Profit Corporation Instructions Wyoming Secretary of State 2019

Understanding the Wyoming Nonprofit Corporation

A Wyoming nonprofit corporation is a legal entity formed for purposes other than generating profit. This structure allows organizations to operate while receiving certain tax benefits and protections under state law. Nonprofits can engage in various activities, including charitable, educational, or religious endeavors. To establish a Wyoming nonprofit corporation, specific requirements must be met, including filing articles of incorporation with the Wyoming Secretary of State.

Steps to Complete the Wyoming Nonprofit Corporation Articles

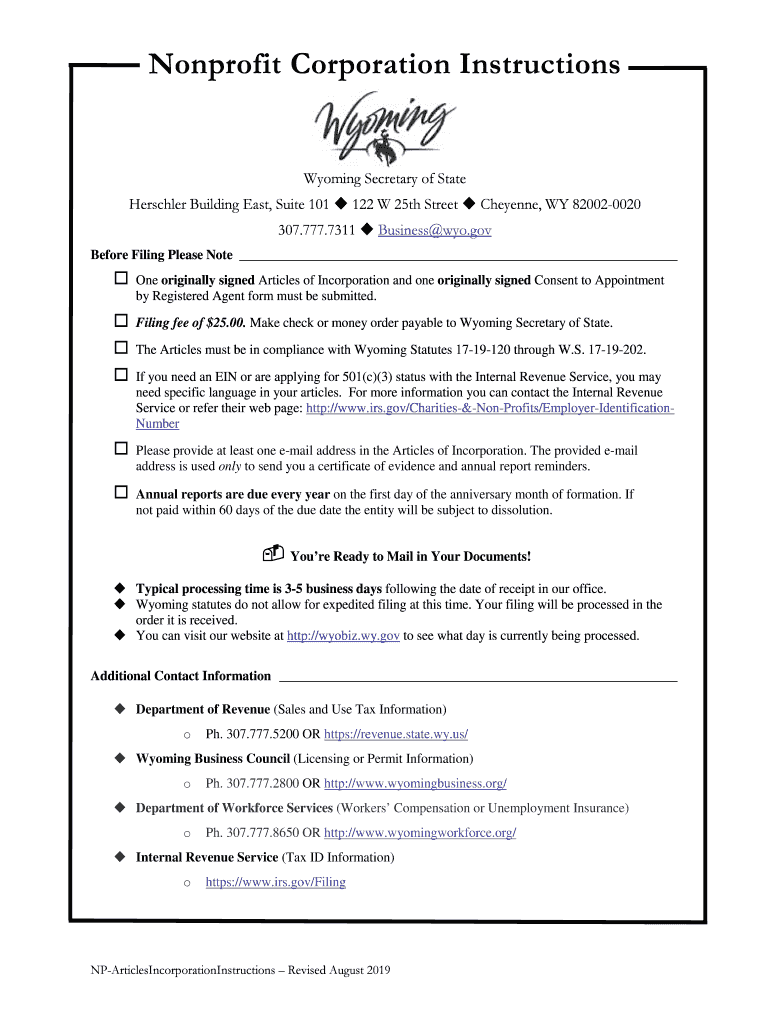

Completing the articles of incorporation for a Wyoming nonprofit corporation involves several key steps:

- Choose a unique name for your nonprofit that complies with state regulations.

- Designate a registered agent who will receive legal documents on behalf of the organization.

- Prepare the articles of incorporation, including the nonprofit's purpose, duration, and management structure.

- File the articles with the Wyoming Secretary of State, either online or by mail.

- Pay the required filing fee, which is typically around $50.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

Required Documents for Wyoming Nonprofit Corporation

To successfully establish a Wyoming nonprofit corporation, several documents are essential:

- Articles of Incorporation: This foundational document outlines the nonprofit's purpose and structure.

- Bylaws: Internal rules governing the operation of the nonprofit.

- Registered Agent Consent Form: A document confirming the registered agent's agreement to serve in this capacity.

- IRS Form 1023: If seeking federal tax-exempt status, this application must be completed and submitted.

Filing Methods for Articles of Incorporation

There are multiple methods to submit the articles of incorporation for a Wyoming nonprofit corporation:

- Online: The Wyoming Secretary of State's website allows for electronic filing, which is often faster and more convenient.

- By Mail: Completed forms can be mailed to the Secretary of State's office, though this method may take longer for processing.

- In-Person: Organizations can also file documents directly at the Secretary of State's office, ensuring immediate confirmation of receipt.

Eligibility Criteria for Establishing a Wyoming Nonprofit

To form a Wyoming nonprofit corporation, certain eligibility criteria must be met:

- The organization must be formed for a lawful purpose that aligns with nonprofit objectives.

- At least three individuals must serve as initial directors on the board.

- The name of the nonprofit must be distinguishable from existing entities registered in Wyoming.

Legal Use of the Wyoming Nonprofit Corporation Articles

The articles of incorporation serve as a vital legal document that establishes the existence of the nonprofit in Wyoming. This document outlines the organization's structure, purpose, and governance. It is essential for compliance with state regulations and for obtaining tax-exempt status from the IRS. Properly executed articles ensure that the nonprofit can operate legally and fulfill its mission effectively.

Quick guide on how to complete profit corporation instructions wyoming secretary of state

Effortlessly Prepare Profit Corporation Instructions Wyoming Secretary Of State on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Profit Corporation Instructions Wyoming Secretary Of State across any platform with the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

The easiest method to edit and electronically sign Profit Corporation Instructions Wyoming Secretary Of State with ease

- Locate Profit Corporation Instructions Wyoming Secretary Of State and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes requiring new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Profit Corporation Instructions Wyoming Secretary Of State to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct profit corporation instructions wyoming secretary of state

Create this form in 5 minutes!

How to create an eSignature for the profit corporation instructions wyoming secretary of state

How to generate an e-signature for a PDF document in the online mode

How to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

How to make an e-signature from your mobile device

The best way to create an e-signature for a PDF document on iOS devices

How to make an e-signature for a PDF file on Android devices

People also ask

-

What is a Wyoming nonprofit corporation?

A Wyoming nonprofit corporation is a legal entity organized for a charitable, educational, or other nonprofit purpose under Wyoming law. This structure allows organizations to operate without the intent of making a profit, providing them with specific tax benefits and liability protections essential for nonprofit activities.

-

How do I set up a Wyoming nonprofit corporation?

To set up a Wyoming nonprofit corporation, you must file Articles of Incorporation with the Secretary of State and create bylaws that outline your organization’s governance. Additionally, obtaining an Employer Identification Number (EIN) from the IRS is essential for tax purposes, allowing your nonprofit to operate legally in Wyoming.

-

What are the benefits of creating a Wyoming nonprofit corporation?

Creating a Wyoming nonprofit corporation offers several benefits, including limited liability protection for directors and officers, tax-exempt status for many activities, and eligibility for grants from government entities and private foundations. This structure promotes credibility and can enhance fundraising efforts.

-

What are the costs associated with forming a Wyoming nonprofit corporation?

Forming a Wyoming nonprofit corporation involves initial filing fees for the Articles of Incorporation and potential costs related to legal assistance or ongoing compliance filings. However, these costs are often offset by the tax advantages and funding opportunities available to nonprofit organizations in Wyoming.

-

Can airSlate SignNow help with document management for a Wyoming nonprofit corporation?

Yes, airSlate SignNow provides intuitive tools for Wyoming nonprofit corporations to easily manage and eSign documents. This cost-effective solution streamlines workflows and enables organizations to focus on their mission rather than administrative burdens, enhancing overall efficiency.

-

What features does airSlate SignNow offer for nonprofit organizations?

airSlate SignNow offers features like customizable templates, automated workflows, and secure eSignature capabilities that are perfect for Wyoming nonprofit corporations. These tools empower organizations to manage their documents more efficiently, saving time and ensuring compliance with legal requirements.

-

Is airSlate SignNow compliant with Wyoming nonprofit regulations?

Yes, airSlate SignNow is designed to comply with the legal standards required for Wyoming nonprofit corporations. The platform ensures that all electronic signatures are legally binding and accepted, meeting the necessary regulations for nonprofit documentation in Wyoming.

Get more for Profit Corporation Instructions Wyoming Secretary Of State

- Have you ever been evicted from a rental unit form

- Do you have any pets that you would like to occupy the residence form

- Thank you for your assistance and prompt return of this verification form

- For the entire term of the lease said term being as indicated in the above described lease form

- Quotagreementquot between quotlandlordquot and form

- You or persons you are responsible for are interfering with your form

- Fillable online auction donor form pdffiller

- Defendantrespondent form

Find out other Profit Corporation Instructions Wyoming Secretary Of State

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy