Tn Bus417 When Necessary Form 2009-2026

What is the Tn Bus417 When Necessary Form

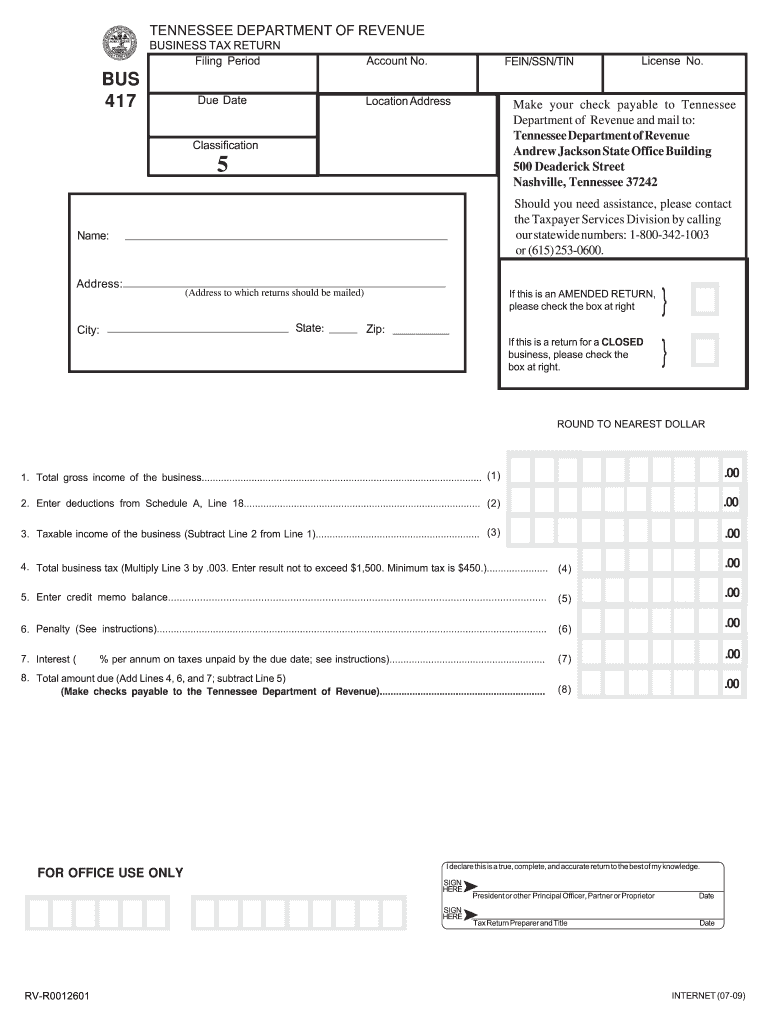

The Tn Bus417 When Necessary Form is a specific document used within the state of Tennessee for various regulatory and compliance purposes. This form is essential for businesses to report certain activities and ensure they are meeting state requirements. Understanding the purpose and function of this form is crucial for any business operating in Tennessee, as it helps maintain compliance with local laws and regulations.

How to use the Tn Bus417 When Necessary Form

Using the Tn Bus417 When Necessary Form involves several key steps. First, identify the specific requirements that necessitate the form's use. Next, gather all relevant information and documentation required to complete the form accurately. Once you have filled out the form, it is important to review it for accuracy before submission. This ensures that all information is correct and compliant with state regulations, minimizing the risk of delays or penalties.

Steps to complete the Tn Bus417 When Necessary Form

Completing the Tn Bus417 When Necessary Form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary information, including business details and relevant documentation.

- Access the form through the appropriate state resources or platforms.

- Fill in all required fields accurately, ensuring all information is current.

- Review the form for any errors or omissions.

- Submit the completed form according to state guidelines, either online or via mail.

Legal use of the Tn Bus417 When Necessary Form

The legal use of the Tn Bus417 When Necessary Form is vital for ensuring compliance with Tennessee state laws. This form must be filled out and submitted in accordance with specific regulations that govern business operations. Failure to properly utilize this form can result in legal repercussions, including fines or other penalties. It is essential for businesses to understand the legal implications of this form and to use it correctly to avoid complications.

Key elements of the Tn Bus417 When Necessary Form

Key elements of the Tn Bus417 When Necessary Form include various sections that require detailed information about the business and its operations. Common elements may consist of:

- Business name and contact information

- Type of business entity

- Description of the activities necessitating the form

- Signature of the authorized representative

Each of these components plays a crucial role in ensuring that the form is completed correctly and meets all regulatory requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Tn Bus417 When Necessary Form can vary based on specific business activities and state regulations. It is important to be aware of these deadlines to ensure timely submission. Missing a deadline may lead to penalties or complications with compliance. Regularly check state announcements or consult with a legal advisor to stay informed about any changes in filing requirements or deadlines.

Quick guide on how to complete tn bus417 when necessary form

Your assistance manual on how to prepare your Tn Bus417 When Necessary Form

If you’re wondering how to finish and submit your Tn Bus417 When Necessary Form, here are some brief guidelines on how to simplify tax processing.

To start, all you need to do is establish your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is a highly intuitive and powerful document solution that allows you to modify, create, and finalize your income tax forms with ease. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures, and return to edit information as necessary. Enhance your tax management with sophisticated PDF editing, electronic signing, and simple sharing options.

Adhere to the steps below to finalize your Tn Bus417 When Necessary Form in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through different versions and schedules.

- Click Obtain form to launch your Tn Bus417 When Necessary Form in our editor.

- Fill in the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Signature Tool to add your legally-recognized eSignature (if required).

- Examine your document and amend any mistakes.

- Save modifications, print your copy, send it to your intended recipient, and download it to your device.

Refer to this guide to submit your taxes electronically with airSlate SignNow. Be aware that filing on paper can heighten return errors and prolong reimbursements. Of course, prior to electronically filing your taxes, consult the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

Is it necessary to fill out the forms given out by colleges like IP, Manipal and others? Why, when we are already filling out the NEET?

These pvt n deemed universities are taking admissions on the basis of neet score but to enter your neet score you have to register in their site first and then enter your marks.This is simply done to earn money as govt have not allowed them to conduct separate tests.ATB!

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

-

Is it necessary to fill out form 15G to withdraw PF?

Greeting !!!Below are basic details for Form 15G or form 15HForm 15G or form 15H is submitted to request income provider for not deducting TDS for prescribed income. In that form, declaration maker declares that his estimated taxable income for the same year is Nil.If you fulfill following conditions, submit form 15G / form 15H:1. Your estimated tax liability for the current year is NIL and2. Your interest for financial year does not exceed basic exemption limit + relief under section 87A.Only resident Indian can submit form 15G / form 15H. NRI cannot submit those forms. Also note that individual and person can submit form 15G/ H and company and firm cannot submit those forms. However, AOP and HUF can submit those forms.Consequences of wrongly submitting form 15G or form 15H:If your estimated income from all the sources is more than thebasic exemption limit ( + relief under section 87A if applicable), don’t submitform 15G or form 15H to income provider. Wrongly submission of form 15G / form15H will attract section 277 of income tax act.Be Peaceful !!!

-

Is it necessary to fill out the BHU preference entry form online?

It is advisable to fill out bhu preference entry form online for your own convenience. You will be asked to fill that form during counselling once again so it is not that important but u should fill it beforehand so that u can have an overview of subject combination.

Create this form in 5 minutes!

How to create an eSignature for the tn bus417 when necessary form

How to make an electronic signature for the Tn Bus417 When Necessary Form in the online mode

How to create an eSignature for your Tn Bus417 When Necessary Form in Chrome

How to create an electronic signature for signing the Tn Bus417 When Necessary Form in Gmail

How to make an eSignature for the Tn Bus417 When Necessary Form straight from your smartphone

How to make an eSignature for the Tn Bus417 When Necessary Form on iOS devices

How to create an eSignature for the Tn Bus417 When Necessary Form on Android

People also ask

-

What is the Tn Bus417 When Necessary Form and its purpose?

The Tn Bus417 When Necessary Form is a specific document used in Tennessee to ensure that necessary procedures are followed when managing transportation for students. This form helps schools and parents communicate effectively about the transportation needs of students, ensuring safety and compliance.

-

How can airSlate SignNow help with the Tn Bus417 When Necessary Form?

With airSlate SignNow, you can easily eSign and send the Tn Bus417 When Necessary Form electronically, streamlining the process for parents and school administrators. Our platform allows for quick completion and submission, ensuring that you can manage forms efficiently without the hassle of printing and scanning.

-

Is there a cost associated with using airSlate SignNow for the Tn Bus417 When Necessary Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, making it a cost-effective solution for managing the Tn Bus417 When Necessary Form. You can choose from several subscription options based on your usage requirements and team size, ensuring you get the best value for your needs.

-

What features does airSlate SignNow offer for the Tn Bus417 When Necessary Form?

AirSlate SignNow provides robust features for the Tn Bus417 When Necessary Form, including customizable templates, secure eSigning, and real-time tracking of documents. These features enhance efficiency, allowing you to manage forms seamlessly and ensure all necessary signatures are collected promptly.

-

Can I integrate airSlate SignNow with other applications for managing the Tn Bus417 When Necessary Form?

Absolutely! AirSlate SignNow integrates with a variety of applications, such as Google Drive and Microsoft Office, allowing you to manage the Tn Bus417 When Necessary Form within your existing workflows. This integration enhances productivity by enabling you to access and send documents from your preferred platforms.

-

What are the benefits of using airSlate SignNow for the Tn Bus417 When Necessary Form?

Using airSlate SignNow for the Tn Bus417 When Necessary Form simplifies the document management process, reduces paper waste, and ensures quicker turnaround times. Additionally, the platform enhances security and compliance, providing peace of mind for both schools and parents.

-

Is it easy to use airSlate SignNow for completing the Tn Bus417 When Necessary Form?

Yes, airSlate SignNow is designed for ease of use, making it simple for anyone to complete the Tn Bus417 When Necessary Form without any prior experience. The intuitive interface guides users through each step, ensuring a smooth and efficient signing process.

Get more for Tn Bus417 When Necessary Form

- Pampgs global business services form

- Home processors new york state department of agriculture amp markets form

- Profit corporation instructions wyoming secretary of state form

- Fillable online dsps wi box 8935 fax phone madison form

- Connecticut practice book connecticut judicial branch form

- Motion for first order of notice foreclosure action form

- Public assistance connecticut judicial branch ctgov form

- Illinois secretary of state employeeattorney information

Find out other Tn Bus417 When Necessary Form

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself