Insurance CarrierSelf InsurerThird Party Adjuster Form

What is the Insurance CarrierSelf InsurerThird Party Adjuster

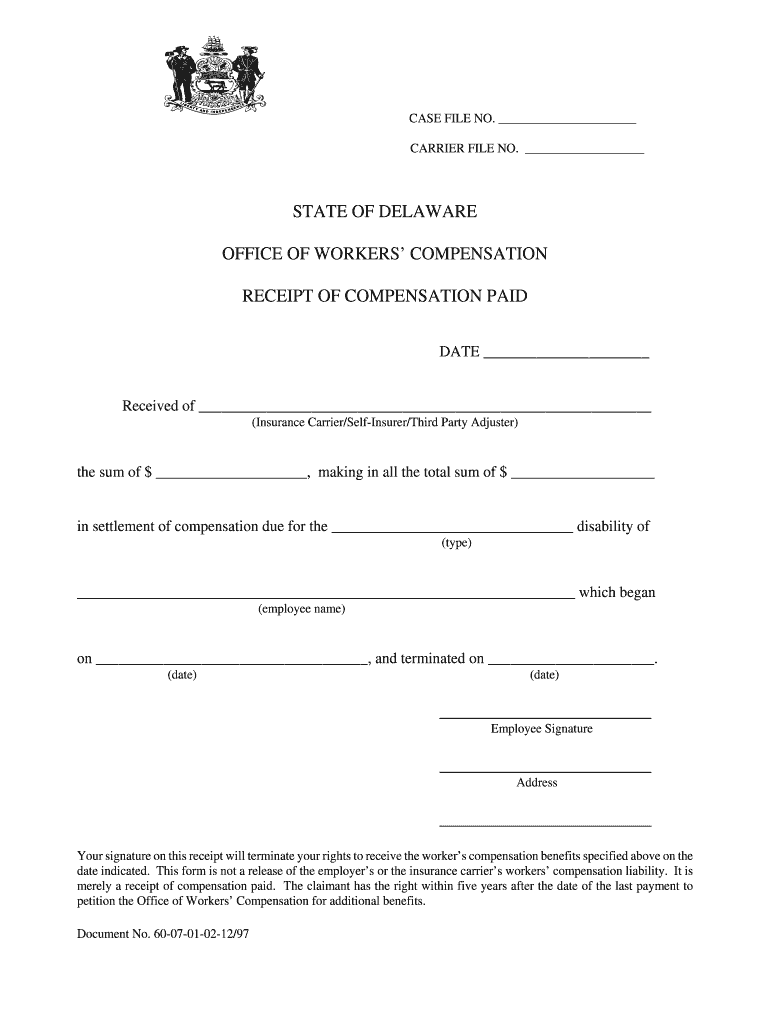

The Insurance CarrierSelf InsurerThird Party Adjuster form is a critical document used in the insurance industry to delineate the responsibilities and roles of various parties involved in managing claims. This form helps clarify the relationship between the insurance carrier, self-insured entities, and third-party adjusters. Understanding this form is essential for ensuring compliance with regulations and facilitating smooth claims processing.

How to use the Insurance CarrierSelf InsurerThird Party Adjuster

Using the Insurance CarrierSelf InsurerThird Party Adjuster form involves several straightforward steps. First, gather all necessary information regarding the claim, including details about the involved parties and the nature of the claim. Next, accurately complete the form, ensuring that all required fields are filled out. After filling in the details, review the form for accuracy before submitting it to the appropriate entity, such as an insurance carrier or regulatory body. Utilizing electronic signature solutions can streamline this process, making it easier to manage and submit the form securely.

Steps to complete the Insurance CarrierSelf InsurerThird Party Adjuster

Completing the Insurance CarrierSelf InsurerThird Party Adjuster form requires careful attention to detail. Follow these steps for effective completion:

- Collect all relevant information, including policy numbers, claimant details, and incident descriptions.

- Fill out the form systematically, ensuring that each section is complete and accurate.

- Double-check all entries for errors or omissions.

- Sign the form electronically or manually, as required.

- Submit the completed form to the designated party, ensuring to keep a copy for your records.

Legal use of the Insurance CarrierSelf InsurerThird Party Adjuster

The legal use of the Insurance CarrierSelf InsurerThird Party Adjuster form is governed by specific regulations that ensure its validity in claims processing. To be legally binding, the form must be completed accurately and signed by all relevant parties. Compliance with laws such as the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) is essential when using electronic signatures. These laws affirm that electronic signatures hold the same legal weight as traditional handwritten signatures, provided that the signers consent to use electronic means.

Key elements of the Insurance CarrierSelf InsurerThird Party Adjuster

Several key elements must be included in the Insurance CarrierSelf InsurerThird Party Adjuster form to ensure its effectiveness and legality. These elements include:

- Identification of Parties: Clearly state the names and roles of the insurance carrier, self-insurer, and third-party adjuster.

- Claim Details: Provide comprehensive information regarding the claim, including dates, locations, and descriptions of the incident.

- Signatures: Ensure that all parties involved sign the form to validate it.

- Date of Completion: Include the date when the form was completed and signed.

State-specific rules for the Insurance CarrierSelf InsurerThird Party Adjuster

Each state may have specific rules and regulations governing the use of the Insurance CarrierSelf InsurerThird Party Adjuster form. It is crucial to familiarize yourself with these state-specific requirements to ensure compliance. These rules may dictate how the form should be completed, submitted, and retained. Additionally, some states might have unique provisions regarding the roles of self-insurers and third-party adjusters, which can impact claims processing and liability.

Quick guide on how to complete insurance carrierself insurerthird party adjuster

Effortlessly prepare Insurance CarrierSelf InsurerThird Party Adjuster on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can easily find the correct form and securely store it in the cloud. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Insurance CarrierSelf InsurerThird Party Adjuster on any device using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

The easiest method to modify and eSign Insurance CarrierSelf InsurerThird Party Adjuster without hassle

- Obtain Insurance CarrierSelf InsurerThird Party Adjuster and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Insurance CarrierSelf InsurerThird Party Adjuster and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the benefits of using airSlate SignNow for Insurance Carrier, Self Insurer, and Third Party Adjuster workflows?

airSlate SignNow streamlines document management for Insurance Carrier, Self Insurer, and Third Party Adjuster entities by providing easy eSigning capabilities. The platform enhances efficiency, reduces turnaround times, and ensures compliance with regulatory standards, making it an ideal choice for managing insurance-related documentation.

-

How does airSlate SignNow integrate with existing systems used by Insurance Carriers and Adjusters?

airSlate SignNow offers robust integrations with various CRM and ERP systems commonly used by Insurance Carrier, Self Insurer, and Third Party Adjuster professionals. This seamless connectivity helps maintain workflows and ensures that documents are easily accessible and manageable within existing digital frameworks.

-

Is there a free trial available for Insurance Carrier, Self Insurer, and Third Party Adjuster users?

Yes, airSlate SignNow provides a free trial for families of users including Insurance Carrier, Self Insurer, and Third Party Adjuster professionals. This trial allows potential customers to explore the features and benefits of the platform before committing to a subscription.

-

How does airSlate SignNow ensure the security of documents for Insurance Carrier and Third Party Adjuster clients?

Security is a priority for airSlate SignNow, especially for sensitive documents handled by Insurance Carrier and Third Party Adjuster clients. The platform uses encryption and secure cloud storage to protect documents, ensuring that only authorized personnel have access to important information.

-

What pricing plans are available for Insurance Carrier, Self Insurer, and Third Party Adjuster businesses?

airSlate SignNow offers flexible pricing plans tailored to the needs of Insurance Carrier, Self Insurer, and Third Party Adjuster businesses. Users can choose from various subscription options to find a plan that fits their budget while providing the necessary features to enhance their document workflows.

-

Can airSlate SignNow accommodate high-volume document signing needed by Insurance Carriers?

Absolutely. airSlate SignNow is designed to handle high-volume document signing, which is essential for Insurance Carrier, Self Insurer, and Third Party Adjuster operations. The platform can efficiently manage large quantities of documents while maintaining fast turnaround times and high reliability.

-

What are the key features of airSlate SignNow that benefit Insurance Carrier and Adjuster operations?

airSlate SignNow features include easy document eSigning, customizable templates, automated workflows, and real-time tracking, all of which cater to Insurance Carrier, Self Insurer, and Third Party Adjuster operations. These features help improve efficiency and ensure that all document processes are smooth and compliant.

Get more for Insurance CarrierSelf InsurerThird Party Adjuster

Find out other Insurance CarrierSelf InsurerThird Party Adjuster

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF