Indiana Sales Disclosure Form

What is the Indiana Sales Disclosure Form

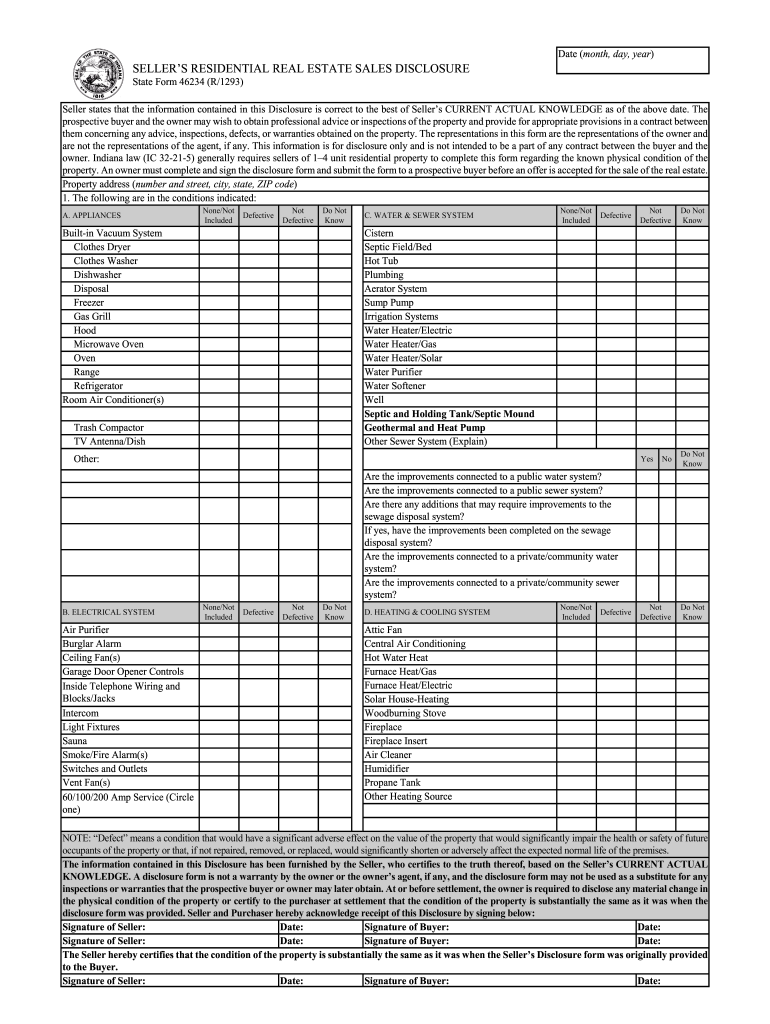

The Indiana Sales Disclosure Form is a legal document required by the state of Indiana for real estate transactions. This form provides essential information about the property being sold, including its condition, any known defects, and other critical details that may affect the buyer's decision. The seller must complete this form to disclose any material facts about the property, ensuring transparency in the transaction process. This form is a key component in protecting both the buyer and seller, as it helps to establish clear expectations and reduce the risk of disputes.

Key elements of the Indiana Sales Disclosure Form

Several key elements are essential to the Indiana Sales Disclosure Form. These include:

- Property Information: This includes the address, legal description, and type of property.

- Seller's Disclosure: Sellers must disclose any known issues, such as structural problems, pest infestations, or environmental hazards.

- Utilities and Systems: Information about the heating, cooling, plumbing, and electrical systems must be provided.

- Additional Disclosures: Any other relevant details that may impact the buyer's decision should be included.

Completing these elements accurately is crucial for compliance with Indiana law and for ensuring a smooth transaction.

Steps to complete the Indiana Sales Disclosure Form

Completing the Indiana Sales Disclosure Form involves several steps to ensure accuracy and compliance:

- Gather Property Information: Collect all necessary details about the property, including its address and legal description.

- Assess Property Condition: Conduct a thorough inspection of the property to identify any issues that need to be disclosed.

- Fill Out the Form: Complete the form, providing all required information and disclosures.

- Review and Sign: Review the completed form for accuracy and have all necessary parties sign it to validate the document.

Following these steps helps ensure that the form is properly completed and legally binding.

Legal use of the Indiana Sales Disclosure Form

The Indiana Sales Disclosure Form must be used in accordance with state laws to ensure its legal validity. Sellers are required to provide this form to potential buyers before the sale is finalized. Failure to provide the disclosure can lead to legal consequences, including potential lawsuits or financial penalties. It is essential for sellers to understand their obligations under Indiana law and to use the form as intended to protect themselves and the buyer.

How to obtain the Indiana Sales Disclosure Form

The Indiana Sales Disclosure Form can be obtained through various channels. It is available online from the Indiana state government website, where users can download a printable version. Additionally, real estate professionals, such as agents and brokers, often have copies of the form available for their clients. It is important to ensure that the most current version of the form is used to comply with any changes in state regulations.

Disclosure Requirements

Disclosure requirements for the Indiana Sales Disclosure Form are designed to protect buyers by ensuring they receive all pertinent information about the property. Sellers must disclose any known defects, issues with the property, or other factors that could influence a buyer's decision. This includes information about structural integrity, environmental hazards, and the condition of major systems. Adhering to these requirements is essential for a transparent transaction and helps to build trust between the seller and buyer.

Quick guide on how to complete form seller

Ensure precision on Indiana Sales Disclosure Document

In the realm of contracts, listing management, meeting organization, and property showings, realtors and real estate professionals shift between various duties daily. Many of these tasks involve a signNow amount of paperwork, such as Indiana Sales Disclosure Form, that needs to be completed promptly and as accurately as possible.

airSlate SignNow serves as a comprehensive platform that allows professionals in real estate to reduce the documentation burden, enabling them to focus more on their clients’ objectives throughout the negotiation journey and assisting them in securing the most favorable terms on the agreement.

Steps to fill out Indiana Sales Disclosure Form with airSlate SignNow:

- Go to the Indiana Sales Disclosure Form section or utilize our library’s search features to find the document you require.

- Click Get form—you’ll be directed to the editing interface immediately.

- Begin filling out the document by selecting fillable fields and entering your information.

- Add additional text and modify its settings if needed.

- Select the Sign option in the upper toolbar to create your signature.

- Explore other functions available for annotating and enhancing your document, such as drawing, highlighting, adding shapes, and so forth.

- Access the comment tab and include notes regarding your document.

- Conclude the process by downloading, sharing, or emailing your document to your intended recipients or organizations.

Eliminate paper entirely and streamline the homebuying experience with our intuitive and powerful platform. Experience greater convenience when signNowing Indiana Sales Disclosure Form and other real estate documents online. Try our solution today!

Create this form in 5 minutes or less

FAQs

-

How do I fill out form 26QB for TDS in case of more than one buyer and seller?

Hi,Please select Yes in the column of Whether more than one Buyer/seller as applicable, and enter the Primary Member details in the Address of Transferee/Transferor & no need of secondary person details.The reason to include this is to know whether the agreement includes more than one buyer/seller, so the option is enabled.Hope it is useful.

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

Have you ever gotten a great deal on a car through strange means?

In about 2003, I found a ‘73.5 Porsche 911 that was pristine. The seller was a broker I’d dealt with previously, selling it as a favor for a friend. I looked it over, talked to the owner and got the story. It was a real-deal two owner car, really low miles, beautiful condition.I left my 930 as a security deposit and took it to the shop I used for pre-buy inspections and hung out while that was done. In the process, looking over the underside, I noted a bunch of body-color overspray. At some point, this car had been re-sprayed; it wasn’t as pristine as was thought.That said, it was in marvelous condition, I was completely satisfied, was ready to buy it at the asking price.I drove it back, and was sitting with the broker, looking over the paperwork, and as I was filling out forms, said “You know, this car has been resprayed” and showed him a photo of the underside.He got really red in the face, and left the room. I heard him on the phone. After a bit he came back, and apologized and said “How about I knock five grand off the price?”Um. Sure??Completely unexpected. Turned a decent deal into a massively great deal.

-

I don't have enough money to buy a house. How can I buy a house with limited money?

A home is the most expensive thing most people will buy in their entire lives. Most people pay between 2 and 10 times their annual income for a home and spend most of their working lives paying down the mortgage. Saving the down payment for your first home is difficult. For most it requires living well below their means while they save up between 5% and 25% of the purchase price of a home as a down payment.Take a look at your current annual income. Then look at the prices for modest homes in your area. You might not be able to afford a house on a lot. You might have to settle for a small apartment. If you can’t find anything for 10 times your annual income or less, you aren’t going to be able to afford to buy a home, even If you could save up a down payment. Your only solution will be to increase your annual income.Maybe your best use of any savings you can scrape together might be more education and training that will allow you to qualify for a better paying job. If you are stuck in a low wage rut, you need to make breaking out of that your first priority. Let saving for a home come later, after you have established a better career.

-

How many guns bought using the gun show loophole have actually been used in gun crimes? How do supporters of closing that loophole expect it to be enforced? Isn’t that law a toothless tiger?

You’re falling for the usual lies told to the uninformed.In order to buy a gun commercially, you have to get it from a dealer with a Federal Firearms License. He has certain rules he must enforce in order to keep his license. It doesn’t matter if he has a gun shop, sells from his home, sells on the internet, sells at gun shows or sells from a cave on the moon.He can only sell the kinds of guns sold lawfully in his state and/or the state he may be sending the gun to. If he is selling a gun directly to a buyer in his jurisdiction, he must enforce the laws of that jurisdiction. Those include filling out and filing the proper forms, registration, any relevant state or federal waiting period, proper identification, a background check with state and federal authorities, payment of relevant taxes and any other laws which may apply. If he is sending a gun to another jurisdiction, he can only send it to another FFL dealer in that state and that dealer must enforce the laws applicable in that jurisdiction.The only procedures which differ at gun shows are those made applicable because the sale is made in the venue of the gun show. For instance, if a vendor from Arizona brings guns into California, he can only bring in those which comply with California law and he must arrange for another FFL dealer based in California to keep the gun for the waiting period and ensure that all relevant procedures and laws are complied with.Occasionally, you may see private individuals bringing guns into the gun show to sell to other private individuals. In such a case the officials running the show check people with guns in and out in order to ensure that the law has been complied with. For instance, in California individuals engaging in a gun transfer must do it through an FFL dealer at the show and comply with all laws.It is exactly the same as buying a gun in any gun store except that you do it in a large arena and get to wander around looking at guns and accessories you normally cannot get in any other forum.From time to time you will hear politicians such as Nancy Pelosi demanding to eliminate the “gun show loophole.” The reason they can keep saying this is that they make points with their gullible and misinformed constituents, giving the impression that they are battling the NRA and crazed gun owners to establish yet another “reasonable regulation” for some practice which is already taken care of by federal and state law.Have you noticed that, as much as they castigate the ”gun show loophole” they never actually produce legislation to eliminate it? It shouldn’t be that difficult, but for one thing . . .They are lying to you. There is no “gun show loophole.” As usual, for some reason you believe them.

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

In California, when purchasing a car from a private party, does the old owner immediately remove the license plate?

I wanted to update the answers here as I recently talked to a seller who had personalized plates which he had taken off the car, claiming that it was legal for me, the buyer, to drive a car with no plates, just tape the registration to windshield. That was completely not true. It is the sellers responsibility to get no fee regular license plates. From the Ca DMV website:“What do I do with the license plates when I sell my car? Most vehicles have sequentially issued "standard" license plates that remain with the vehicle when ownership is transferred. If the vehicle has a special interest or personalized license plate, these plates belong to the plate owner, not the vehicle. Aas the seller you must decide if you want to retain the license plate for use on another vehicle, or release your interest in the license plate. You (meaning the seller) may remove the plates for reassignment to another vehicle or retain for future use and apply for a no-fee Regular Series License Plate. This should be done prior to obtaining the smog certification (if required). Depending on the type of license plate, complete a Special Interest License Plate Application (REG 17) form or a Special License Plate Application (REG 17A) form to indicate retention or release of the special license plate and give the form to the buyer. If you are releasing the plate ownership to the buyer, the buyer would also complete a separate REG 17 form.”Link to Ca DMV page about changing vehicle ownership, above about half way down page in FAQ’s. HTVR 32

-

Why are teddy bears more strictly regulated than guns?

As someone who has been published in The Huffington Post, I can tell you that it is a hard left (very liberal) paper. What they are reporting here isn't news. They are, instead, advocating under the guise of news. For what it's worth, this isn't me claiming this. Allsides did a pretty good job of evaluating them: Huffington Post. I'm not saying that HuffPo is a terrible paper, run by terrible people. Instead, you should remember that what you've just read is a public service announcement.Teddy Bears are more carefully regulated? You're kidding, right? This doesn't even pass on first glance. I doubt anyone who understands gun control could argue that teddy bears are more regulated.Do they regulate how big of a teddy bear you can buy? Do they tell you that you can buy a black teddy bear, but not a silver one? Do you have to wait ten days to pick up a teddy bear you've already paid for? Can you be arrested because the laws about teddy bear configurations have changed, and you didn't know? No? No need to keep abreast of the TONS of teddy bear legislation? Surprising. Be careful crossing state lines with your Teddy Ruxpin. You have no idea how New Jersey will react. Or New York. Or California. Firearms are far more regulated than just about anything, probably up to and including pharmacology.And, I should point out, this is all to regulate a constitutionally protected right which is never supposed to be infringed.Teddy Bears are regulated only in their manufacture. You, as a citizen and consumer don't have to worry about anything. On the other hand, as a gun owner, you constantly have to be on guard. I don't disagree with the necessity of this, but I do laugh at the outrageous assertion that it is otherwise.So all that being said, let’s look at what the Illinois Counsel Against Gun Violence has to say: Ah. They listed maybe three dozen lines of laws regulating teddy bears and one law which hits guns. Well. That’s pretty damning.Except for one thing. The federal government, per our constitution, doesn’t regulate guns. Not that it really doesn’t, mind you. It just isn’t supposed to.So here’s the rub! Let’s look at all 50 states’ laws regarding teddy bears:ZERO.Let’s look at just California state laws regarding guns:Well… I would, but I’m not sure that Quora could handle it. In fact, it’s such a byzantine set of laws, they have an entire governmental department (the Bureau of Firearms) to regulate it. There are laws on the books regarding just about everything concerning firearms.To sum things up, teddy bears aren't more heavily regulated. Nothing of the sort. But maybe they should be. You have no constitutional right to a teddy bear.

Create this form in 5 minutes!

How to create an eSignature for the form seller

How to generate an eSignature for the Form Seller online

How to generate an electronic signature for your Form Seller in Chrome

How to generate an eSignature for putting it on the Form Seller in Gmail

How to create an electronic signature for the Form Seller straight from your smart phone

How to create an eSignature for the Form Seller on iOS devices

How to generate an electronic signature for the Form Seller on Android

People also ask

-

What is the Indiana Sales Disclosure Form?

The Indiana Sales Disclosure Form is a required document that must be filed when selling real estate in Indiana. This form provides essential information about the property and its sale, ensuring transparency in real estate transactions. With airSlate SignNow, you can easily eSign and manage your Indiana Sales Disclosure Form online.

-

How can I use airSlate SignNow for the Indiana Sales Disclosure Form?

With airSlate SignNow, you can effortlessly create, fill out, and eSign the Indiana Sales Disclosure Form. Our platform allows you to streamline the signing process, making it simple to manage real estate documents digitally. Plus, you can access your forms from any device, ensuring convenience and efficiency.

-

Is airSlate SignNow suitable for real estate agents in Indiana?

Absolutely! airSlate SignNow is an ideal solution for real estate agents in Indiana who need to handle the Indiana Sales Disclosure Form. Our platform simplifies document management and enhances collaboration, allowing agents to get contracts signed quickly and efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a range of pricing plans to cater to different business needs, including options tailored for real estate professionals. You can choose from individual, business, or enterprise plans, ensuring you find the right fit for managing the Indiana Sales Disclosure Form and other documents.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow. Whether you use CRM tools, document management systems, or other real estate software, you can easily incorporate the Indiana Sales Disclosure Form into your existing processes.

-

What are the benefits of using airSlate SignNow for the Indiana Sales Disclosure Form?

Using airSlate SignNow for the Indiana Sales Disclosure Form offers numerous benefits, including faster turnaround times, enhanced security, and reduced paperwork. Our platform allows you to track the signing process in real time, ensuring that your transactions are completed smoothly and efficiently.

-

Is it safe to eSign the Indiana Sales Disclosure Form with airSlate SignNow?

Yes, it is completely safe to eSign the Indiana Sales Disclosure Form using airSlate SignNow. We prioritize security with advanced encryption and compliance with legal standards, ensuring that your documents remain confidential and protected throughout the signing process.

Get more for Indiana Sales Disclosure Form

- Resale certificate nevada form

- Tr8 technical report form

- Annual maintenance report form

- Blower door test form fill online printable fillable

- Cf 4 form

- Application for reissue of summons format

- Insurance update and vehicle reinstatement servicearizona form

- Contact usdivision of motor vehiclesnh department form

Find out other Indiana Sales Disclosure Form

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template