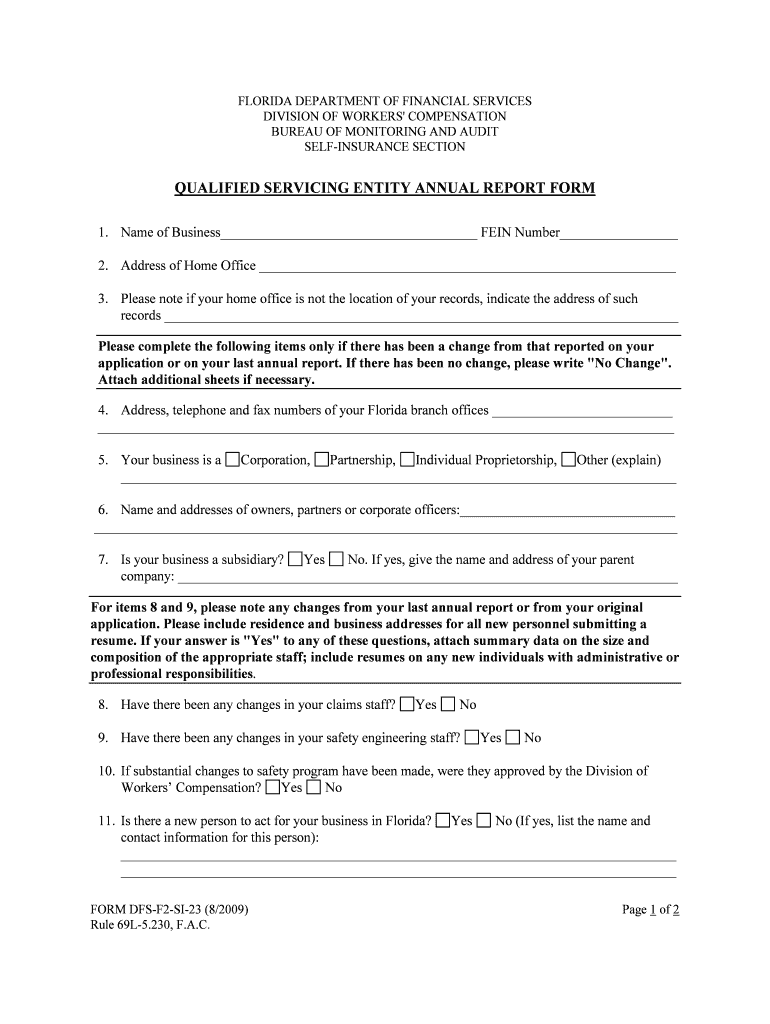

Name of Business FEIN Number Form

What is the Name Of Business FEIN Number

The Name Of Business FEIN Number, or Federal Employer Identification Number, is a unique identifier assigned by the Internal Revenue Service (IRS) to businesses operating in the United States. This number is essential for various tax-related purposes, including filing tax returns, reporting employee wages, and opening business bank accounts. It serves as a means to identify a business entity, similar to how a Social Security Number identifies an individual.

How to obtain the Name Of Business FEIN Number

To obtain a Name Of Business FEIN Number, a business must complete an application process with the IRS. This can be done online through the IRS website, by mail, or by phone. The online application is the most efficient method, allowing businesses to receive their FEIN immediately upon completion. When applying, businesses will need to provide information such as the legal name of the business, the type of entity, and the reason for applying.

Steps to complete the Name Of Business FEIN Number

Completing the Name Of Business FEIN Number form involves several key steps:

- Gather necessary information about the business, including its legal name, address, and structure.

- Determine the appropriate reason for applying for the FEIN, such as starting a new business or hiring employees.

- Visit the IRS website to access the online application or download the required forms.

- Fill out the application accurately, ensuring all information is correct and complete.

- Submit the application through the chosen method (online, mail, or phone).

Legal use of the Name Of Business FEIN Number

The Name Of Business FEIN Number is legally required for various business activities. It is used for tax reporting purposes, including income tax returns and payroll taxes. Additionally, businesses may need to provide their FEIN when applying for loans, permits, or licenses. Proper use of the FEIN helps ensure compliance with federal regulations and can protect against identity theft by ensuring that the business's tax information is secure.

IRS Guidelines

The IRS provides specific guidelines regarding the use and application of the Name Of Business FEIN Number. Businesses must ensure that they apply for the FEIN in a timely manner, especially if they plan to hire employees or file certain tax forms. The IRS also emphasizes the importance of keeping the FEIN confidential to prevent unauthorized use. Failure to comply with IRS guidelines can lead to penalties or complications in tax reporting.

Required Documents

When applying for the Name Of Business FEIN Number, certain documents may be required, depending on the business structure. Commonly required documents include:

- Articles of Incorporation or Organization for corporations and LLCs.

- Partnership agreements for partnerships.

- Personal identification for the business owner, such as a driver's license or Social Security Number.

Having these documents ready can streamline the application process and ensure that all necessary information is provided.

Quick guide on how to complete name of business fein number

Effortlessly prepare Name Of Business FEIN Number on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Name Of Business FEIN Number on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Name Of Business FEIN Number without hassle

- Locate Name Of Business FEIN Number and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal weight as an ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Name Of Business FEIN Number and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Name Of Business FEIN Number and why is it important?

A Name Of Business FEIN Number, or Federal Employer Identification Number, is an essential identifier for businesses in the U.S. It is used for various tax purposes and helps to establish your business's unique identity. Having a Name Of Business FEIN Number is crucial for opening a business bank account and filing business taxes.

-

How can I obtain a Name Of Business FEIN Number?

You can obtain a Name Of Business FEIN Number by applying through the IRS website using Form SS-4. The process is straightforward and can often be completed online within a short period. With your Name Of Business FEIN Number in hand, you can proceed with important business operations like opening bank accounts and hiring employees.

-

Does airSlate SignNow help in managing documents requiring the Name Of Business FEIN Number?

Yes, airSlate SignNow supports document management that includes fields for the Name Of Business FEIN Number. This allows you to easily collect, store, and send documents that require this number. Our platform ensures compliance and helps streamline the paperwork process.

-

What features does airSlate SignNow offer for businesses needing a Name Of Business FEIN Number?

airSlate SignNow offers features such as e-signatures, customizable templates, and document workflows that simplify the management of documents requiring the Name Of Business FEIN Number. These features enhance the efficiency of your business operations and ensure secure handling of sensitive information.

-

Are there any pricing options for airSlate SignNow related to the Name Of Business FEIN Number?

airSlate SignNow provides flexible pricing plans that accommodate businesses of all sizes, whether you need to handle documents with a Name Of Business FEIN Number or other forms of documentation. You can choose from various subscription models based on your document signing and storage needs.

-

Can airSlate SignNow integrate with other tools I use for handling the Name Of Business FEIN Number?

Absolutely! airSlate SignNow integrates seamlessly with numerous platforms, allowing you to connect your existing tools for managing the Name Of Business FEIN Number. This ensures a smooth workflow and enhances productivity by keeping everything connected.

-

What are the benefits of using airSlate SignNow for documents needing the Name Of Business FEIN Number?

Using airSlate SignNow for your documents that require the Name Of Business FEIN Number can streamline your signing process, increase efficiency, and improve security. Our platform simplifies tracking and management of important documents, ensuring that your information is safe and accessible.

Get more for Name Of Business FEIN Number

- Iffco tokio pre auth form 24834155

- New employee information form human resources

- Spring street shelter referral form mhasmc

- Basketball camp registration form shirt size ys ym yl yxl as

- Volleyball questionnaire form

- Alternate work schedule participation form county of santa clara sccgov

- It 245 771664406 form

- Short term loan agreement template form

Find out other Name Of Business FEIN Number

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement