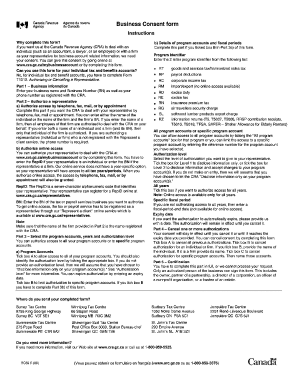

Canada Revenue Agency Form RC59

What is the Canada Revenue Agency Form RC59

The Canada Revenue Agency Form RC59 is a document used to authorize a representative to act on behalf of a taxpayer in dealings with the Canada Revenue Agency (CRA). This form is essential for individuals or businesses who want someone else, such as a tax professional, to manage their tax matters, including filing returns and responding to inquiries. By completing this form, taxpayers grant permission for their designated representative to access their tax information and communicate with the CRA on their behalf.

How to use the Canada Revenue Agency Form RC59

Using the Canada Revenue Agency Form RC59 involves a few straightforward steps. First, the taxpayer must fill out the form with their personal information, including their name, address, and social insurance number. Next, they need to provide details about the representative, such as their name and contact information. It is crucial to specify the type of authorization being granted, whether for a specific transaction or for all tax matters. Once completed, the form must be signed and submitted to the CRA to formalize the authorization.

Steps to complete the Canada Revenue Agency Form RC59

Completing the Canada Revenue Agency Form RC59 requires careful attention to detail. Here are the steps to follow:

- Download the form from the CRA website or obtain a physical copy.

- Fill in your personal information, including your full name, address, and social insurance number.

- Provide the representative's details, including their name, address, and phone number.

- Select the type of authorization you wish to grant, specifying whether it is for a single transaction or ongoing representation.

- Sign and date the form to validate your authorization.

- Submit the completed form to the CRA by mail or through their online services.

Legal use of the Canada Revenue Agency Form RC59

The Canada Revenue Agency Form RC59 is legally binding once it is signed and submitted. It complies with the necessary legal frameworks that govern the authorization of representatives. This means that the CRA is obligated to recognize the authority granted by the taxpayer through this form. It is essential for both the taxpayer and the representative to understand the implications of the authorization, including the responsibilities and limitations of the representative's role.

Key elements of the Canada Revenue Agency Form RC59

Several key elements must be included in the Canada Revenue Agency Form RC59 to ensure it is valid:

- Taxpayer Information: Full name, address, and social insurance number of the taxpayer.

- Representative Information: Name, address, and contact details of the authorized representative.

- Authorization Scope: Clearly defined scope of authority, whether for specific transactions or general representation.

- Signatures: Both the taxpayer's signature and date are required to validate the form.

Form Submission Methods

The Canada Revenue Agency Form RC59 can be submitted through various methods to accommodate different preferences. Taxpayers can send the completed form by mail to the CRA's designated address. Alternatively, the form can be submitted electronically through the CRA's online services, which may expedite the processing time. It is important to keep a copy of the submitted form for personal records and to ensure that the CRA has received the authorization.

Quick guide on how to complete canada revenue agency form rc59

Complete Canada Revenue Agency Form RC59 effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Canada Revenue Agency Form RC59 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and electronically sign Canada Revenue Agency Form RC59 without hassle

- Locate Canada Revenue Agency Form RC59 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Canada Revenue Agency Form RC59 and ensure exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canada revenue agency form rc59

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Canada Revenue Agency Form RC59?

The Canada Revenue Agency Form RC59 is a document used by businesses to authorize a representative to deal with the CRA on their behalf. This form facilitates communication and ensures that your representative can manage tax-related issues efficiently, making it essential for businesses needing assistance with their tax filings.

-

How can airSlate SignNow help with the Canada Revenue Agency Form RC59?

airSlate SignNow streamlines the process of completing and submitting the Canada Revenue Agency Form RC59. With our eSignature solution, you can easily fill out, sign, and send the form securely, saving time and reducing the hassle of traditional paper methods.

-

Is airSlate SignNow cost-effective for managing the Canada Revenue Agency Form RC59?

Yes, airSlate SignNow offers a cost-effective solution for handling documents like the Canada Revenue Agency Form RC59. With various pricing plans, businesses can choose the option that fits their budget while enjoying the comprehensive features necessary for efficient document management.

-

What features does airSlate SignNow offer for the Canada Revenue Agency Form RC59?

airSlate SignNow includes features such as secure eSigning, document templates, and automated workflows specifically designed for managing the Canada Revenue Agency Form RC59. These features enhance efficiency and ensure that you can complete your tax authorization process seamlessly.

-

Can I integrate airSlate SignNow with other software for managing the Canada Revenue Agency Form RC59?

Absolutely! airSlate SignNow offers integrations with various software tools, allowing you to manage the Canada Revenue Agency Form RC59 alongside your existing systems. This flexibility helps streamline your workflow and keeps all your important documents in one place.

-

What are the benefits of using airSlate SignNow for the Canada Revenue Agency Form RC59?

Using airSlate SignNow for the Canada Revenue Agency Form RC59 provides several benefits, including faster processing times, enhanced security, and improved compliance with CRA regulations. This leads to a smoother experience for both businesses and their authorized representatives.

-

How secure is the Canada Revenue Agency Form RC59 when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When using our platform for the Canada Revenue Agency Form RC59, your documents are protected with advanced encryption measures and robust authentication processes, ensuring that your sensitive information remains safe throughout the eSigning process.

Get more for Canada Revenue Agency Form RC59

- The iep form filled in

- Request judicial intervention addendum form

- Greater binghamton association of realtors inc and broome county form

- Purchase agreement offer receipt and lake realty ohio form

- Money agreement oregon form

- Hpap sales contract baddendumb greater bwashingtonb urban league gwul form

- E kimley horn proposalpdf sumter county form

- 2013 montgomery jurisdictional addendum form

Find out other Canada Revenue Agency Form RC59

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will