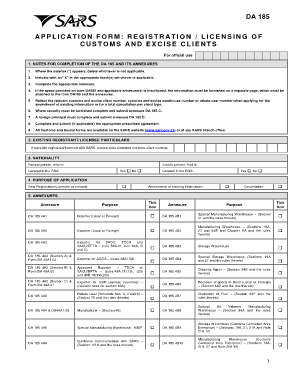

CUSTOMS and EXCISE CLIENTS Form

Understanding the Customs and Excise Clients Form

The Customs and Excise Clients form is a critical document used by businesses engaged in international trade. This form helps facilitate the import and export of goods, ensuring compliance with U.S. customs regulations. It captures essential information about the client and the nature of the goods being traded, which is vital for customs clearance. Understanding its components and requirements is crucial for businesses to avoid delays and penalties.

Steps to Complete the Customs and Excise Clients Form

Completing the Customs and Excise Clients form involves several key steps:

- Gather Required Information: Collect all necessary details about your business, including your Employer Identification Number (EIN), contact information, and the specifics of the goods being imported or exported.

- Fill Out the Form: Accurately enter all required information on the form. Ensure that the descriptions of goods are clear and comply with customs regulations.

- Review for Accuracy: Double-check all entries for accuracy to avoid potential issues with customs authorities.

- Submit the Form: Choose your preferred submission method—online through a secure platform, by mail, or in person at a customs office.

Legal Use of the Customs and Excise Clients Form

The Customs and Excise Clients form must be completed in accordance with U.S. laws and regulations. It serves as a legally binding document that provides the necessary information for customs clearance. To ensure its legal standing, all submissions should adhere to the guidelines set forth by the U.S. Customs and Border Protection (CBP) and be accompanied by any required supporting documentation. Non-compliance can lead to significant penalties.

Key Elements of the Customs and Excise Clients Form

This form includes several key elements that must be accurately filled out:

- Client Information: Name, address, and contact details of the business.

- Goods Description: Detailed descriptions of the items being imported or exported, including quantity and value.

- Customs Classification: Harmonized Tariff Schedule (HTS) codes that classify the goods for tariff purposes.

- Signature: A signature from an authorized representative of the business, confirming the accuracy of the information provided.

Form Submission Methods

The Customs and Excise Clients form can be submitted through various methods, depending on the preferences of the business and the requirements of the customs authority:

- Online Submission: Many businesses opt to submit the form electronically through a secure platform, which can expedite the process.

- Mail: The form can be printed and mailed to the appropriate customs office, although this method may result in longer processing times.

- In-Person Submission: Businesses may also choose to deliver the form in person to a customs office for immediate processing.

Penalties for Non-Compliance

Failure to comply with the requirements of the Customs and Excise Clients form can result in severe penalties. These may include:

- Fines: Financial penalties can be imposed for inaccuracies or omissions in the form.

- Delays: Non-compliance can lead to delays in customs clearance, affecting the timely delivery of goods.

- Seizure of Goods: In severe cases, customs authorities may seize goods that are not properly documented.

Quick guide on how to complete customs and excise clients

Effortlessly Prepare CUSTOMS AND EXCISE CLIENTS on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to find the correct template and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without any hold-ups. Manage CUSTOMS AND EXCISE CLIENTS on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Method to Edit and Electronically Sign CUSTOMS AND EXCISE CLIENTS Without Stress

- Find CUSTOMS AND EXCISE CLIENTS and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign CUSTOMS AND EXCISE CLIENTS while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the customs and excise clients

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What benefits does airSlate SignNow offer for CUSTOMS AND EXCISE CLIENTS?

airSlate SignNow provides CUSTOMS AND EXCISE CLIENTS with an efficient solution for managing documents electronically. It streamlines the process of signing and sending critical paperwork, saving time and reducing errors. With its user-friendly interface, CUSTOMS AND EXCISE CLIENTS can easily manage all their documentation needs in one place.

-

How does airSlate SignNow ensure compliance for CUSTOMS AND EXCISE CLIENTS?

For CUSTOMS AND EXCISE CLIENTS, compliance is crucial. airSlate SignNow offers features that keep all documents secure and compliant with industry standards. Our platform provides activity logs and secure storage, ensuring that CUSTOMS AND EXCISE CLIENTS can meet regulatory requirements with confidence.

-

What pricing plans are available for CUSTOMS AND EXCISE CLIENTS?

airSlate SignNow offers flexible pricing plans designed to meet the needs of CUSTOMS AND EXCISE CLIENTS. Pricing is based on the number of users and the features required, allowing CUSTOMS AND EXCISE CLIENTS to choose the best fit for their business. Contact us for a tailored quote that suits your specific requirements.

-

Can CUSTOMS AND EXCISE CLIENTS integrate airSlate SignNow with other software?

Yes, airSlate SignNow easily integrates with various software solutions commonly used by CUSTOMS AND EXCISE CLIENTS. This includes CRM systems, cloud storage, and enterprise applications. Custom integrations can also be developed to fit the unique workflows of CUSTOMS AND EXCISE CLIENTS.

-

How does airSlate SignNow enhance document security for CUSTOMS AND EXCISE CLIENTS?

Security is a top priority for airSlate SignNow, especially for CUSTOMS AND EXCISE CLIENTS. Our platform uses encryption and secure cloud storage to protect sensitive information. CUSTOMS AND EXCISE CLIENTS can have peace of mind knowing their documents are handled securely.

-

Is training provided for CUSTOMS AND EXCISE CLIENTS using airSlate SignNow?

Absolutely! airSlate SignNow offers comprehensive training and support for CUSTOMS AND EXCISE CLIENTS. Our dedicated customer service team is available to assist with onboarding and answer any questions, ensuring CUSTOMS AND EXCISE CLIENTS can utilize the platform effectively.

-

What types of documents can CUSTOMS AND EXCISE CLIENTS eSign with airSlate SignNow?

CUSTOMS AND EXCISE CLIENTS can eSign a variety of documents using airSlate SignNow, including contracts, agreements, and customs declarations. Our platform supports multiple file formats, making it versatile for any documentation needs faced by CUSTOMS AND EXCISE CLIENTS. This efficiency helps streamline their workflows.

Get more for CUSTOMS AND EXCISE CLIENTS

- Fdny a 35 practice test form

- Declaration of security pdf form

- Pdf to doc convert pdf to word online form

- Rtd special discount card application form

- Plasmapheresis order set form

- Lizard and bullfrog fun sheets fact sheet on lizard and bullfrogs for kids form

- Therapeutic separation agreement template form

- Therapy agreement template form

Find out other CUSTOMS AND EXCISE CLIENTS

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors