Name of Accountant Form

What is the Name Of Accountant

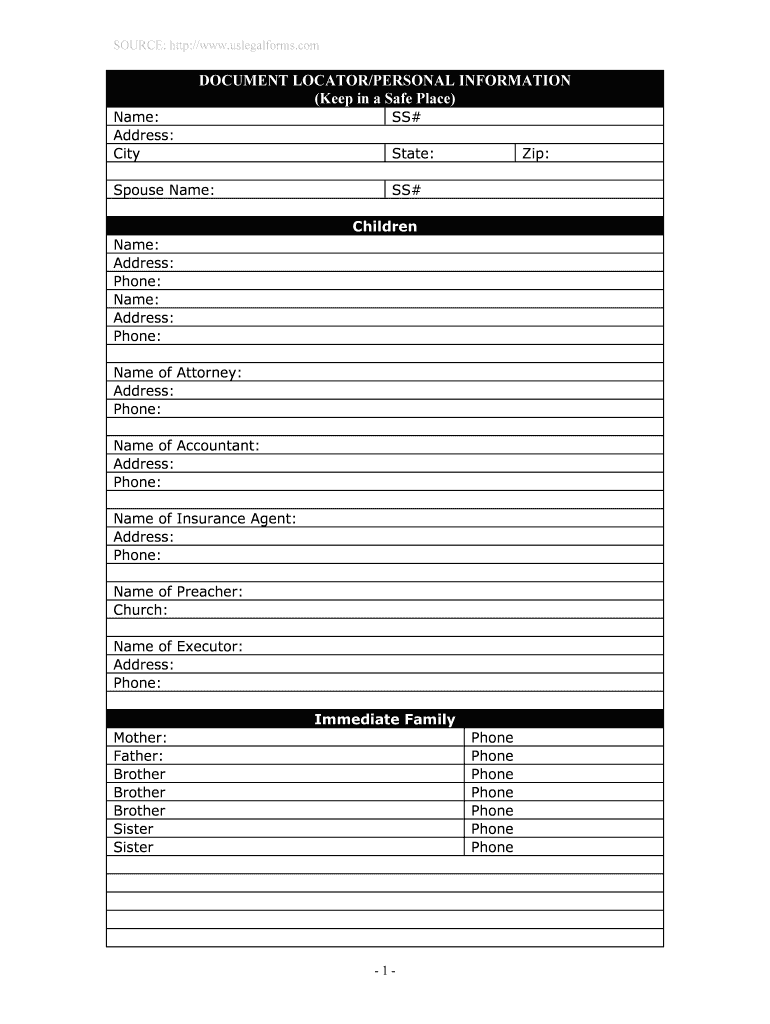

The Name Of Accountant form is a crucial document used in various financial and legal contexts, primarily to identify the individual or firm responsible for accounting services. This form typically includes essential details such as the accountant's name, contact information, and professional credentials. It is often required for tax filings, financial audits, and compliance with regulatory standards. Understanding the specifics of this form is vital for both individuals and businesses to ensure accurate reporting and accountability in financial matters.

How to use the Name Of Accountant

Using the Name Of Accountant form involves several straightforward steps. First, gather all necessary information about the accountant, including their full name, license number, and contact details. Next, accurately fill out the form, ensuring that all fields are completed to avoid any processing delays. Once the form is filled, it may need to be submitted to relevant entities, such as tax authorities or financial institutions, depending on its intended use. Ensuring that the form is completed correctly is essential for maintaining compliance and avoiding potential penalties.

Steps to complete the Name Of Accountant

Completing the Name Of Accountant form requires careful attention to detail. Follow these steps for a successful submission:

- Collect necessary information about the accountant, including their name, address, and professional qualifications.

- Access the form through the appropriate channel, whether online or in paper format.

- Fill in all required fields accurately, ensuring no information is omitted.

- Review the completed form for any errors or missing details.

- Submit the form to the relevant authority or organization as required.

Legal use of the Name Of Accountant

The legal use of the Name Of Accountant form is governed by specific regulations that vary by state and context. This form is essential for establishing accountability and transparency in financial reporting. It serves as a formal declaration of the accountant's role and responsibilities. Compliance with legal requirements ensures that the form is recognized in legal proceedings and by regulatory bodies. It is crucial to understand the legal implications of the information provided on this form to avoid any issues related to misrepresentation or fraud.

IRS Guidelines

The Internal Revenue Service (IRS) has specific guidelines regarding the use of the Name Of Accountant form, particularly in relation to tax filings. Accountants are often required to provide their information on various tax documents to ensure proper identification and accountability. Familiarizing oneself with IRS regulations helps ensure that the form is used correctly and that all necessary information is included. Failure to comply with IRS guidelines can result in penalties or delays in processing tax returns.

Required Documents

When completing the Name Of Accountant form, several supporting documents may be required to validate the information provided. These documents can include:

- Proof of the accountant's professional qualifications, such as licenses or certifications.

- Identification documents, which may include a driver's license or passport.

- Any relevant financial statements or reports that support the accountant's role.

Having these documents ready can streamline the completion process and ensure compliance with any regulatory requirements.

Penalties for Non-Compliance

Failure to properly complete or submit the Name Of Accountant form can lead to significant penalties. Non-compliance may result in fines, delays in processing financial documents, or complications during audits. It is essential to adhere to all guidelines and ensure that the form is submitted accurately and on time to avoid these potential consequences. Understanding the risks associated with non-compliance can motivate individuals and businesses to prioritize the proper handling of this form.

Quick guide on how to complete name of accountant

Effortlessly prepare Name Of Accountant on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the required form and securely store it online. airSlate SignNow offers all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Name Of Accountant on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

Easily modify and eSign Name Of Accountant

- Obtain Name Of Accountant and click on Get Form to begin.

- Utilize our tools to complete your document.

- Highlight pertinent sections of the documents or black out sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Edit and eSign Name Of Accountant and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of a Name Of Accountant in document management?

The Name Of Accountant plays a crucial role in document management by ensuring that all financial paperwork is accurate and complies with regulations. With airSlate SignNow, accountants can efficiently manage and eSign documents, streamlining their workflow and reducing the risk of errors.

-

How can airSlate SignNow assist a Name Of Accountant with client contracts?

airSlate SignNow enables a Name Of Accountant to effortlessly send and eSign client contracts, thereby accelerating the approval process. This solution not only saves time but also provides a secure and legally binding method for managing contracts, making it an ideal choice for busy accountants.

-

What are the pricing options for airSlate SignNow for a Name Of Accountant?

Pricing for airSlate SignNow varies based on the features and number of users required, making it adaptable for any Name Of Accountant. You can choose from several plans that cater specifically to small accounting firms or larger enterprises, ensuring that you only pay for what you need.

-

What features does airSlate SignNow offer for a Name Of Accountant?

airSlate SignNow offers an array of features tailored for a Name Of Accountant, including customizable templates, advanced security settings, and integration capabilities with other accounting tools. These features help streamline document processes and enhance overall productivity.

-

Why should a Name Of Accountant choose airSlate SignNow over other e-signature solutions?

A Name Of Accountant should choose airSlate SignNow for its user-friendly interface, robust features, and competitive pricing. Additionally, it provides excellent customer support and integrates seamlessly with financial software, making it a superior choice for accounting needs.

-

Can a Name Of Accountant integrate airSlate SignNow with other software?

Yes, airSlate SignNow allows for easy integrations with various accounting software that a Name Of Accountant might already be using. This functionality ensures a smooth workflow by connecting all your essential tools in one platform, eliminating data silos and enhancing efficiency.

-

What benefits does airSlate SignNow provide for a Name Of Accountant’s workflow?

AirSlate SignNow greatly enhances a Name Of Accountant’s workflow by automating the signing process, reducing turnaround times on crucial documents. This not only minimizes administrative tasks but also allows accountants to focus more on strategic financial advising and client relations.

Get more for Name Of Accountant

Find out other Name Of Accountant

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors