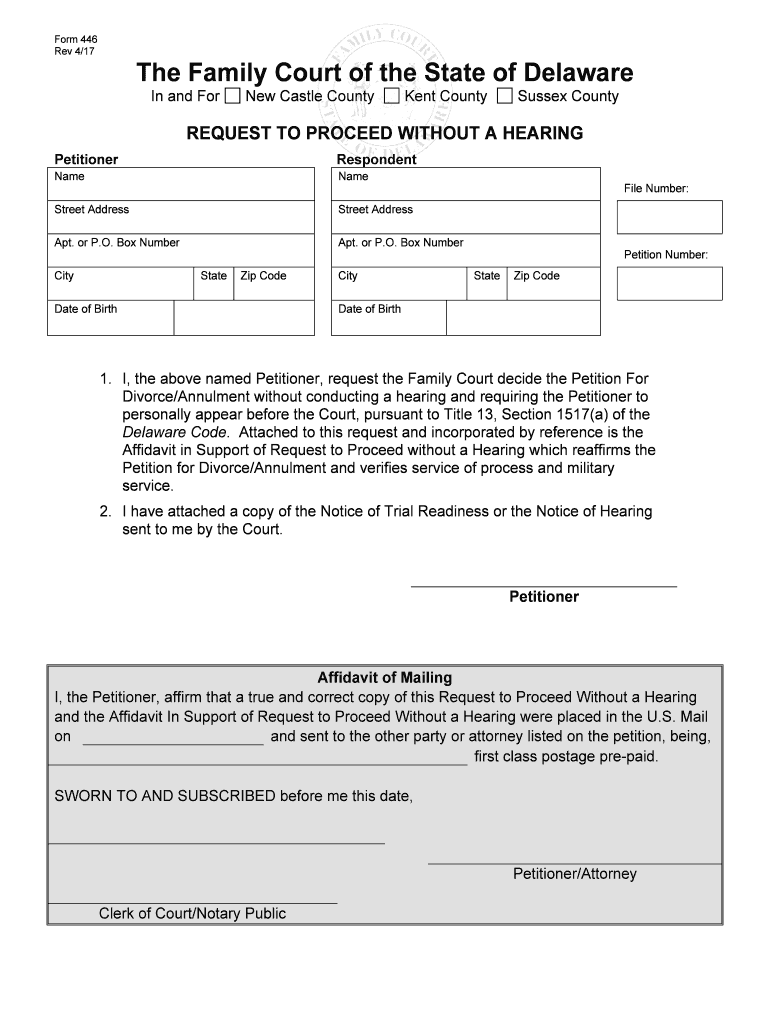

Form 446

What is the Form 446

The Form 446 is a crucial document used primarily in the context of tax reporting and compliance within the United States. It serves as a means for individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). This form is essential for ensuring that taxpayers meet their legal obligations and provides the IRS with necessary data to assess tax liabilities accurately.

How to use the Form 446

Using the Form 446 involves several steps that ensure accurate completion and submission. First, gather all relevant financial documents and information required for the form. This may include income statements, receipts, and any other documentation that supports the entries on the form. Next, fill out the form carefully, ensuring that all information is accurate and complete. Once completed, review the form for any errors before submission. It is advisable to retain a copy for your records.

Steps to complete the Form 446

Completing the Form 446 involves a systematic approach to ensure compliance and accuracy. Begin by downloading the form from the IRS website or obtaining a physical copy. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your income and any deductions or credits applicable to your situation.

- Double-check all entries to confirm accuracy.

- Sign and date the form before submission.

Legal use of the Form 446

The legal use of the Form 446 is governed by IRS regulations and guidelines. To ensure that the form is considered valid, it must be filled out completely and accurately. Any discrepancies or omissions can lead to penalties or delays in processing. Furthermore, it is important to maintain compliance with all applicable tax laws and regulations to avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 446 are critical for maintaining compliance with tax regulations. Typically, the form must be submitted by April fifteenth of the tax year following the reporting period. However, specific deadlines may vary based on individual circumstances, such as extensions or changes in tax laws. It is important to stay informed about any updates from the IRS regarding filing dates to avoid penalties.

Required Documents

To complete the Form 446, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous tax returns for reference

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Digital vs. Paper Version

When it comes to submitting the Form 446, taxpayers have the option to choose between a digital or paper version. The digital version allows for quicker submission and often includes features that help ensure accuracy, such as automatic calculations and error checks. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods or lack access to digital tools. Regardless of the chosen method, it is essential to ensure that the form is completed correctly and submitted on time.

Quick guide on how to complete form 446

Effortlessly prepare Form 446 on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the accurate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your paperwork swiftly without hindrances. Manage Form 446 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 446 with ease

- Locate Form 446 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 446 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 446 and how can airSlate SignNow assist with it?

Form 446 refers to specific documentation required in certain business processes. With airSlate SignNow, you can easily send, eSign, and manage Form 446 online, ensuring that your documents are securely handled and compliant with regulations. Our user-friendly interface makes it simple to complete your Form 446 efficiently.

-

What pricing options does airSlate SignNow offer for managing Form 446?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including options for single users and teams. Each plan is designed to provide exceptional value for managing documents like Form 446. You can choose a plan that fits your frequency of use and the number of users involved.

-

What features does airSlate SignNow provide for enhancing the Form 446 signing process?

AirSlate SignNow includes features such as template creation, in-person signing, and automated reminders, all of which enhance the efficiency of the Form 446 signing process. Our integration options also allow for a seamless workflow, making it easy to manage multiple documents simultaneously.

-

Is airSlate SignNow compliant with legal standards for Form 446?

Yes, airSlate SignNow is compliant with electronic signature laws and regulations, ensuring that your Form 446 is legally binding. We adhere to standards set forth by the ESIGN Act and UETA, which provides peace of mind when sending important documents digitally.

-

Can I integrate airSlate SignNow with other software for handling Form 446?

Absolutely! airSlate SignNow offers integrations with various software applications, including CRM and document management systems. This makes it easy to streamline your workflow when handling Form 446, allowing you to access all tools from a single platform.

-

How can airSlate SignNow improve the overall efficiency of processing Form 446?

Using airSlate SignNow can dramatically reduce the time it takes to process Form 446 by digitizing the signing process. Features like bulk sending and tracking notifications allow for faster collaboration, leading to quicker approvals and ultimately improving your operational efficiency.

-

What benefits does airSlate SignNow offer over traditional methods for Form 446?

AirSlate SignNow provides signNow advantages over traditional methods, such as reduced paper usage, lower costs, and increased speed. By allowing you to manage Form 446 electronically, you eliminate manual errors and improve accessibility for all stakeholders involved.

Get more for Form 446

- What is contingency removal form

- Truist wire transfer form

- Door machining sheet form

- Student exploration roller coaster physics gizmo answer key form

- Beih20 460807767 form

- Restraining order template uk fill online printable form

- Recording consent form rcf bstapbborgbau stap org

- How to make a change in business ownership the balance small business form

Find out other Form 446

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe