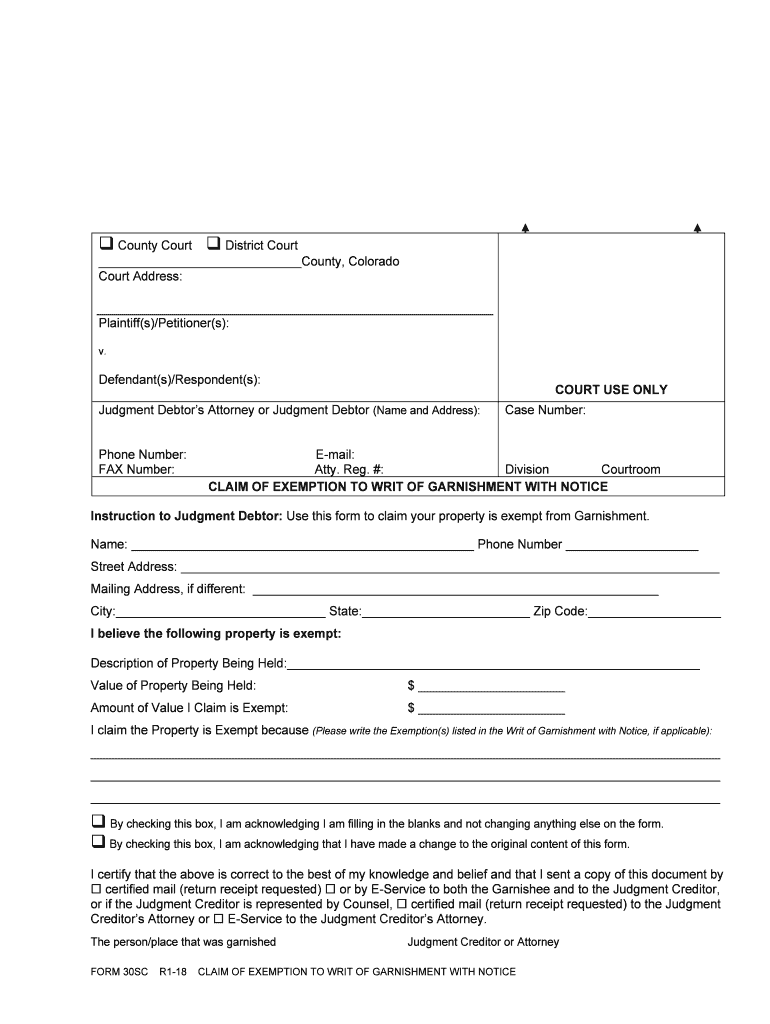

The form titled "I Believe The Following Property Is Exempt" is primarily used to assert that specific property is not subject to taxation or other legal obligations. This form is often required in various legal and financial contexts, particularly when individuals or businesses seek to clarify their tax liabilities or property status. By completing this form, the signer formally declares their belief in the exempt status of the property in question, which can include real estate, personal property, or other assets.

How to use the I Believe The Following Property Is Exempt

Using the "I Believe The Following Property Is Exempt" form involves several straightforward steps. First, gather all necessary information regarding the property, including its location, type, and any relevant tax identification numbers. Next, accurately fill out the form, ensuring that all fields are completed with precise information. Once the form is filled out, it should be signed and dated by the individual or authorized representative. It is crucial to keep a copy of the completed form for your records, as it may be needed for future reference or verification.

Steps to complete the I Believe The Following Property Is Exempt

Completing the "I Believe The Following Property Is Exempt" form requires careful attention to detail. Follow these steps for effective completion:

- Identify the property you believe is exempt.

- Gather supporting documentation that validates your claim, such as previous tax statements or exemption certificates.

- Fill out the form with accurate information, ensuring clarity in each section.

- Review the form for any errors or omissions before signing.

- Submit the completed form to the appropriate authority, whether that be a local tax office or another governing body.

Legal use of the I Believe The Following Property Is Exempt

The legal use of the "I Believe The Following Property Is Exempt" form is essential for ensuring compliance with tax regulations. This form serves as a formal declaration and can protect the signer from potential legal repercussions related to misreported property status. It is important to understand that the use of this form must align with local laws and regulations governing property exemptions. Failure to use the form correctly may result in penalties or loss of exempt status.

Eligibility Criteria

To qualify for using the "I Believe The Following Property Is Exempt" form, certain eligibility criteria must be met. Generally, the individual or entity must own the property in question and have a valid reason for claiming exemption. This may include properties used for charitable purposes, religious institutions, or other qualifying categories as defined by state or local laws. It is advisable to consult with a legal or tax professional to confirm eligibility before submitting the form.

Required Documents

When completing the "I Believe The Following Property Is Exempt" form, specific documents may be required to support your claim. These typically include:

- Proof of ownership, such as a deed or title.

- Previous tax returns or exemption certificates.

- Documentation that supports the basis for exemption, such as letters from relevant authorities.

Having these documents ready can facilitate a smoother submission process and strengthen your case for exemption.

Quick guide on how to complete i believe the following property is exempt

Complete I Believe The Following Property Is Exempt effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as a fantastic eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents promptly without any hold-ups. Manage I Believe The Following Property Is Exempt on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and electronically sign I Believe The Following Property Is Exempt with ease

- Locate I Believe The Following Property Is Exempt and click Get Form to begin.

- Utilize the resources we provide to fill out your form.

- Emphasize key sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and electronically sign I Believe The Following Property Is Exempt and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'I Believe The Following Property Is Exempt' mean in my document?

The phrase 'I Believe The Following Property Is Exempt' typically indicates that the signer is stating their belief regarding the exemption status of certain property. This can be crucial in legal and financial documents where exemptions impact tax liability or compliance. Understanding this can help ensure that all relevant information is accurately communicated and documented.

-

How can airSlate SignNow help me with property exemption documents?

With airSlate SignNow, you can easily create, send, and eSign documents related to property exemptions, including those that require the statement 'I Believe The Following Property Is Exempt.' Our platform allows for seamless document management, ensuring that all signatures and approvals are captured securely and efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to fit various business needs. Whether you're a small business looking to eSign personal documents or a larger organization needing advanced features for compliance, we have a suitable option for you. Explore our plans to see how we can assist your needs regarding 'I Believe The Following Property Is Exempt.'

-

Are there any features specifically designed for managing exemptions?

Yes, airSlate SignNow includes features that cater to managing exemption documentation. You can customize templates to include statements like 'I Believe The Following Property Is Exempt,' set reminders for key dates, and track the status of documents in real-time. These tools streamline your workflow and ensure compliance with necessary regulations.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Salesforce, and Zapier, allowing you to automate workflows that involve documents needing the statement 'I Believe The Following Property Is Exempt.' This integration capability enhances productivity and ensures all necessary data is connected.

-

How secure is my information when using airSlate SignNow?

Your information is extremely secure with airSlate SignNow. We employ advanced encryption methods and adhere to strict compliance standards to protect your data, especially in documents where 'I Believe The Following Property Is Exempt' is stated. You can trust that your sensitive information is handled with the highest level of security.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including time savings, cost-effectiveness, and a user-friendly interface. By facilitating the eSigning process for documents that include 'I Believe The Following Property Is Exempt,' you enhance efficiency and accuracy in your operations, allowing your team to focus on more strategic tasks.

Get more for I Believe The Following Property Is Exempt

Find out other I Believe The Following Property Is Exempt

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer