The Amounts Paid to Insure the Property on the Purchaser's Behalf If Collected Form

What is the amounts paid to insure the property on the purchaser's behalf if collected

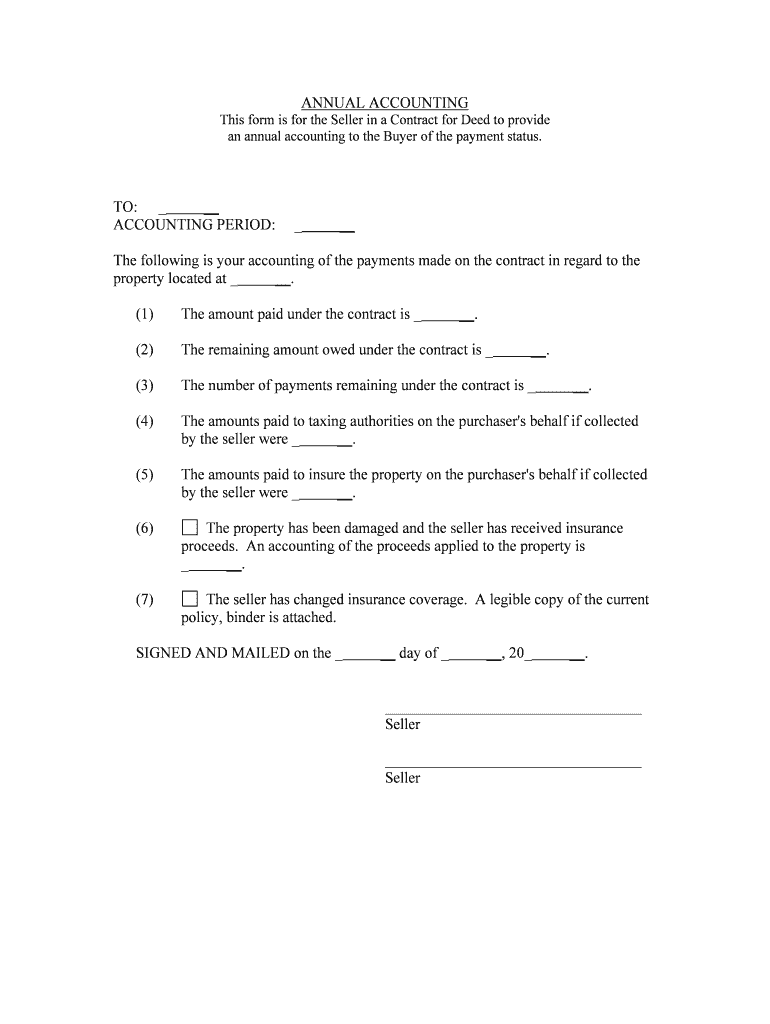

The amounts paid to insure the property on the purchaser's behalf if collected refers to the insurance premiums that are paid by one party on behalf of another during a real estate transaction. This form is essential in documenting the financial responsibilities associated with insuring a property, ensuring that all parties are aware of the costs involved. It serves as a record that the purchaser may not have directly paid these amounts but is still liable for them, thereby clarifying financial obligations in the transaction.

How to use the amounts paid to insure the property on the purchaser's behalf if collected

To use this form effectively, begin by gathering all necessary information regarding the property and the insurance premiums involved. Ensure that the form is filled out accurately, reflecting the correct amounts and details of the parties involved. Once completed, the form should be signed by the relevant parties to validate the agreement. Utilizing electronic signature tools can streamline this process, making it easier to manage and store the document securely.

Steps to complete the amounts paid to insure the property on the purchaser's behalf if collected

Completing the form involves several key steps:

- Collect all relevant information about the property and the insurance premiums.

- Fill in the form with accurate details, including the names of the parties involved and the amounts paid.

- Review the form for accuracy and completeness.

- Obtain signatures from all parties involved to finalize the agreement.

- Store the completed form securely, preferably in a digital format for easy access.

Key elements of the amounts paid to insure the property on the purchaser's behalf if collected

Key elements of this form include:

- The names and contact information of the purchaser and the party paying the insurance.

- A detailed breakdown of the insurance premiums paid.

- The date of payment and the effective date of the insurance coverage.

- Signatures of the involved parties to confirm agreement and understanding.

Legal use of the amounts paid to insure the property on the purchaser's behalf if collected

This form is legally binding when executed correctly, meaning that it must meet specific requirements under U.S. law. It should be filled out accurately, signed by all relevant parties, and stored securely. Compliance with eSignature laws ensures that the form is recognized in legal contexts, providing protection and clarity regarding financial obligations related to property insurance.

Examples of using the amounts paid to insure the property on the purchaser's behalf if collected

Examples of when this form might be used include situations where a buyer is purchasing a home and the seller has already paid for a year of homeowners insurance. In this case, the buyer would need to acknowledge the premium amount paid on their behalf. Another scenario could involve a real estate investor who has a property insured by a management company, where the management company pays the insurance premiums but requires the investor to reimburse them.

Quick guide on how to complete the amounts paid to insure the property on the purchasers behalf if collected

Effortlessly Prepare The Amounts Paid To Insure The Property On The Purchaser's Behalf If Collected on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly and without delays. Handle The Amounts Paid To Insure The Property On The Purchaser's Behalf If Collected on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and eSign The Amounts Paid To Insure The Property On The Purchaser's Behalf If Collected Smoothly

- Locate The Amounts Paid To Insure The Property On The Purchaser's Behalf If Collected and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which only takes a few seconds and carries the same legal validity as a traditional ink signature.

- Verify all information and then click the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign The Amounts Paid To Insure The Property On The Purchaser's Behalf If Collected while ensuring effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the amounts paid to insure the property on the purchaser's behalf if collected?

The amounts paid to insure the property on the purchaser's behalf if collected covers the costs that ensure the property is adequately protected against potential risks. Understanding these amounts is crucial for buyers as they might impact the overall cost of property acquisition. Ensuring accurate calculations helps prevent unforeseen expenses during the purchasing process.

-

How do the amounts paid affect my total property expenses?

The amounts paid to insure the property on the purchaser's behalf if collected can signNowly impact your total property expenses. It's essential to budget for these insurance costs when planning your finances. By understanding these amounts upfront, you can avoid surprises and ensure a smoother purchasing experience.

-

Are there any benefits to insuring the property on the purchaser's behalf?

Yes, insuring the property on the purchaser's behalf provides protection against unexpected damages and liabilities. This proactive measure ensures that the buyer is safeguarded from financial risks associated with property ownership. Additionally, it helps streamline the buying process, allowing for peace of mind throughout the transaction.

-

Can I choose the insurance provider for the amounts paid to insure the property?

Typically, buyers have the option to choose their insurance provider; however, it's essential to review the terms of your agreement first. The amounts paid to insure the property on the purchaser's behalf if collected may have recommended or preferred providers suggested by the seller or agent. Always consult with your real estate agent for the best options available.

-

What features should I look for in an insurance policy for these amounts?

When evaluating an insurance policy related to the amounts paid to insure the property on the purchaser's behalf if collected, consider features like coverage limits, deductibles, and included risks. Comprehensive coverage is vital to protect against various hazards. Look for policies that offer flexible terms and responsive customer support to meet your needs effectively.

-

How can airSlate SignNow assist with managing property insurance documents?

airSlate SignNow simplifies the management of property insurance documents by enabling efficient eSigning and document sharing. By utilizing our platform, you can easily collect signatures and store the necessary paperwork electronically. This streamlines the process, ensuring all documents related to the amounts paid to insure the property on the purchaser's behalf if collected are organized and accessible.

-

What integration options does airSlate SignNow offer for insurance processes?

airSlate SignNow integrates seamlessly with various business applications to enhance your insurance processes. This includes CRMs, financial software, and real estate platforms, making it easier to manage the amounts paid to insure the property on the purchaser's behalf if collected. These integrations help streamline workflows and reduce administrative burdens.

Get more for The Amounts Paid To Insure The Property On The Purchaser's Behalf If Collected

- Fillable living trust form

- Hsn code for ladies dress form

- The republic of uganda visa application passports and visas com form

- Vark questionnaire pdf 84530545 form

- Harvard vanguard medical records form

- Caja de seguro social subsistema mixto de pensiones panam css gob form

- Hospital referral form mercy hospital

- Immunizations health services district resources form

Find out other The Amounts Paid To Insure The Property On The Purchaser's Behalf If Collected

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy