Ca Sales Tax 2021

What is the California Sales Tax?

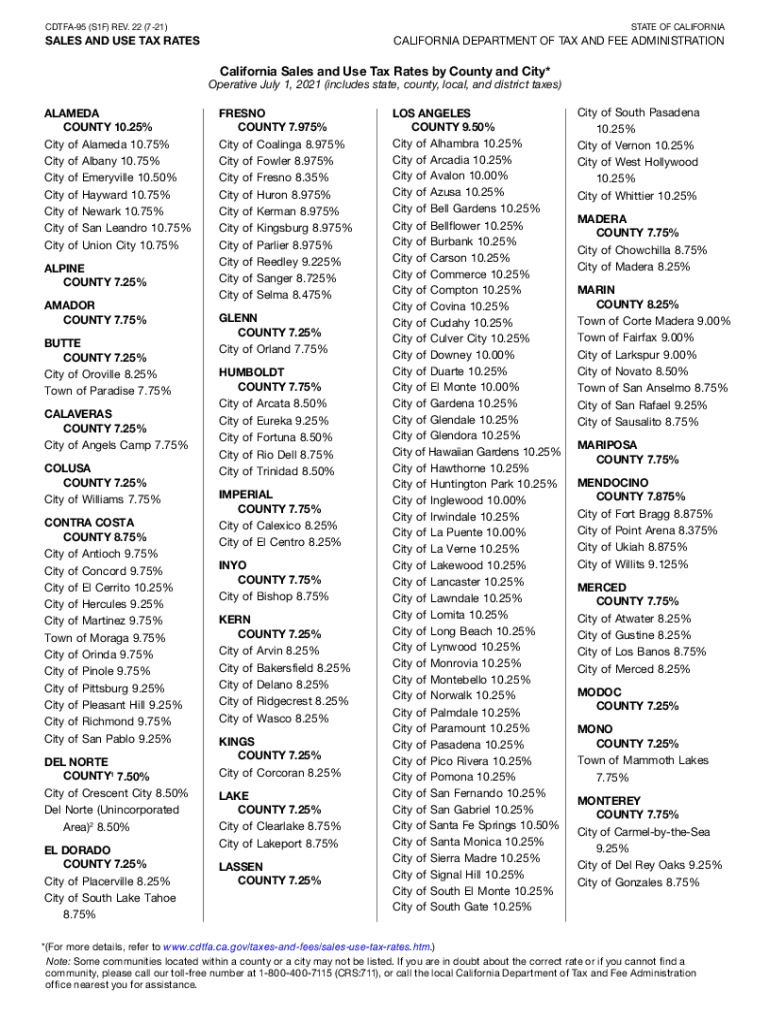

The California sales tax is a consumption tax imposed on the sale of goods and certain services within the state. It is calculated as a percentage of the retail price of taxable items. The standard state sales tax rate is currently seven and a quarter percent, but local jurisdictions can add additional taxes, resulting in varying total rates across different areas. Understanding the California sales tax is essential for both consumers and businesses, as it affects pricing and compliance obligations.

How to Use the California Sales Tax

Using the California sales tax involves several steps for both consumers and businesses. For consumers, it is important to recognize when sales tax is applicable, typically during purchases of tangible personal property. Businesses must calculate the appropriate sales tax rate based on their location and the goods sold. They are responsible for collecting this tax from customers and remitting it to the California Department of Tax and Fee Administration (CDTFA). Accurate record-keeping is crucial for compliance and reporting.

Steps to Complete the California Sales Tax

Completing the California sales tax process requires businesses to follow specific steps:

- Determine taxability: Identify whether the goods or services sold are subject to sales tax.

- Calculate the tax: Apply the correct sales tax rate based on the location of the sale.

- Collect the tax: Add the sales tax to the total sale price during the transaction.

- Report and remit: File sales tax returns and remit collected taxes to the CDTFA by the due date.

Legal Use of the California Sales Tax

The legal use of the California sales tax is governed by state law. Businesses must adhere to regulations set by the CDTFA, including proper registration for a seller’s permit, accurate tax calculation, and timely filing of returns. Failure to comply with these legal requirements can result in penalties and interest charges. It is essential for businesses to stay informed about any changes in tax rates or regulations to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for California sales tax returns vary based on the reporting period assigned to the business. Most businesses file quarterly, with returns due on the last day of the month following the end of the quarter. For annual filers, the return is typically due on January thirty-first. It is crucial for businesses to mark these deadlines on their calendars to avoid late fees and penalties.

Required Documents

To file California sales tax returns, businesses need to gather specific documents, including:

- Sales records: Detailed records of all sales transactions, including dates, amounts, and tax collected.

- Purchase records: Documentation of purchases made for resale, which may be exempt from sales tax.

- Previous tax returns: Copies of prior filings to ensure consistency and accuracy in reporting.

Penalties for Non-Compliance

Non-compliance with California sales tax regulations can lead to significant penalties. Businesses may face fines for late filing, failure to collect the correct amount of tax, or not remitting collected taxes on time. Interest may also accrue on unpaid balances. Understanding these potential consequences underscores the importance of maintaining accurate records and adhering to all filing requirements.

Quick guide on how to complete 2021 ca sales tax

Complete Ca Sales Tax effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly with no delays. Handle Ca Sales Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and eSign Ca Sales Tax with ease

- Find Ca Sales Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent parts of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome form searching, or mistakes that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Ca Sales Tax and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 ca sales tax

Create this form in 5 minutes!

People also ask

-

What are the CA CDTFA rates for eSignature solutions?

The CA CDTFA rates for eSignature solutions vary based on the provider and usage. It's important to compare different services, including airSlate SignNow, to find an option that offers competitive pricing while ensuring compliance with the latest tax regulations. By understanding these rates, businesses can make an informed decision that aligns with their budget.

-

How can airSlate SignNow help with CA CDTFA compliance?

airSlate SignNow ensures compliance with CA CDTFA regulations by providing secure and legally binding eSignatures. Our platform is designed to meet the legal standards required for electronic signatures, ensuring that your documents are valid. This helps businesses stay compliant while efficiently managing their documentation processes.

-

What features does airSlate SignNow offer for managing CA CDTFA-related documents?

AirSlate SignNow offers several features suited for managing CA CDTFA-related documents, including templated workflows, document tracking, and audit trails. These functionalities streamline the signing process and enhance document management. By leveraging these features, businesses can effectively handle all aspects of compliance with CA CDTFA rates.

-

Are there any hidden fees associated with airSlate SignNow when dealing with CA CDTFA rates?

With airSlate SignNow, transparency is key, and we pride ourselves on having no hidden fees. Our pricing plans are clear and include everything necessary for compliance with CA CDTFA rates. This allows your business to budget accurately without unexpected costs.

-

Can I integrate airSlate SignNow with other software related to CA CDTFA compliance?

Yes, airSlate SignNow easily integrates with various software systems to enhance your CA CDTFA compliance processes. Our platform can connect with CRM systems, document management tools, and accounting software. This integration capability ensures that you have a seamless experience while managing your compliance-related tasks.

-

What benefits does airSlate SignNow provide for businesses focusing on CA CDTFA rates?

By using airSlate SignNow, businesses can greatly benefit from increased efficiency and reduced turnaround times for document signing, which is crucial for staying compliant with CA CDTFA rates. Additionally, our user-friendly platform enhances collaboration and ensures that all eSignature processes are secure, helping you maintain audit readiness.

-

Is customer support available for questions about CA CDTFA rates and eSignatures?

Absolutely! airSlate SignNow offers comprehensive customer support to assist with any questions regarding CA CDTFA rates and how they relate to our eSignature services. Our knowledgeable team is available to provide guidance, ensuring you make the most of our platform while remaining compliant.

Get more for Ca Sales Tax

- Form cr 101 plea form with explanations and waiver of

- Cr 110jv 790 order for victim restitution judicial council form

- 2014 2019 form ca cr 112jv 792 fill online printable

- Defendants statement of assets formdunkmulque

- Defendants statement of assets california courts cagov form

- Find your court la law library form

- Fillable online cal crim form notice of appeal penal code

- Cr 130 form

Find out other Ca Sales Tax

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement