Form M1 Individual Income Tax

What is the Form M1 Individual Income Tax

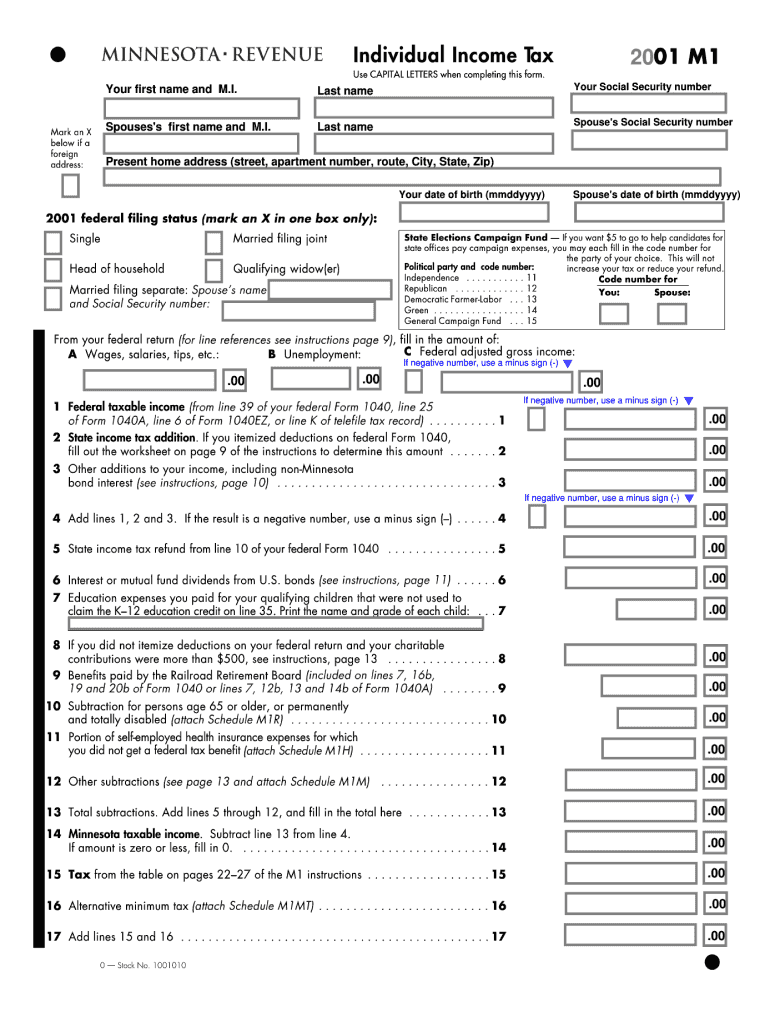

The Form M1 is the individual income tax return used by residents of Minnesota to report their income and calculate their state tax liability. This form is essential for individuals who earn income in Minnesota and must comply with state tax regulations. It includes various sections for reporting income, deductions, and credits, allowing taxpayers to determine their overall tax obligation. The M1 form is specifically designed to accommodate the unique tax laws and requirements of Minnesota, making it a critical document for state tax compliance.

How to use the Form M1 Individual Income Tax

Using the Form M1 involves several steps to ensure accurate completion and submission. Taxpayers must gather all necessary documents, including W-2s, 1099s, and other income statements. After collecting the required information, individuals should carefully fill out the form, ensuring that all income sources are reported and deductions are claimed appropriately. Once completed, the form can be submitted either electronically or via mail, depending on the taxpayer's preference and eligibility. It is important to review the form for accuracy before submission to avoid potential penalties or delays.

Steps to complete the Form M1 Individual Income Tax

Completing the Form M1 requires a systematic approach to ensure all information is accurately reported. Here are the steps to follow:

- Gather documents: Collect all relevant income documents, including W-2s and 1099s.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: List all sources of income, including wages, self-employment income, and interest.

- Claim deductions: Identify and enter any applicable deductions, such as student loan interest or mortgage interest.

- Calculate tax liability: Use the provided tax tables to determine your tax due based on your income and deductions.

- Review and sign: Double-check all entries for accuracy, then sign and date the form.

- Submit the form: Choose your submission method—electronically or by mail—and send the completed form to the appropriate tax authority.

Legal use of the Form M1 Individual Income Tax

The legal use of the Form M1 is governed by Minnesota state tax laws. This form must be completed accurately and submitted by the designated filing deadline to avoid penalties. Taxpayers are required to provide truthful and complete information on their M1 form, as any discrepancies can lead to audits or legal repercussions. Additionally, the form must comply with the state's regulations regarding eSignatures if submitted electronically, ensuring that all electronic submissions are legally binding and secure.

Filing Deadlines / Important Dates

Filing deadlines for the Form M1 are crucial for compliance with state tax regulations. Typically, the deadline for submitting the M1 form is April 15 of each year, coinciding with federal tax filing deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, allowing for additional time to file. Keeping track of these important dates ensures that individuals meet their tax obligations without incurring late fees.

Required Documents

To accurately complete the Form M1, taxpayers must gather several key documents. Required documents typically include:

- W-2 forms from employers, detailing wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation for eligible deductions, such as mortgage statements or student loan interest statements.

- Previous year’s tax return, which can provide helpful reference points.

Having these documents on hand facilitates a smoother and more accurate filing process.

Quick guide on how to complete 2001 form m1 2001 individual income tax

Complete Form M1 Individual Income Tax effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and without delays. Handle Form M1 Individual Income Tax on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign Form M1 Individual Income Tax with ease

- Locate Form M1 Individual Income Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes a few seconds and carries the same legal implications as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose your preferred method to submit your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Form M1 Individual Income Tax and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

Create this form in 5 minutes!

How to create an eSignature for the 2001 form m1 2001 individual income tax

How to generate an electronic signature for the 2001 Form M1 2001 Individual Income Tax in the online mode

How to generate an eSignature for your 2001 Form M1 2001 Individual Income Tax in Chrome

How to make an electronic signature for signing the 2001 Form M1 2001 Individual Income Tax in Gmail

How to generate an eSignature for the 2001 Form M1 2001 Individual Income Tax from your smartphone

How to make an eSignature for the 2001 Form M1 2001 Individual Income Tax on iOS devices

How to generate an eSignature for the 2001 Form M1 2001 Individual Income Tax on Android OS

People also ask

-

What is form m1, and how can it benefit my business?

Form m1 is a customizable document template designed for efficient data collection and electronic signatures. By utilizing form m1, businesses can streamline their workflows, reduce paperwork, and enhance productivity with its user-friendly interface.

-

How does airSlate SignNow’s form m1 integration work?

The integration of form m1 in airSlate SignNow allows seamless data capture and automated workflows. Users can easily connect form m1 with various applications, enabling real-time data transfer and enhancing collaboration across teams without any coding skills.

-

What are the pricing plans for using form m1 on airSlate SignNow?

AirSlate SignNow offers diverse pricing plans, allowing users to choose the one that best fits their needs based on features like form m1 access. Depending on the plan, businesses can enjoy flexible payment options with discounts for annual subscriptions, ensuring affordability.

-

Is form m1 secure for collecting sensitive information?

Yes, form m1 on airSlate SignNow is designed with robust security features to protect sensitive information. This includes data encryption, secure storage, and compliance with industry standards, providing peace of mind for businesses handling confidential documents.

-

Can I customize form m1 to suit my business needs?

Absolutely! Form m1 in airSlate SignNow is highly customizable, allowing users to tailor fields, layouts, and branding elements to match their specific requirements. This flexibility ensures that form m1 aligns perfectly with your business processes and enhances user experience.

-

What industries can benefit from using form m1?

Form m1 is versatile and can benefit a wide range of industries, including healthcare, finance, and real estate. Its adaptability to various business needs makes it an ideal choice for any organization looking to streamline their documentation and eSignature processes.

-

How can form m1 improve my team’s productivity?

By implementing form m1, teams can automate repetitive tasks and reduce the time spent on manual data entry. This efficiency boost allows team members to focus on more strategic initiatives, thereby enhancing overall productivity and collaboration within the organization.

Get more for Form M1 Individual Income Tax

- Wwwpdffillercom538517124 note in order tofillable online note in order to fill and save this form

- Get the free instructions to form scc544 articles of

- How to fill out form g 1450

- Us passports travelgov form

- Wwwharrishealthorgsitecollectiondocumentseligibilityhow to get your harris health financial assistance form

- Power outage incident action checklist fill online form

- Wwwcisagovsitesdefaultthe risk management process for federal facilities form

- Waiver registration form

Find out other Form M1 Individual Income Tax

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement