Promissory Note Term W Joint & Several Liability Canada Form

What is the Promissory Note Term W Joint & Several Liability Canada

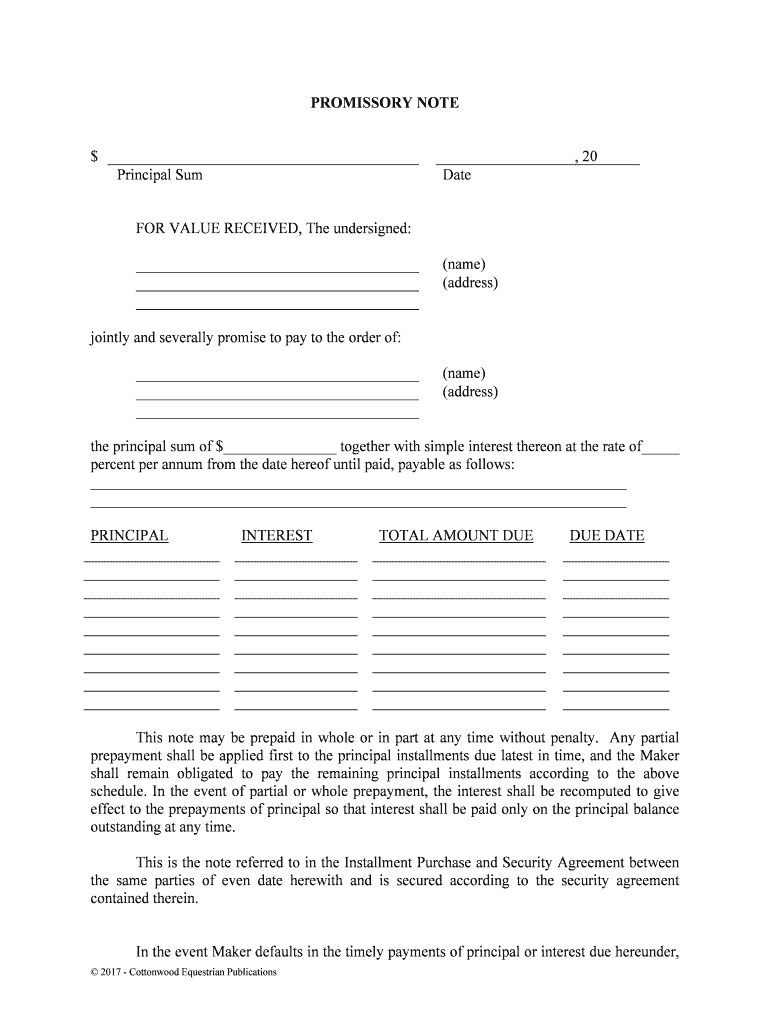

A promissory note with joint and several liability is a legal document wherein one party promises to pay a specified amount to another party, with multiple individuals being responsible for the debt. In the context of Canada, this type of note indicates that all parties involved can be held individually liable for the entire amount owed, allowing the creditor to pursue any one of them for full repayment. This arrangement is particularly useful in situations where multiple borrowers are involved, as it provides greater security for the lender.

Key Elements of the Promissory Note Term W Joint & Several Liability Canada

Understanding the essential components of this promissory note is crucial. Key elements include:

- Parties Involved: Identification of all borrowers and the lender.

- Principal Amount: The total sum of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the unpaid balance.

- Payment Terms: Details regarding the repayment schedule, including due dates and methods of payment.

- Joint and Several Liability Clause: A statement clarifying that each borrower is responsible for the full amount of the debt.

- Signatures: All parties must sign the document to validate it legally.

Steps to Complete the Promissory Note Term W Joint & Several Liability Canada

Completing a promissory note involves several important steps to ensure its legality and effectiveness:

- Gather Information: Collect necessary details about all parties involved, including full names and addresses.

- Determine Loan Terms: Decide on the principal amount, interest rate, and repayment schedule.

- Draft the Document: Use a template or create a document that includes all required elements mentioned above.

- Review the Terms: Ensure all parties understand and agree to the terms outlined in the note.

- Sign the Document: All parties must sign the promissory note in the presence of a witness or notary, if required.

- Distribute Copies: Provide copies of the signed document to all parties for their records.

Legal Use of the Promissory Note Term W Joint & Several Liability Canada

This promissory note serves as a legally binding agreement and can be enforced in court if necessary. It is essential that the document complies with local laws and regulations to ensure its enforceability. In the event of default, the lender may pursue any or all of the borrowers for repayment, which underscores the importance of understanding the implications of joint and several liability.

How to Use the Promissory Note Term W Joint & Several Liability Canada

Utilizing this promissory note effectively involves understanding its purpose and implications. It can be used in various scenarios, such as:

- Personal loans between family or friends.

- Business loans involving multiple partners or stakeholders.

- Real estate transactions where multiple buyers are involved.

When using the note, ensure that all parties are aware of their responsibilities and the terms of repayment to avoid potential disputes.

Examples of Using the Promissory Note Term W Joint & Several Liability Canada

Examples can help clarify how this promissory note functions in real-life situations:

- Family Loan: Two siblings borrow money from a parent to purchase a car, signing a promissory note that holds them jointly liable for repayment.

- Business Partnership: Three partners take out a loan to fund a startup, agreeing to a promissory note that allows the lender to collect from any partner if the loan is not repaid.

- Real Estate Purchase: A group of friends buys a vacation property together, signing a promissory note to secure financing, with each person equally responsible for the loan.

Quick guide on how to complete promissory note term w joint ampampamp several liability canada

Complete Promissory Note Term W Joint & Several Liability Canada effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents rapidly without issues. Manage Promissory Note Term W Joint & Several Liability Canada on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Promissory Note Term W Joint & Several Liability Canada with minimal effort

- Find Promissory Note Term W Joint & Several Liability Canada and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to finalize your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form hunting, or errors that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Promissory Note Term W Joint & Several Liability Canada while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Promissory Note Term W Joint & Several Liability Canada?

A Promissory Note Term W Joint & Several Liability Canada is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender, structured with joint and several liabilities. This means that if multiple parties sign the note, each can be individually responsible for the entire debt. This type of agreement is commonly used in Canada to ensure accountability among co-borrowers.

-

How does airSlate SignNow facilitate the creation of a Promissory Note Term W Joint & Several Liability Canada?

airSlate SignNow streamlines the creation of a Promissory Note Term W Joint & Several Liability Canada by providing customizable templates that save time and effort. Users can easily input necessary details and legally eSign the document from anywhere, ensuring compliance with Canadian laws. This user-friendly process makes documentation quick and accessible.

-

What are the benefits of using airSlate SignNow for a Promissory Note Term W Joint & Several Liability Canada?

Using airSlate SignNow for a Promissory Note Term W Joint & Several Liability Canada offers numerous benefits, including enhanced security and reduced paperwork. The platform's eSignature feature ensures timely execution of documents, while cloud storage allows for automatic backup and easy retrieval. This efficiency can signNowly streamline financial transactions.

-

Is there a cost associated with creating a Promissory Note Term W Joint & Several Liability Canada on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow to create a Promissory Note Term W Joint & Several Liability Canada, but the platform provides flexible pricing plans to suit various needs. The investment is worth it given the ease of use, comprehensive features, and reliable customer support. Users can select a plan that aligns with their frequency of use and required features.

-

Can I customize the Promissory Note Term W Joint & Several Liability Canada template on airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize the Promissory Note Term W Joint & Several Liability Canada template to fit their specific needs. This includes adjusting terms, adding signers, and modifying clauses to reflect unique agreements. Customization ensures that the document meets all parties' expectations and obligations.

-

What integrations does airSlate SignNow offer for managing a Promissory Note Term W Joint & Several Liability Canada?

airSlate SignNow offers various integrations with popular business tools such as Google Workspace, Microsoft Office, and CRM systems like Salesforce. These integrations enable easy importation and exportation of data, streamlining the process of managing a Promissory Note Term W Joint & Several Liability Canada. This connectivity helps users maintain a consistent workflow across platforms.

-

How secure is the storage of my Promissory Note Term W Joint & Several Liability Canada on airSlate SignNow?

Security is a top priority at airSlate SignNow, which employs industry-leading encryption and compliance measures to protect your Promissory Note Term W Joint & Several Liability Canada. Documents are securely stored in the cloud with restricted access to ensure privacy and data integrity. You can trust that your sensitive information is safeguarded at all times.

Get more for Promissory Note Term W Joint & Several Liability Canada

- Rf 1401 po polsku form

- Hivaids quiz student handout handout for talk to me site form

- Download job application form gckuwait com

- Standard form real estate contract top producer websites

- Employment application short form 16956686

- Vittoria booster form

- Documenting disability form

- Flat rate agreement template form

Find out other Promissory Note Term W Joint & Several Liability Canada

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast