Utah Application Form 2004-2026

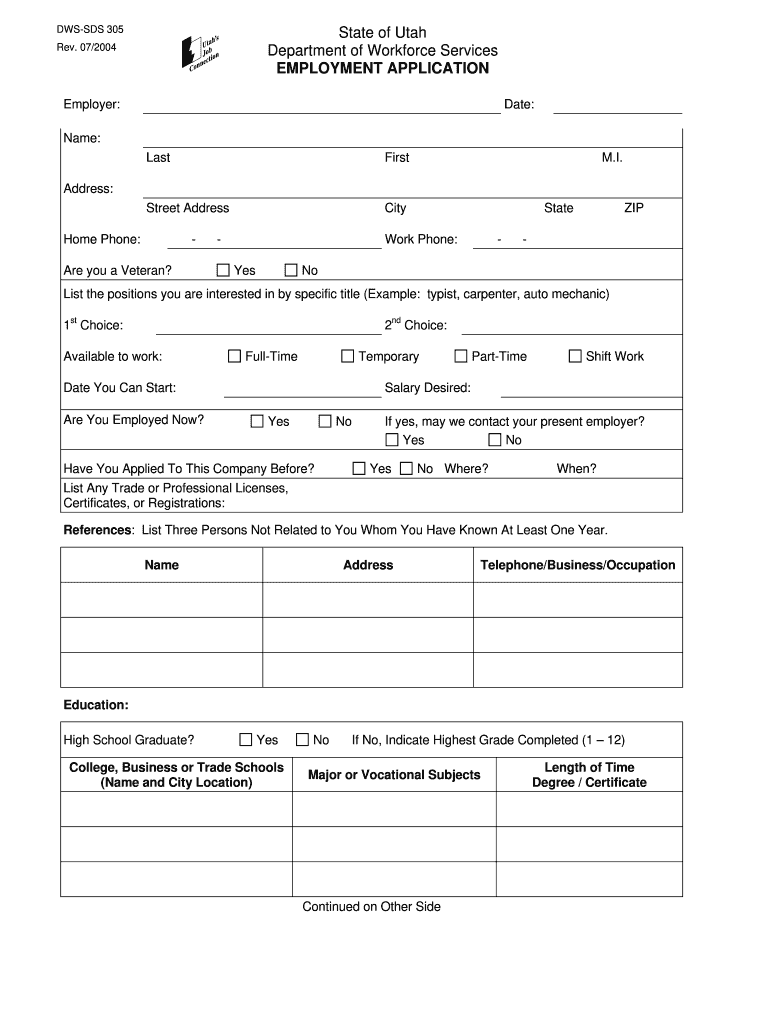

What is the DWS Application Form?

The DWS application form is a crucial document used in the state of Utah for individuals seeking employment-related services. This form is specifically designed to collect necessary information from applicants who may be eligible for various assistance programs, including unemployment benefits and job training services. By accurately completing the DWS application form, individuals can access resources that support their employment journey and ensure they receive the benefits they are entitled to under state law.

Steps to Complete the DWS Application Form

Completing the DWS application form involves several important steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number, contact details, and employment history. Next, fill out the application with precise details about your work experience, education, and any relevant skills. It is essential to review the form for completeness before submission. Finally, submit the application either online or by mail, depending on your preference and the options available.

Legal Use of the DWS Application Form

The DWS application form must be filled out in accordance with state regulations to be considered legally valid. This means that all information provided must be truthful and accurate, as any discrepancies can lead to penalties or denial of benefits. Additionally, electronic submissions of the DWS application form must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that digital signatures are legally binding and secure.

Required Documents for the DWS Application Form

When submitting the DWS application form, applicants are often required to provide supporting documentation to verify their identity and eligibility. Common documents include:

- Proof of identity, such as a driver's license or state ID

- Social Security card or number

- Pay stubs or tax returns to verify income

- Any relevant educational certificates or training records

Having these documents ready can streamline the application process and help ensure a successful submission.

Who Issues the DWS Application Form?

The DWS application form is issued by the Utah Department of Workforce Services. This state agency is responsible for managing employment services and benefits for residents. They provide resources and support to help individuals navigate the job market and access necessary assistance programs. For any inquiries or support regarding the DWS application form, applicants can contact the Department directly for guidance.

Form Submission Methods

Applicants have multiple options for submitting the DWS application form. The most common methods include:

- Online submission through the Utah Department of Workforce Services website

- Mailing a printed version of the form to the appropriate office

- In-person submission at a local DWS office

Choosing the right submission method can depend on personal preferences and the urgency of the application.

Quick guide on how to complete utah employment form

Optimize your HR workflows with Utah Application Form Template

Every HR professional understands the importance of keeping employee information organized and tidy. With airSlate SignNow, you gain access to an extensive library of state-specific employment forms that greatly enhance the organization, administration, and preservation of all work-related documents in one location. airSlate SignNow enables you to oversee Utah Application Form management from start to finish, offering comprehensive editing and eSignature tools at your fingertips. Improve your precision, document safety, and eliminate minor manual errors with just a few clicks.

Steps to modify and eSign Utah Application Form:

- Choose the appropriate state and look for the form you need.

- Access the form page and click Get Form to start working with it.

- Allow Utah Application Form to load in the editor and follow the prompts that indicate necessary fields.

- Input your information or insert additional fillable fields into the document.

- Utilize our tools and features to adjust your form as needed: annotate, redact sensitive information, and create an eSignature.

- Review your document for mistakes before moving forward with its submission.

- Click Done to save changes and download your form.

- Alternatively, forward your document directly to your recipients and gather signatures and data.

- Safely store completed forms within your airSlate SignNow account and access them whenever necessary.

Employing a versatile eSignature solution is crucial when managing Utah Application Form. Make even the most intricate workflows as seamless as possible with airSlate SignNow. Begin your free trial today to explore what you can achieve with your team.

Create this form in 5 minutes or less

FAQs

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

Should I dress up if I'm going into a recruiting company to fill out my employment form?

If you’re going in just to fill out forms and it’s not a part of the interview process then I’d say you should wear whatever you would normally wear to work.Appropriate work attire varies by region, industry and company. So if you’re not sure how to dress for work then consider how your interviewers dressed during your interviews. Were they wearing suits and ties? Tee shirts and jeans? Did it vary from person to person or was the dress fairly consistent?If you’re still unsure then dressing up a little bit never hurts.

-

Do banks treat you differently when you make large deposits?

I’m a professional poker player and won an event once for $286,000. So not an obscene amount of money, but more than your typical customer probably walks in and deposits in cash. Which, btw, if you ever come across a quarter million in cash, It’s probably not the brightest idea to just walk into your local bank branch, unannounced, and start handing them stacks of hundreds wrapped up in $10,000 bundles.This was also directly following the big 3 U.S. poker sites facing indictment and being shut down in the U.S. So claiming online gambling winnings was not a good idea given the climate.I entered the bank and approached an open teller’s window, unzipped my Columbia House duffle bag—which had been given to me as a free gift for being suckered into joining their movie club almost a decade before. As I started stacking the money I stacked 7 packs of $10,000 and opened one up as they were also denominated in stacks of $1000 and separated in the middle by a $5,000 band. I told the teller that I’d like to wire $75,000 to the Bellagio Hotel and Casino —I was headed to Vegas that weekend to play in some high stakes games which were running—and proceeded to pull out the necessary information to wire the money. I put the $5,000 on top and took the other $5000 and stuck it in my sport coat pocket so I’d have some walking around money for when I first arrived in Vegas, before I was able to get to the cage to collect my wire.I had lived in Vegas for a number of years, and it wasn’t unheard of for someone to win an amount like this and have it paid out in cash. Uncommon? A little. But certainly not unheard of. Except I wasn’t in Vegas, I was in a local branch in the suburbs of Kansas City. Where apparently a sub 30 year old doesn’t walk in very often with near $300,000 in cash bundled up in a old, blue, Columbia House duffel bag for a deposit.She instantly asked, “Where did you get all this money?” And then, “That’s a lot to send to a casino to gamble with.”To which I thought, “That’s none of your f**king business.”She must have been able to read the disdain on my face as she instantly excused herself and apologized. A couple minutes later when I had the cash all stacked up on the ledge of the teller window with the 75K off to the side and a slip filled out with the information for wiring the money to the Bellagio main cage, a man approached in a suit and tie and asked if I’d like a private room. I told him I didn’t really need one, that the money was all there, had already been counted, and was ready for deposit. I looked around now to notice several bank employees and customers staring at me but quickly looking away and going back to their business as they saw me looking around the bank.Apparently they don’t just take your word for it when you tell them how much it is, even when packaged up in nice, neat, 10K stacks and 50K bundles. The man in the suit and tie introduced himself as the branch manager and informed me that the money would have to be ran through the machine to be counted and to verify none of the bills were counterfeit. He asked me if I wouldn’t mind coming back to his office and waiting where they could discuss some deposit options with me and then offered me some coffee or something to drink as he motioned with his arms the direction to his office.He too asked me where I had gotten the money, and I was very careful not to mention anything about gambling or playing poker as I knew what an apprehensive issue it was in the financial industry at the time. The Wire Act didn’t prevent playing poker online, exactly, it prevented financial institutions from processing gambling transactions. And the Big Three poker sites in the U.S. hadn’t been shut down with their owners indicted for offering poker online, they had been shut down with the owners indicted for purchasing a bank in Utah where they processed the illegal transactions fraudulently under phony business names. So I told him I’d obtained it selling drugs with a smirk.He didn’t find it as funny as I did so I quickly told him I was kidding, then vaguely told him that I had gotten the money from a friend I had a business interest with, and if he checked my account history he would see that large wires and cash deposits like this weren’t extremely uncommon. He then asked me why I was wiring 75K to Bellagio, and I again smiled and told him it was none of their business and asked if they wanted to continue to do business together or not. He seemed a bit jolted by my standoffish attitude but also seemed to acknowledge that there wasn’t anything illegal about wiring the money to the Bellagio, in fact, Bank of America (a branch of which we currently resided), had a specific account to account transfer option that allowed money to be transferred internally, instantly between any BoA account holder and MGM property.After a brief bit of silence I broke up his dumbfounded look by saying, “look man, are you going to count the money and verify it or not. I’m kinda busy today.” He informed me that the money had been counted and was actually $900 dollars long of $281,000, which I’d put 5K in my pocket of the original $286,000 and to this day scratch my head wondering where/how that extra 900 found its way in there.He seemed to sense I was perplexed by the previous accounting error and said, “looks like you don’t need to go to Vegas, you’re getting lucky already.”I smiled and he informed me they would have to fill out all the necessary tax and legal compliance paperwork including a suspicious activity report (SAR) with FinCen.That was in 2012 and I’ve never heard anything from FinCen. Though I do pay my taxes as required by law and do claim professional gambler as my form of employment. I suspect they have a stack of SAR’s somewhere at FinCen on me that they’ve investigated a few times before as I’ve used some creative ways to repatriate gambling winnings over the years, everything from foreign bank accounts in Malta, to Bitcoins, to even using large bulk purchases of prepaid phone cards (don’t ask). For a period I was “randomly” selected to be searched at the airport EVERY. SINGLE. TIME. I flew anywhere for anything. But that has since stopped, which I can only imagine I owe a “Thanks, Obama,” for having the Department of Homeland Security and the DOJ scrub those lists.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

Create this form in 5 minutes!

How to create an eSignature for the utah employment form

How to make an electronic signature for your Utah Employment Form in the online mode

How to make an electronic signature for the Utah Employment Form in Chrome

How to make an electronic signature for signing the Utah Employment Form in Gmail

How to create an electronic signature for the Utah Employment Form right from your smartphone

How to generate an electronic signature for the Utah Employment Form on iOS devices

How to create an eSignature for the Utah Employment Form on Android OS

People also ask

-

What is the DWS application form and how does it work?

The DWS application form is an electronic document used to collect necessary information for various services. With airSlate SignNow, you can easily create, send, and eSign the DWS application form, streamlining the entire process and enhancing efficiency.

-

How can I create a DWS application form using airSlate SignNow?

Creating a DWS application form with airSlate SignNow is simple. The user-friendly interface allows you to design your form with customizable fields, ensuring it meets your specific needs. Once created, you can share it instantly via email or a secure link.

-

Is there a cost associated with using the DWS application form through airSlate SignNow?

Yes, there are various pricing plans available for using the DWS application form via airSlate SignNow. Depending on your business needs, you can choose from different packages that offer features aligning with your requirements, ensuring a cost-effective solution.

-

What features does airSlate SignNow offer for the DWS application form?

airSlate SignNow provides numerous features for the DWS application form, such as customizable templates, electronic signatures, and workflow automation. These features not only save time but also enhance the security and accessibility of your documents.

-

Can I track the status of my DWS application form once it's sent?

Absolutely! With airSlate SignNow, you can easily track the status of your DWS application form. You'll receive notifications when it's viewed and signed, allowing you to stay informed throughout the process.

-

Does airSlate SignNow integrate with other applications for the DWS application form?

Yes, airSlate SignNow offers seamless integrations with various applications commonly used in businesses. This capability enables users to connect their existing tools with the DWS application form, streamlining operations and improving overall productivity.

-

What are the benefits of using airSlate SignNow for the DWS application form?

Using airSlate SignNow for the DWS application form provides numerous benefits, such as enhanced efficiency, reduced paper usage, and secure electronic signatures. It simplifies the document management process, allowing teams to focus on more critical tasks instead.

Get more for Utah Application Form

- Occupational self assessment pdf form

- Mmabatho nursing college application forms 2021 pdf

- Lcwu online fee challan 2021 form

- Birth of the universe answer key form

- Tr83b form

- 12 week metabolic meal plan pdf form

- Grade 7 english textbook pdf download form

- Solution of fundamentals of electrical drives by gk dubey pdf form

Find out other Utah Application Form

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement