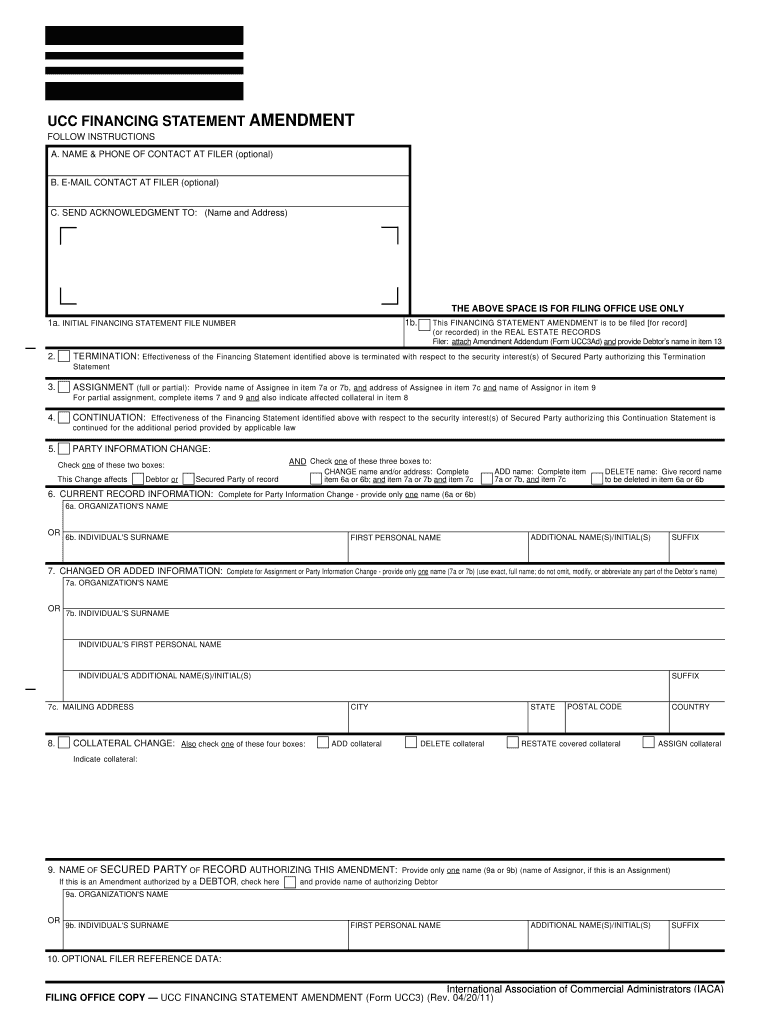

B E MAIL CONTACT at FILER Optional Form

What is the B E MAIL CONTACT AT FILER optional

The B E MAIL CONTACT AT FILER optional form is a document used primarily for tax purposes, allowing individuals or businesses to provide an optional email address for communication with the Internal Revenue Service (IRS). This form facilitates easier correspondence regarding tax matters, ensuring that the filer can receive important updates, notifications, and confirmations electronically. By including an email address, filers can streamline their communication process and enhance their ability to manage their tax obligations efficiently.

How to use the B E MAIL CONTACT AT FILER optional

Using the B E MAIL CONTACT AT FILER optional form involves a few straightforward steps. First, ensure that you have the correct form version and that it is filled out completely. Include your email address in the designated section, making sure it is accurate to avoid any communication issues. Once completed, the form should be submitted along with any related tax documents to the appropriate IRS office. It is advisable to keep a copy of the submitted form for your records, as it may be useful for future correspondence.

Steps to complete the B E MAIL CONTACT AT FILER optional

Completing the B E MAIL CONTACT AT FILER optional form requires attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the form from the IRS website or through official channels.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Locate the section for the optional email contact and enter your email address clearly.

- Review the completed form for accuracy, ensuring all required fields are filled.

- Sign and date the form where indicated.

- Submit the form according to the instructions provided, either electronically or via mail.

Legal use of the B E MAIL CONTACT AT FILER optional

The B E MAIL CONTACT AT FILER optional form serves a legal purpose by providing a means for the IRS to communicate with filers regarding their tax status. Including an email address does not change the legal obligations of the filer but enhances the efficiency of communication. It is important to note that the information provided must be accurate and current to ensure compliance with IRS regulations. Failure to provide accurate information may lead to delays or issues in processing tax-related matters.

IRS Guidelines

The IRS has specific guidelines regarding the use of the B E MAIL CONTACT AT FILER optional form. Filers are encouraged to provide an email address to facilitate faster communication. The IRS advises that the email address should be monitored regularly to ensure that important notifications are not missed. Additionally, filers should be aware of the privacy implications of sharing their email address and take necessary precautions to protect their personal information.

Form Submission Methods (Online / Mail / In-Person)

The B E MAIL CONTACT AT FILER optional form can be submitted through various methods, depending on the preferences of the filer. Options include:

- Online Submission: If the form is part of an electronic filing process, it can be submitted directly through approved tax software.

- Mail Submission: Filers may print the completed form and send it via postal mail to the designated IRS address.

- In-Person Submission: Certain IRS offices may accept forms submitted in person, though it is advisable to check ahead for specific procedures.

Quick guide on how to complete b e mail contact at filer optional

Easily prepare B E MAIL CONTACT AT FILER optional on any device

Digital document management has become increasingly popular among enterprises and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, since you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents efficiently without delays. Manage B E MAIL CONTACT AT FILER optional across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign B E MAIL CONTACT AT FILER optional effortlessly

- Find B E MAIL CONTACT AT FILER optional and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choice. Edit and eSign B E MAIL CONTACT AT FILER optional and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is B E MAIL CONTACT AT FILER optional in airSlate SignNow?

B E MAIL CONTACT AT FILER optional refers to the ability to add an optional email contact when sending documents for eSignature through airSlate SignNow. This feature allows users to specify additional recipients who may need access to the document, ensuring that all relevant parties are informed. This flexibility enhances document management and communication within your business.

-

How does airSlate SignNow handle pricing for its features?

airSlate SignNow offers a variety of pricing plans that cater to different business sizes and needs. Each plan includes essential features, such as B E MAIL CONTACT AT FILER optional, allowing users to streamline their eSignature processes efficiently. You can try various plans through a free trial to determine which best fits your organization's requirements.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integration with numerous applications, enhancing your workflow flexibility. You can connect it with CRM systems, cloud storage services, and other productivity tools. This capability makes utilizing features like B E MAIL CONTACT AT FILER optional seamless within your existing processes.

-

What industries benefit the most from using airSlate SignNow?

Various industries benefit from airSlate SignNow, especially those that require frequent document signing, such as real estate, legal, healthcare, and finance. The platform's features, including B E MAIL CONTACT AT FILER optional, tailor to unique requirements across these sectors, improving efficiency and compliance. Businesses looking for reliable eSignature solutions find signNow value in its usability.

-

Is it secure to use airSlate SignNow for sending sensitive documents?

Absolutely, airSlate SignNow prioritizes security and employs advanced encryption to protect your documents during transmission. Features like B E MAIL CONTACT AT FILER optional ensure you can manage who has access to sensitive information. Compliance with regulations further assures users that their data is handled with care and within legal guidelines.

-

What are the key benefits of using airSlate SignNow?

The key benefits of airSlate SignNow include a user-friendly interface, cost-effectiveness, and robust features like B E MAIL CONTACT AT FILER optional. These elements combined help businesses improve their document workflows, reduce turnaround times, and enhance customer experiences. Organizations can save time and resources by opting for this comprehensive eSignature solution.

-

Can I customize my documents when using airSlate SignNow?

Yes, airSlate SignNow offers customization options for documents, allowing users to tailor templates according to their branding and specific needs. The integration of features like B E MAIL CONTACT AT FILER optional ensures that you can add the necessary contacts without disrupting the document's integrity. This customization leads to more professional and consistent communications.

Get more for B E MAIL CONTACT AT FILER optional

Find out other B E MAIL CONTACT AT FILER optional

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word