Indiana W4 2011-2026

What is the Indiana W-4?

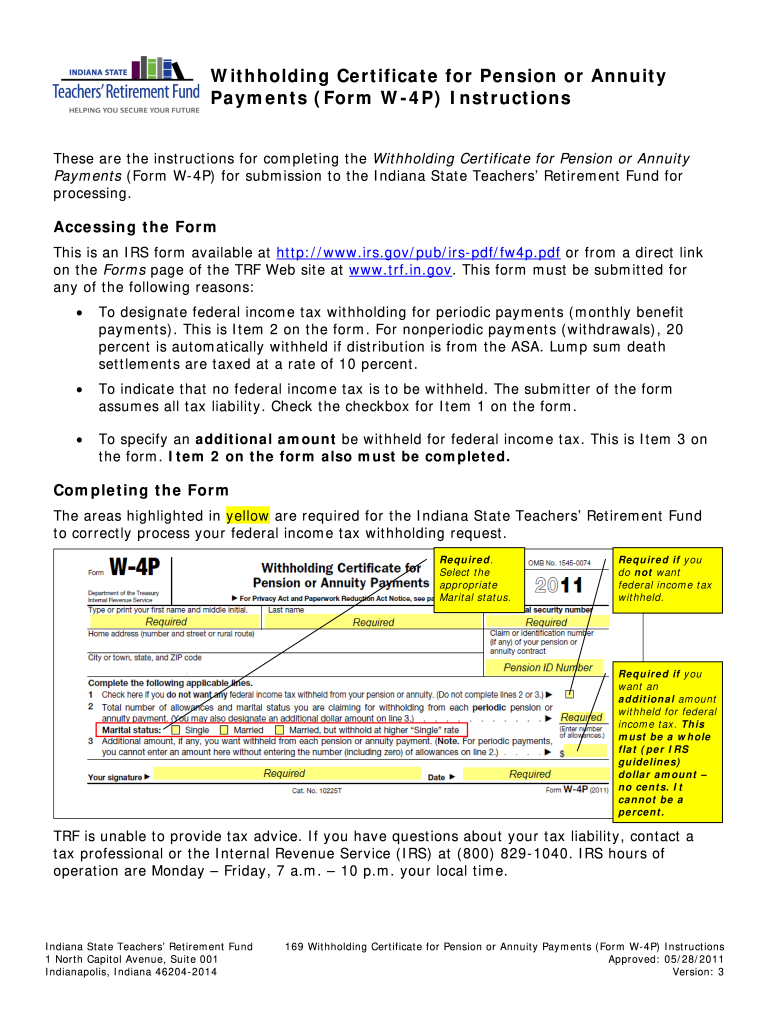

The Indiana W-4 is a state-specific tax withholding form used by employees in Indiana. It allows individuals to specify the amount of state income tax to be withheld from their paychecks. This form is crucial for ensuring that the correct amount of tax is deducted, helping to avoid underpayment or overpayment during the tax year. The Indiana W-4 is similar to the federal W-4 form but includes state-specific guidelines and requirements.

Steps to Complete the Indiana W-4

Filling out the Indiana W-4 involves several straightforward steps:

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Claim allowances based on your personal situation, such as dependents or additional income.

- Sign and date the form to certify that the information provided is accurate.

It is essential to review the completed form for accuracy before submitting it to your employer, as errors can lead to incorrect withholding.

How to Use the Indiana W-4

To use the Indiana W-4 effectively, submit it to your employer upon starting a new job or when your financial situation changes. Employers use this form to determine the appropriate amount of state tax to withhold from your wages. If you need to adjust your withholding, you can submit a new Indiana W-4 at any time throughout the year.

Legal Use of the Indiana W-4

The Indiana W-4 must be completed accurately to comply with state tax laws. Providing false information on the form can result in penalties, including fines or increased tax liability. It is important to understand the legal implications of the information you provide and to ensure that it reflects your current financial situation.

IRS Guidelines

While the Indiana W-4 is a state form, it is essential to be aware of how it interacts with federal tax regulations. The IRS provides guidelines on how to fill out the federal W-4, which can influence your state withholding. Understanding both forms can help you manage your overall tax liability more effectively.

Filing Deadlines / Important Dates

There are no specific deadlines for submitting the Indiana W-4; however, it is advisable to complete it as soon as you start a new job or experience a significant life change. Keeping your W-4 up to date ensures that your tax withholding aligns with your current financial circumstances, helping you avoid surprises during tax season.

Quick guide on how to complete indiana state w4 pension form

Your assistance manual on how to prepare your Indiana W4

If you’re uncertain about how to create and submit your Indiana W4, here are some straightforward guidelines to simplify your tax processing.

First, you just need to set up your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to edit, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and revisit to modify responses as necessary. Streamline your tax management with enhanced PDF editing, eSigning, and convenient sharing.

Follow the steps below to complete your Indiana W4 in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through editions and schedules.

- Select Get form to access your Indiana W4 in our editor.

- Fill in the necessary fillable fields with your information (text, numbers, checkmarks).

- Use the Sign Tool to insert your legally-binding eSignature (if required).

- Review your document and correct any mistakes.

- Save changes, print your version, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper filing can lead to errors and delays in refunds. Before e-filing your taxes, be sure to check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

What is the best way to fill out a W4 form?

Before understanding the best way, we need to understand what is W4 form?To answer this:A W-4 form advises your employer how much tax to withhold from every paycheck. Your employer transmits the tax to the IRS for your sake. Toward the year's end, your employer will send you a W-2 showing (in addition to other things) how much it withheld for you that year.How to fill Form W4:You'll most likely round out a W-4 when you begin an occupation, however you can change your W-4 whenever. Simply download it from the IRS website, round it out and offer it to your HR or finance group.The simple part is providing your name, address, conjugal status and other fundamental individual information. The crucial step is choosing the quantity of allowances to guarantee.Try not to freeze on the off chance that you don't have the foggiest idea how to round out a W-4. The W-4 form accompanies an allowances worksheet that will enable you to make sense of what number to guarantee.The more allowances you guarantee, the less tax will be withheld from your paycheck.What’s the best way to fill out Form W-4?Here’s the general strategy:If you got a huge tax bill in April and don’t want another, you can use Form W-4 to increase your withholding. That’ll help you owe less (or nothing) next April.If you got a huge refund last year, you’re giving the government a free loan and could be needlessly living on less of your paycheck all year. Consider using Form W-4 to reduce your withholding.The more allowances you claim, the less tax will be taken out of your paycheck.To know more about W4 form, join this W4 webinar and learn how fill this form.

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

Do un-contracted workers have to fill out IRS W4 form?

I have no idea what an “un-contracted worker” is. I am not familiar with that term.Employees working in the U.S. complete a Form W-4.Independent contractors in the U.S. do not. Instead, they usually complete a Form W-9.If unclear on the difference between an employee or an independent contractor, see Independent Contractor Self Employed or Employee

-

Do employees need to fill out a w4 every year?

No. Once you initially complete your W-4 form and give it to H.R. , that's it. The only time you want to have it amended or changed is if too much or not enough of your paycheck is being withheld for Federal Income taxes. Thanks for the question.

-

How do I fill out a W4 form if am I a dependent of my father -who is a non US citizen living abroad, but pays for most of my living expenses?

You can be claimed as a dependent for tax purposes by a parent if:1. You are under age 19 at the end of the year, or under age 24 and a full-time student, or permanently and totally disabled; and2. You lived with that parent for at least half of the year (counting time spent temporarily absent from the home, i.e. at school); and3. You did not provide more than half of your own support.I bring that up just in case your mother - who you did not mention - meets all of those requirements. Note that the support requirement is only that you don't provide more than half of your own support - and not that the claiming parent does, so it's possible that you may still be your mother's dependent.Assuming that's not the case, then yor father, as a nonresident alien, would not generally be allowed to claim any exemption for dependents (assuming he has a US tax obligation). He might be able to do so if you qualify as his dependent otherwise and he is a resident of Canada or Mexico, but that's an unusual circumstance.On the W4 it doesn't really matter that much; claiming 1 instead of zero only means that the employer will withhold less in taxes, and many people report a different number than the allowance calculator (which the IRS doesn't see) computes. What does matter is that you know your dependency status for the year when it comes time to actually file your return. If you can be claimed as a dependent on someone else's return, you cannot claim your own exemption - even if that other person does not claim you.

Create this form in 5 minutes!

How to create an eSignature for the indiana state w4 pension form

How to generate an eSignature for the Indiana State W4 Pension Form in the online mode

How to create an electronic signature for the Indiana State W4 Pension Form in Chrome

How to generate an electronic signature for signing the Indiana State W4 Pension Form in Gmail

How to create an eSignature for the Indiana State W4 Pension Form right from your smart phone

How to create an electronic signature for the Indiana State W4 Pension Form on iOS devices

How to make an eSignature for the Indiana State W4 Pension Form on Android OS

People also ask

-

What is the Indiana W4 form and why is it important?

The Indiana W4 form is essential for employees in Indiana as it determines the amount of state income tax withheld from their paycheck. Completing the Indiana W4 accurately ensures that you are compliant with state tax regulations and helps you avoid owing money at tax time. It's crucial for both employees and employers to understand the specifics of this form.

-

How can airSlate SignNow help with the Indiana W4 form?

airSlate SignNow simplifies the process of completing and submitting the Indiana W4 form by allowing users to fill out and eSign documents electronically. Our platform ensures that the Indiana W4 is securely stored and easily accessible, making it convenient for both employees and HR departments to manage tax forms efficiently.

-

Is airSlate SignNow affordable for small businesses managing Indiana W4 forms?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for small businesses looking to manage their Indiana W4 forms and other documents. With flexible subscription options, you can choose a plan that fits your budget while benefiting from our robust features that streamline document management.

-

What features does airSlate SignNow offer for handling Indiana W4 forms?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning to simplify the management of Indiana W4 forms. These tools help businesses reduce paperwork, save time, and ensure compliance with state regulations, making it easier to handle tax-related documents.

-

Can I integrate airSlate SignNow with other software for managing Indiana W4 forms?

Absolutely! airSlate SignNow easily integrates with various HR and payroll systems, allowing seamless management of the Indiana W4 forms within your existing workflows. This integration enhances efficiency and helps maintain accurate records without the need for manual data entry.

-

How secure is the data when using airSlate SignNow for Indiana W4 forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure data storage practices to ensure that all information related to the Indiana W4 forms is protected. Our platform complies with industry regulations, providing peace of mind for businesses handling sensitive tax documents.

-

What are the benefits of using airSlate SignNow for Indiana W4 form management?

Using airSlate SignNow for Indiana W4 form management streamlines the entire process, reduces errors, and enhances compliance with state tax laws. Additionally, our user-friendly interface and eSigning capabilities save time for both employees and HR teams, improving overall productivity.

Get more for Indiana W4

- Aflac printable claim forms

- California 540 forms ampamp instructions 2020 personal income tax booklet california 540 forms ampamp instructions 2020

- 2021 ca sales tax form

- Cdtfa 95 form

- Out of state supplier report of alcoholic beverages delawaregov form

- Penalty waiver request 78 629iowa department of revenue form

- Iowa form 78 629a

- Properties archive nebraska real estate investment form

Find out other Indiana W4

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure