Chart for Determining Amount of Wages Subject to 7 Percent Form

What is the Chart For Determining Amount Of Wages Subject To 7 Percent

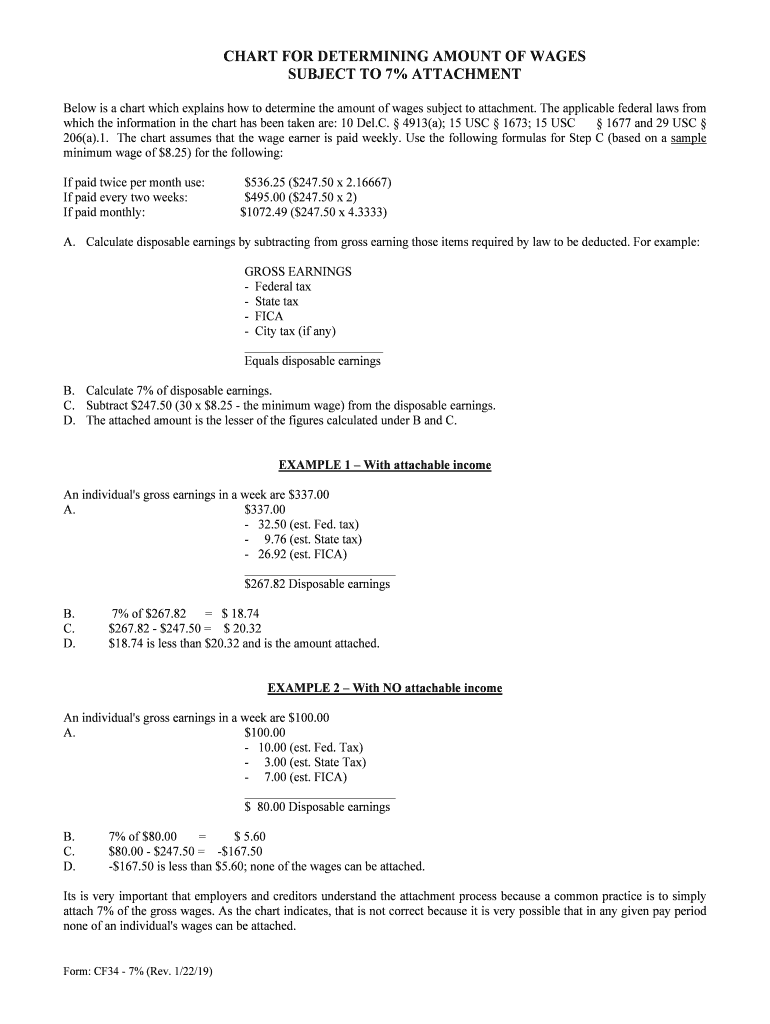

The Chart For Determining Amount Of Wages Subject To 7 Percent is a crucial tool used to ascertain the portion of wages that are subject to a seven percent tax rate. This chart is particularly relevant for employers and employees in understanding their tax obligations. It outlines various wage brackets and the corresponding amounts that fall under this tax rate, allowing for accurate payroll calculations. The chart is essential for compliance with federal and state tax regulations, ensuring that both employers and employees are informed about their financial responsibilities.

How to use the Chart For Determining Amount Of Wages Subject To 7 Percent

Using the Chart For Determining Amount Of Wages Subject To 7 Percent involves several straightforward steps. First, identify the wage amount that needs to be assessed. Next, locate the corresponding bracket on the chart that matches the wage figure. The chart will indicate the amount of wages that are subject to the seven percent tax. It is important to ensure that the correct wage period is considered, whether it be weekly, bi-weekly, or monthly. This process helps in accurately calculating tax withholdings and ensuring compliance with tax laws.

Steps to complete the Chart For Determining Amount Of Wages Subject To 7 Percent

Completing the Chart For Determining Amount Of Wages Subject To 7 Percent requires a systematic approach. Follow these steps:

- Gather all relevant wage information for the pay period.

- Access the chart and identify the appropriate section for the wage amount.

- Match the wage figure to the corresponding tax amount indicated on the chart.

- Document the findings for payroll processing and tax reporting.

- Ensure that all calculations align with current tax regulations.

Legal use of the Chart For Determining Amount Of Wages Subject To 7 Percent

The legal use of the Chart For Determining Amount Of Wages Subject To 7 Percent is pivotal in ensuring compliance with tax laws. Employers must utilize this chart to accurately withhold the correct amount of taxes from employees’ wages. Failure to do so can result in penalties and interest charges from tax authorities. It is essential that employers stay updated on any changes to the chart or tax regulations to maintain legal compliance.

Key elements of the Chart For Determining Amount Of Wages Subject To 7 Percent

Key elements of the Chart For Determining Amount Of Wages Subject To 7 Percent include:

- Wage brackets that categorize different earnings levels.

- The specific percentage rate applied to each wage bracket.

- Guidelines for determining the applicable tax based on the wage amount.

- Instructions for employers on how to implement the chart in payroll systems.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Chart For Determining Amount Of Wages Subject To 7 Percent. These guidelines outline how employers should apply the chart in payroll processing and tax reporting. It is important to refer to the IRS publications for updates on tax rates and compliance requirements. Adhering to these guidelines helps ensure that both employers and employees fulfill their tax obligations accurately.

Quick guide on how to complete chart for determining amount of wages subject to 7 percent

Prepare Chart For Determining Amount Of Wages Subject To 7 Percent effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Chart For Determining Amount Of Wages Subject To 7 Percent on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest method to alter and eSign Chart For Determining Amount Of Wages Subject To 7 Percent without hassle

- Locate Chart For Determining Amount Of Wages Subject To 7 Percent and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose your preferred method to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry about lost or misplaced documents, tedious form searching, or mistakes requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Chart For Determining Amount Of Wages Subject To 7 Percent and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Chart For Determining Amount Of Wages Subject To 7 Percent?

The Chart For Determining Amount Of Wages Subject To 7 Percent is a useful tool that helps businesses calculate the proper amount of wages that should be subject to a 7 percent deduction. This chart provides clarity on wage classifications and ensures compliance with regulations.

-

How does airSlate SignNow use the Chart For Determining Amount Of Wages Subject To 7 Percent in its features?

airSlate SignNow integrates the Chart For Determining Amount Of Wages Subject To 7 Percent in its documentation services, allowing businesses to easily generate and eSign relevant documents. This ensures that all wage calculations are accurate and compliant with the applicable laws.

-

Is there a cost associated with accessing the Chart For Determining Amount Of Wages Subject To 7 Percent?

No, accessing the Chart For Determining Amount Of Wages Subject To 7 Percent is typically free. However, using airSlate SignNow for document management comes with affordable pricing plans that offer cost-effective solutions for businesses of every size.

-

Can I integrate the Chart For Determining Amount Of Wages Subject To 7 Percent with my existing HR software?

Yes, airSlate SignNow allows for seamless integration with various HR software systems. This means you can easily utilize the Chart For Determining Amount Of Wages Subject To 7 Percent alongside your existing workflows to ensure efficient payroll processing.

-

What are the benefits of using airSlate SignNow with the Chart For Determining Amount Of Wages Subject To 7 Percent?

Using airSlate SignNow along with the Chart For Determining Amount Of Wages Subject To 7 Percent simplifies the document signing process. Businesses can streamline their payroll documentation, reducing errors and saving time while ensuring compliance with wage regulations.

-

How can I ensure that I'm using the Chart For Determining Amount Of Wages Subject To 7 Percent correctly?

To use the Chart For Determining Amount Of Wages Subject To 7 Percent correctly, make sure to understand the classifications listed and the percentage rates associated. Regularly reviewing your compliance with this chart will help ensure that your wage calculations are accurate.

-

What type of documents can I eSign using airSlate SignNow with reference to the Chart For Determining Amount Of Wages Subject To 7 Percent?

You can eSign a variety of documents including payroll records, employee contracts, and compliance documents that reference the Chart For Determining Amount Of Wages Subject To 7 Percent. This flexibility enhances workflow efficiency while maintaining legal validity.

Get more for Chart For Determining Amount Of Wages Subject To 7 Percent

- Cape fear valley doctors note form

- Medical assistant shareport card form

- Eea4 form download word

- Form dsa 311 request for examination for state of california documents dgs ca

- Form 4822

- Kms dance team information and contract

- Lease or rental agreement of horse trailer with option to form

- Ashland city fire department 101 court st ashland city tn form

Find out other Chart For Determining Amount Of Wages Subject To 7 Percent

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast