NAME of SELF INSURER Form

What is the name of self insurer

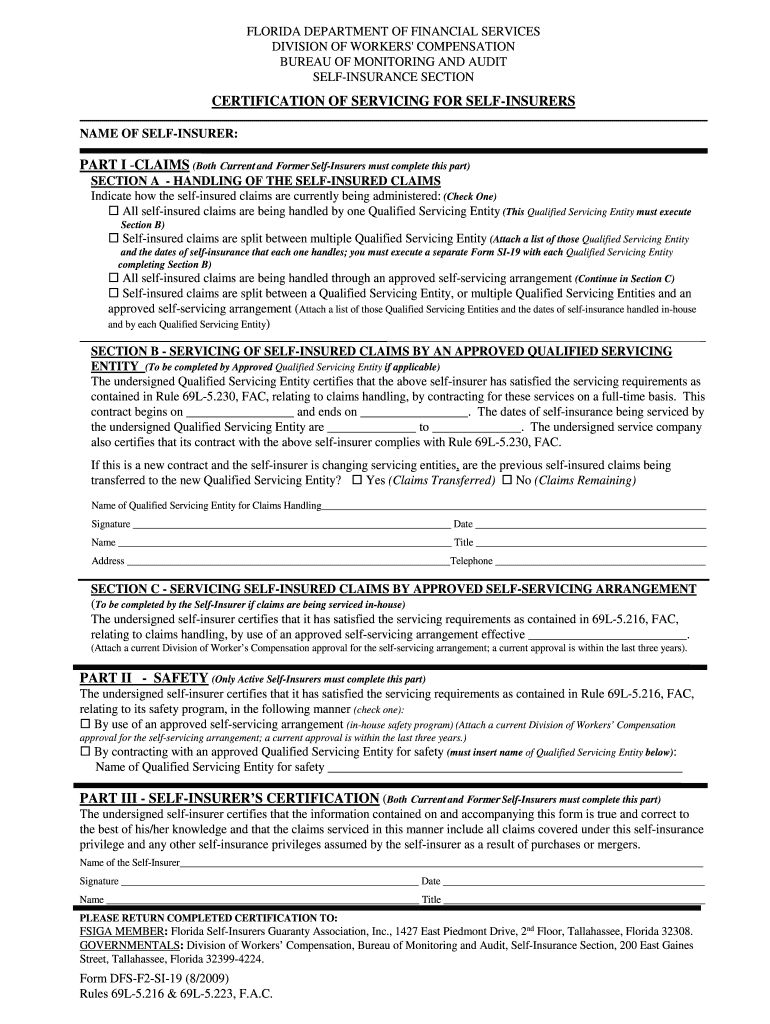

The name of self insurer form is a crucial document for businesses that opt to self-insure against certain risks. This form typically identifies the entity responsible for managing its own insurance claims and liabilities. It serves as a declaration that the business has chosen to assume the financial risks associated with specific types of insurance instead of purchasing traditional insurance policies. Understanding the purpose and implications of this form is essential for compliance and effective risk management.

Steps to complete the name of self insurer

Completing the name of self insurer form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information about your business, including its legal name, address, and the nature of the risks being self-insured. Next, accurately fill out the form, ensuring that all required fields are completed. It is vital to review the form for any errors or omissions before submission. Once verified, submit the form according to the guidelines provided by the relevant regulatory body.

Legal use of the name of self insurer

The legal use of the name of self insurer form is governed by specific regulations that vary by state. This form must be completed in accordance with local laws to ensure that the self-insurance arrangement is recognized as valid. Compliance with legal requirements, such as maintaining adequate financial reserves to cover potential claims, is essential. Additionally, businesses should keep records of their self-insurance activities to demonstrate compliance during audits or inspections.

Key elements of the name of self insurer

Several key elements are essential for the name of self insurer form to be effective and legally binding. These include the identification of the self-insured entity, a clear description of the risks being self-insured, and the financial structure supporting the self-insurance program. Additionally, the form should outline any relevant policies and procedures for managing claims, as well as the responsibilities of the entity in handling potential liabilities. Ensuring these elements are clearly articulated helps protect the business and supports compliance with regulatory requirements.

State-specific rules for the name of self insurer

State-specific rules regarding the name of self insurer form can significantly impact how businesses approach self-insurance. Each state may have unique requirements related to the documentation, financial reserves, and reporting obligations for self-insured entities. It is important for businesses to research and understand the regulations in their state to ensure compliance and avoid potential legal issues. Consulting with a legal or insurance professional familiar with local laws can provide valuable guidance.

Examples of using the name of self insurer

Examples of using the name of self insurer form can illustrate its practical applications in various business contexts. For instance, a construction company may use this form to self-insure against liability claims arising from job site accidents. Similarly, a technology firm might opt for self-insurance to cover risks related to data breaches. These examples highlight the flexibility of the self-insurance model and the importance of accurately completing the form to reflect the specific risks and management strategies of the business.

Quick guide on how to complete name of self insurer

Prepare NAME OF SELF INSURER seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage NAME OF SELF INSURER on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign NAME OF SELF INSURER effortlessly

- Obtain NAME OF SELF INSURER and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign NAME OF SELF INSURER to guarantee outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a NAME OF SELF INSURER?

A NAME OF SELF INSURER is a unique designation for businesses that opt to self-fund their insurance needs instead of purchasing traditional insurance policies. This approach allows companies to customize coverage based on their specific risks and financial capacity, maximizing cost control and flexibility. With airSlate SignNow, you can seamlessly manage documents and contracts related to your self-insurer needs.

-

How does airSlate SignNow benefit businesses acting as a NAME OF SELF INSURER?

With airSlate SignNow, businesses classified as a NAME OF SELF INSURER can efficiently manage all their documentation workflows. The platform simplifies the process of sending and eSigning crucial documents, ensuring compliance and organization. This efficiency allows businesses to focus on their core operations while confidently managing their self-insurance activities.

-

What are the pricing options for airSlate SignNow for a NAME OF SELF INSURER?

airSlate SignNow offers flexible pricing plans tailored for all types of businesses, including those identified as a NAME OF SELF INSURER. Our subscription options provide scalability and are designed to accommodate your document management needs while keeping costs down. You can choose plans that align with the size of your self-insurance operations.

-

Can airSlate SignNow integrate with other tools for NAME OF SELF INSURERS?

Yes, airSlate SignNow supports seamless integration with various tools and platforms essential for managing your self-insurance processes. Whether you need to link to CRM software or financial systems, our platform ensures smooth connectivity, enhancing your overall workflow and data management. This allows NAME OF SELF INSURERS to streamline operations effectively.

-

What features does airSlate SignNow provide for NAME OF SELF INSURERS?

airSlate SignNow provides comprehensive features designed to meet the needs of NAME OF SELF INSURERS, including document templates, easy eSigning, and real-time tracking. These features enhance efficiency and ensure that all necessary documentation is completed accurately and on time. This robust functionality is crucial for maintaining compliance and managing self-insured risks.

-

How does airSlate SignNow ensure security for NAME OF SELF INSURERS?

Security is paramount for airSlate SignNow, especially for businesses acting as a NAME OF SELF INSURER. Our platform employs advanced encryption protocols and secure access controls to safeguard your sensitive documents and data. This commitment to security helps to build trust with your clients and stakeholders while ensuring compliance with regulations.

-

Is it easy to use airSlate SignNow for a NAME OF SELF INSURER?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, ensuring that businesses classified as a NAME OF SELF INSURER can navigate the platform effortlessly. The intuitive interface simplifies the process of document management and eSigning, allowing users of all technical abilities to adopt the solution quickly and effectively.

Get more for NAME OF SELF INSURER

- Shelby county land bank form

- Fannie mae form 1088

- Virginia real estate recovery fund claim form instructions

- Application for appointment and commission of special police officer sos state oh form

- Modelo sc 1340 form

- California individual forms availability

- State form 55582 affidavit for certificate of title correction

- Short tenancy agreement template form

Find out other NAME OF SELF INSURER

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT