GA DO 2A Form

What is the GA DO 2A

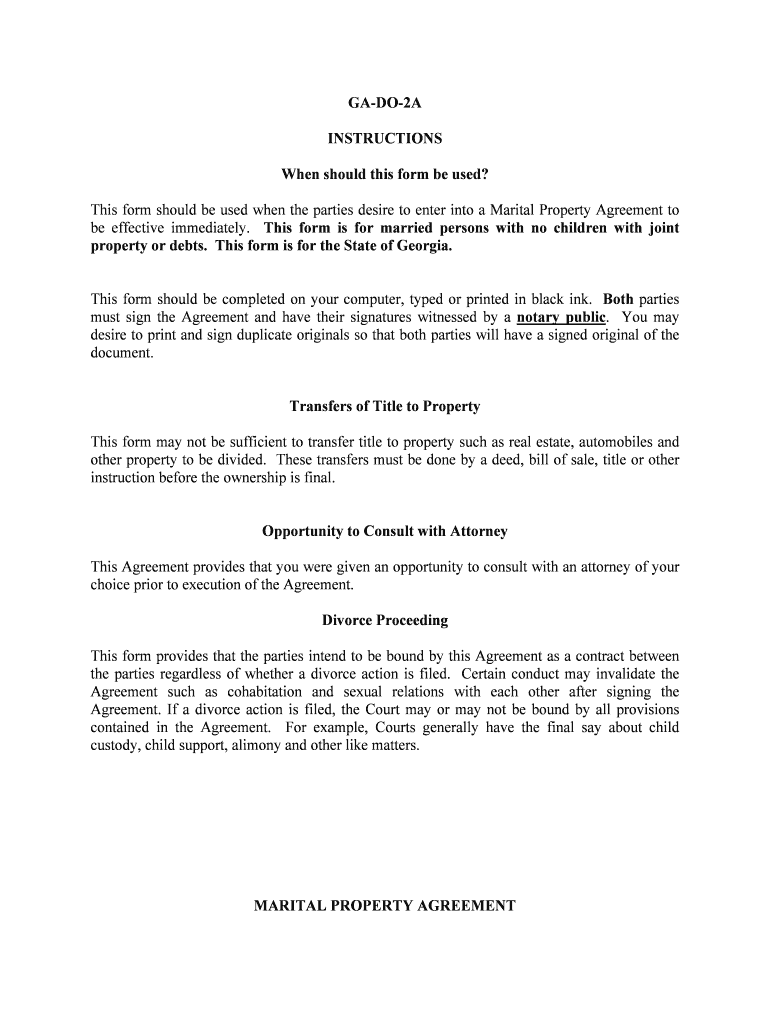

The GA DO 2A form is an essential document used in the State of Georgia for various administrative purposes, particularly related to tax and business filings. This form is primarily utilized by individuals and businesses to report specific information required by state authorities. Understanding its purpose and significance is crucial for compliance with state regulations.

How to use the GA DO 2A

Using the GA DO 2A form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal details and any relevant financial data. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submission. Depending on the requirements, the form can be submitted online, by mail, or in person.

Steps to complete the GA DO 2A

Completing the GA DO 2A form requires attention to detail. Follow these steps:

- Gather all required documentation, including identification and any supporting financial records.

- Download the GA DO 2A form from the appropriate state website.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check your entries for any mistakes or missing information.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the GA DO 2A

The GA DO 2A form must be used in accordance with state laws and regulations. It is essential to ensure that all information provided is truthful and accurate to avoid legal repercussions. The form's legal validity is upheld when it is filled out correctly and submitted within the required timeframe. Compliance with these legal standards is critical for individuals and businesses to avoid penalties.

Key elements of the GA DO 2A

Several key elements are crucial to the GA DO 2A form. These include:

- Identification Information: Personal or business identification details are necessary for processing.

- Financial Data: Accurate financial information must be reported, depending on the form's purpose.

- Signature: A valid signature is required to authenticate the form.

- Date of Submission: The date when the form is submitted is important for compliance tracking.

Form Submission Methods

The GA DO 2A form can be submitted through various methods, providing flexibility for users. The available submission methods include:

- Online Submission: Many users prefer to submit the form electronically via the state’s official portal.

- Mail: The form can be printed and mailed to the designated state office.

- In-Person: Individuals may choose to deliver the form directly to the appropriate office.

Quick guide on how to complete ga do 2a

Complete GA DO 2A effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without any delays. Manage GA DO 2A on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign GA DO 2A with ease

- Find GA DO 2A and click on Get Form to initiate the process.

- Make use of the tools we offer to fill out your document.

- Select important parts of the documents or blackout sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign GA DO 2A and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is GA DO 2A and how does it relate to airSlate SignNow?

GA DO 2A refers to a specific compliance requirement that airSlate SignNow meets, ensuring your documents are legally binding and secure. By using airSlate SignNow, you can easily send and eSign your documents while adhering to GA DO 2A guidelines.

-

How much does airSlate SignNow cost for GA DO 2A compliance?

The pricing for airSlate SignNow varies based on the plan you choose. All pricing tiers enable businesses to meet GA DO 2A compliance requirements affordably, allowing you to select a plan that fits your needs without breaking the bank.

-

What features of airSlate SignNow support GA DO 2A compliance?

airSlate SignNow offers features such as secure authentication, audit trails, and tamper-proof documents. These features are essential to ensure compliance with GA DO 2A, giving you peace of mind when handling sensitive transactions.

-

Can I integrate airSlate SignNow with other software for GA DO 2A projects?

Yes, airSlate SignNow seamlessly integrates with various software solutions such as CRMs and productivity tools. This integration capability enhances your workflow and ensures that your GA DO 2A projects remain efficient.

-

What are the benefits of using airSlate SignNow for GA DO 2A documentation?

Using airSlate SignNow for GA DO 2A documentation streamlines the eSigning process, making it quicker and simpler for all parties involved. Additionally, it provides a cost-effective solution to manage your document workflows while ensuring compliance.

-

Is airSlate SignNow suitable for small businesses focused on GA DO 2A?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses that require GA DO 2A compliance. Its user-friendly interface and affordable pricing make it an ideal choice for small enterprises.

-

What kind of support does airSlate SignNow offer for GA DO 2A users?

airSlate SignNow provides comprehensive support for users focusing on GA DO 2A compliance, including documentation, tutorials, and customer service assistance. This ensures you can navigate the platform and troubleshoot any issues effectively.

Get more for GA DO 2A

- Direct depositqti group form

- Formulier 121

- Petition form northern caribbean university cis ncu edu

- Tecnam p92 manual form

- Veterinary health check form for performance enhancing

- Fact finder high performance advisor pacific advisors

- U s v corica criminal action no 209cr19 form

- Software sale agreement template form

Find out other GA DO 2A

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself