DISCHARGE and RELEASE of LIEN CORPORATION or LLC Form

What is the discharge and release of lien corporation or LLC

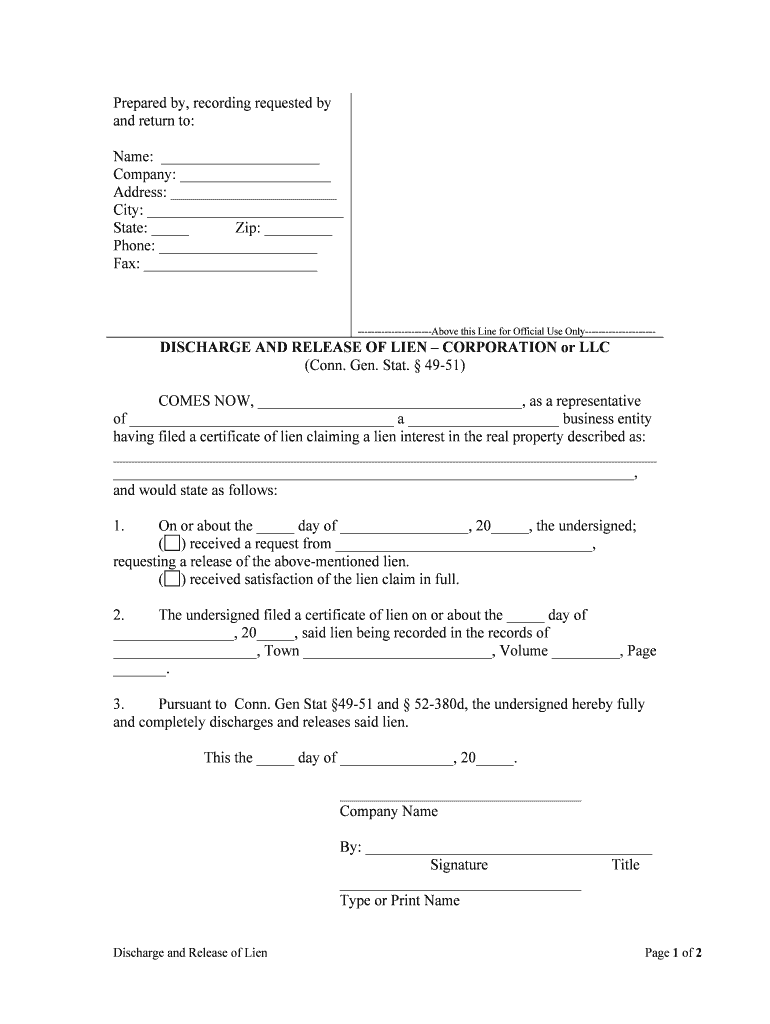

The discharge and release of lien corporation or LLC form is a legal document that officially removes a lien from a property or asset owned by a corporation or limited liability company (LLC). A lien is a legal right or interest that a lender has in the borrower's property, granted until the debt obligation is satisfied. This form is essential for businesses that have settled their debts and wish to clear their title, ensuring they can conduct transactions without encumbrances. The process typically involves the creditor acknowledging the payment and formally releasing their claim on the property.

Steps to complete the discharge and release of lien corporation or LLC

Completing the discharge and release of lien corporation or LLC form involves several key steps:

- Gather necessary information, including the lien details, debtor information, and creditor's acknowledgment of payment.

- Obtain the appropriate form from the relevant state or local authority, ensuring it meets jurisdictional requirements.

- Fill out the form accurately, including all required fields such as names, addresses, and property descriptions.

- Have the form signed by the authorized representative of the creditor, confirming the release of the lien.

- Submit the completed form to the appropriate office, which may include a county clerk or recorder, along with any required fees.

Legal use of the discharge and release of lien corporation or LLC

The legal use of the discharge and release of lien corporation or LLC form is crucial for ensuring that a corporation or LLC can operate without the burden of outstanding liens. This document serves as proof that the lien has been released, which is important for future transactions, including selling or refinancing the property. It is legally binding once properly executed and filed, protecting the interests of both the debtor and creditor. Compliance with local laws and regulations is essential to validate the form's legal standing.

Key elements of the discharge and release of lien corporation or LLC

Several key elements must be included in the discharge and release of lien corporation or LLC form to ensure its validity:

- Debtor Information: The name and address of the corporation or LLC that is being released from the lien.

- Creditor Information: The name and address of the creditor who holds the lien.

- Property Description: A detailed description of the property or asset subject to the lien.

- Statement of Release: A clear statement indicating that the lien is being released due to payment or settlement.

- Signatures: Signatures of authorized representatives from both the creditor and debtor, along with the date of signing.

State-specific rules for the discharge and release of lien corporation or LLC

Each state in the U.S. may have specific rules and regulations governing the discharge and release of lien corporation or LLC forms. These rules can vary in terms of required documentation, filing fees, and submission methods. It is essential for businesses to familiarize themselves with their state's requirements to ensure compliance. Some states may require additional forms or notarization, while others may have electronic filing options available. Consulting with a legal professional or local authority can provide clarity on state-specific regulations.

Form submission methods for the discharge and release of lien corporation or LLC

The discharge and release of lien corporation or LLC form can typically be submitted through various methods, depending on state regulations:

- Online Submission: Many states offer electronic filing options through their official websites, allowing for quicker processing.

- Mail: Forms can often be mailed to the appropriate county clerk or recorder's office, including any required fees.

- In-Person Submission: Businesses may also choose to submit the form in person at the local office, which can provide immediate confirmation of receipt.

Quick guide on how to complete discharge and release of lien corporation or llc

Effortlessly Prepare DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC with Ease

- Locate DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC process?

The DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC process involves eliminating a lien on property or assets held by a corporation or LLC. This is essential for maintaining clear ownership and ensuring that the entity can freely conduct business. Utilizing airSlate SignNow streamlines this process through efficient document management and eSigning capabilities.

-

How does airSlate SignNow help with DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC?

airSlate SignNow provides a user-friendly platform for managing the DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC documentation. The software allows users to create, send, and sign essential documents electronically, signNowly reducing the time taken for this crucial process. With templates and integrations, the process becomes even more efficient.

-

What are the costs associated with using airSlate SignNow for DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs. Depending on the features you choose, you can access an affordable solution for managing your DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC documentation. Detailed pricing can be found on our website.

-

Can I integrate airSlate SignNow with other tools for my DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC?

Yes, airSlate SignNow integrates seamlessly with numerous applications, enhancing your workflow for DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC tasks. This means you can connect it to your CRM, storage services, and more for a comprehensive solution. Check our integrations page for a full list of compatible applications.

-

What are the benefits of using airSlate SignNow for DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC?

Using airSlate SignNow for DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC provides numerous benefits, including faster processing times, the ability to track document status, and improved security for sensitive information. Additionally, it eliminates the need for physical paperwork, promoting a more eco-friendly approach to business.

-

Is airSlate SignNow secure for handling DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC documents?

Absolutely. airSlate SignNow employs industry-standard encryption and security protocols to ensure all DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC documents are protected. This means your sensitive information remains confidential and secure while being processed electronically.

-

How do I get started with airSlate SignNow for DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC?

Getting started with airSlate SignNow for DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC is simple. Just sign up on our website, choose a suitable plan, and you can begin creating, sending, and signing your documents right away. Our user-friendly interface makes the onboarding process straightforward.

Get more for DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC

- Truist signature card form

- Louisiana bus pre trip inspection form

- Telework bapplicationb and agreement 816283 form

- Health surveillance form

- Form approved omb no 1515 0053 department of the treasury

- Www 1040k org florida institute of cpas form

- Okdhs paper claim fill online printable fillable blank form

- Editable non disclosure agreement template form

Find out other DISCHARGE AND RELEASE OF LIEN CORPORATION Or LLC

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document