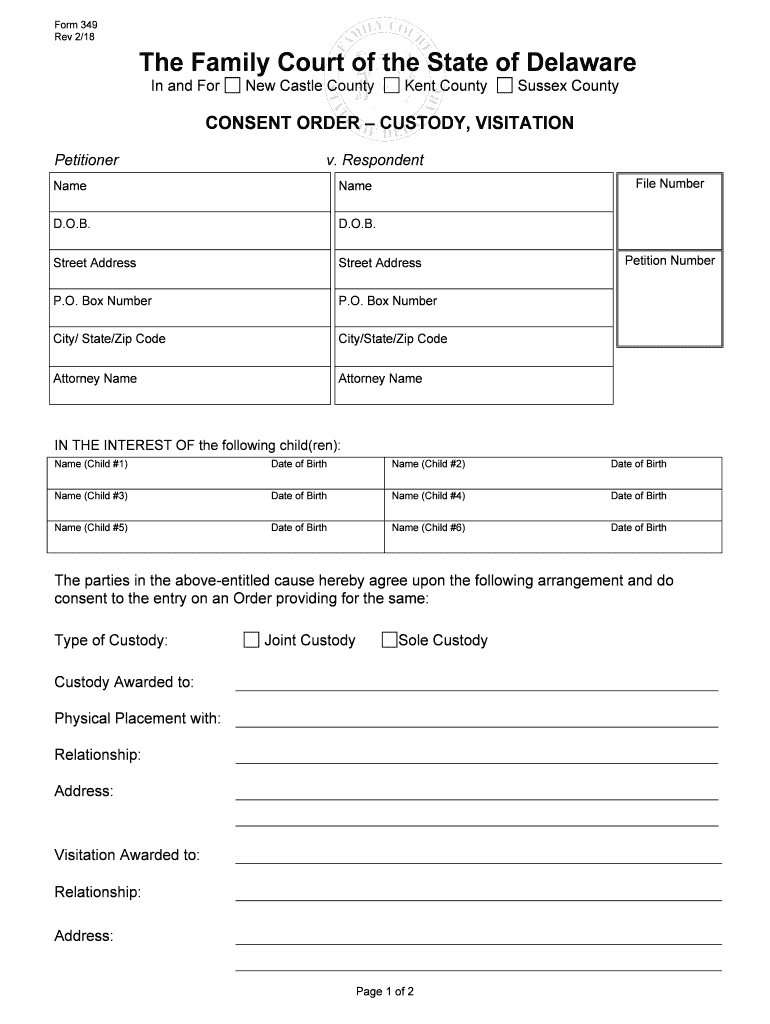

Form 349

What is the Form 349

The Form 349 is a crucial document used primarily for reporting specific financial information to the Internal Revenue Service (IRS). This form is often associated with particular tax situations and is essential for ensuring compliance with federal tax laws. Understanding its purpose is vital for both individuals and businesses to avoid potential penalties and ensure accurate reporting.

How to use the Form 349

Using the Form 349 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents that pertain to the reporting period. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect your financial situation. After completing the form, review it for any errors before submission. This careful attention to detail helps prevent issues with the IRS.

Steps to complete the Form 349

Completing the Form 349 requires a systematic approach. Start by downloading the form from the IRS website or obtaining a physical copy. Follow these steps:

- Read the instructions provided with the form to understand what information is required.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Complete the financial sections with accurate data from your records.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 349

The legal use of the Form 349 is governed by IRS regulations. To be considered valid, the form must be filled out completely and accurately. Additionally, it must be submitted by the appropriate deadlines to avoid penalties. Electronic submission of the form is permitted, provided that it complies with eSignature laws. This ensures that the form holds legal weight and can be used in any necessary legal or tax-related proceedings.

Filing Deadlines / Important Dates

Filing deadlines for the Form 349 are critical for compliance. Typically, the form must be submitted by the tax deadline for the year in which the income was earned or the financial activity occurred. It is essential to stay informed about any changes to these deadlines, as they can vary from year to year. Missing a deadline can result in penalties or interest charges, making timely submission a priority for taxpayers.

Form Submission Methods (Online / Mail / In-Person)

The Form 349 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically, which can expedite processing times.

- Mail: The form can be printed and mailed to the designated IRS address, ensuring it is postmarked by the filing deadline.

- In-Person: For those who prefer face-to-face interaction, visiting a local IRS office is an option for submitting the form directly.

Quick guide on how to complete form 349

Prepare Form 349 effortlessly on any device

Online document administration has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form 349 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Form 349 with ease

- Locate Form 349 and click on Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Modify and eSign Form 349 and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 349 and how can airSlate SignNow help with it?

Form 349 is typically used for specific documentation needs in various industries. With airSlate SignNow, you can easily create, send, and eSign Form 349, streamlining your document workflow and improving efficiency.

-

What features does airSlate SignNow offer for managing Form 349?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure cloud storage, all tailored for managing Form 349. These tools simplify document management, making it easier to handle multiple revisions and approvals.

-

Is there a cost associated with using airSlate SignNow for Form 349?

Yes, airSlate SignNow offers various pricing plans to fit different business needs when dealing with Form 349. Each plan is competitively priced, ensuring you find an affordable solution without compromising on essential features.

-

Can I integrate airSlate SignNow with other software while using Form 349?

Absolutely! airSlate SignNow supports integration with many popular applications, allowing you to seamlessly connect your existing software for an even smoother experience while managing Form 349. This integration helps centralize your workflow and enhances productivity.

-

What are the security measures in place for Form 349 on airSlate SignNow?

airSlate SignNow prioritizes security, ensuring that all documents, including Form 349, are protected with advanced encryption methods. Additionally, the platform complies with regulatory standards to maintain the confidentiality of your data.

-

How can airSlate SignNow improve the efficiency of handling Form 349?

By utilizing airSlate SignNow, businesses can signNowly increase their operational efficiency when handling Form 349. Features like automated workflows, reminders for signatures, and tracking capabilities reduce turnaround times and minimize errors.

-

Is it easy to track the status of Form 349 documents with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including Form 349. You can easily monitor who has opened, signed, or completed the form, ensuring complete visibility throughout the signing process.

Get more for Form 349

- Home inspection checklist form

- Standard form 1219

- Form da1 nomination under act 45za

- Family group sheet family group sheet form

- Residential utility application for the city of byron form

- Griffin spalding county united way agency date april form

- 225 arnold road form

- Citizens introduction to firearms class student application form

Find out other Form 349

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document