Excel W2 Template Form

What is the Excel W-2 Template

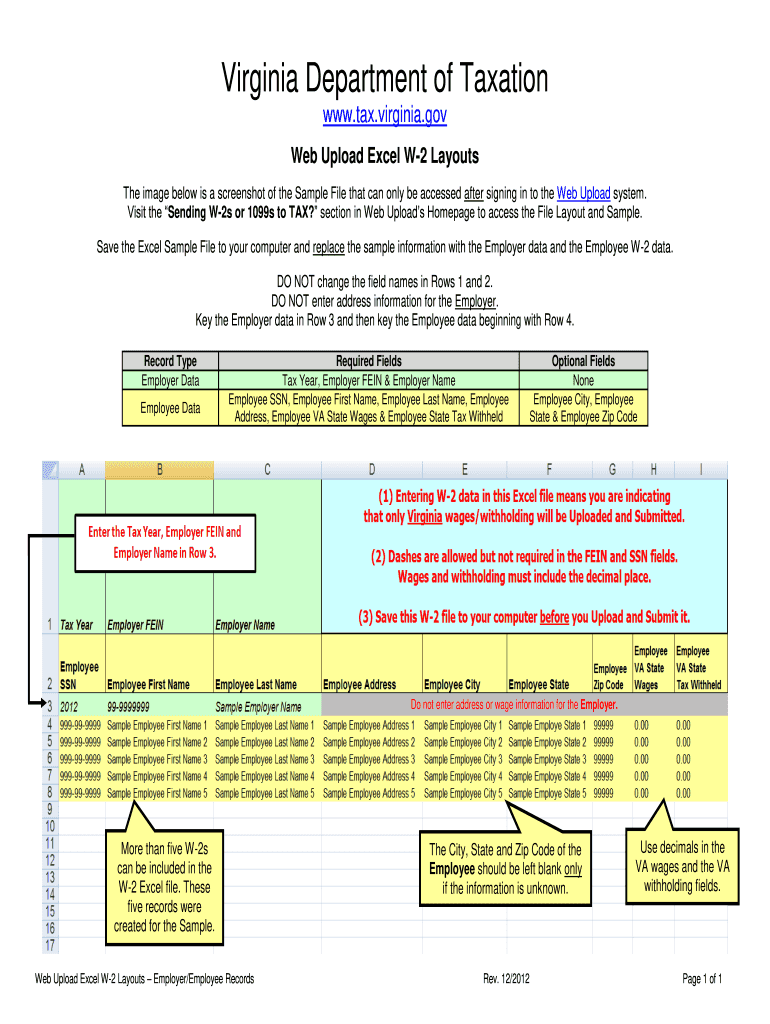

The Excel W-2 template is a digital tool designed to assist employers in generating W-2 forms for their employees. This template streamlines the process of reporting wages and tax withholdings to the Internal Revenue Service (IRS) and employees. It provides a structured format that includes all necessary fields, such as employee identification, earnings, and tax information. Utilizing an Excel spreadsheet template for W-2 forms can enhance accuracy and efficiency in payroll management.

How to Use the Excel W-2 Template

Using the Excel W-2 template involves several straightforward steps. First, download the template from a trusted source. Next, open the template in Microsoft Excel or a compatible spreadsheet program. Fill in the required fields, including employee names, Social Security numbers, wages, and tax withholdings. Once all information is entered, review the data for accuracy. Finally, save the completed form and print it for distribution to employees or electronic submission to the IRS.

Steps to Complete the Excel W-2 Template

Completing the Excel W-2 template requires careful attention to detail. Follow these steps:

- Open the template in Excel.

- Enter the employer's information, including name and Employer Identification Number (EIN).

- Fill in each employee's details, such as their full name and Social Security number.

- Input the total wages paid and the amount of federal, state, and local taxes withheld.

- Ensure that all entries are accurate and conform to IRS guidelines.

- Save the completed template and prepare for distribution.

Legal Use of the Excel W-2 Template

The Excel W-2 template is legally valid as long as it adheres to IRS requirements. Employers must ensure that the information provided is accurate and complete. It is essential to comply with regulations regarding the distribution of W-2 forms, which typically must be provided to employees by January thirty-first of each year. Additionally, electronic filing options are available, provided that they meet the necessary legal standards.

Key Elements of the Excel W-2 Template

Key elements of the Excel W-2 template include:

- Employee Information: Full name, address, and Social Security number.

- Employer Information: Name, address, and Employer Identification Number (EIN).

- Wage Information: Total wages earned, tips, and other compensation.

- Tax Withholdings: Federal income tax, Social Security tax, and Medicare tax amounts.

- State Information: State wages and state tax withheld, if applicable.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of W-2 forms. Employers must ensure that the form is filled out correctly, including all required fields. The IRS mandates that W-2 forms be filed by January thirty-first for the previous tax year. Employers should also retain copies of the W-2 forms for at least four years for record-keeping purposes. Familiarity with these guidelines helps ensure compliance and avoids potential penalties.

Quick guide on how to complete w2 excel template form

Prepare Excel W2 Template effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly and without issues. Manage Excel W2 Template on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to edit and electronically sign Excel W2 Template with ease

- Acquire Excel W2 Template and click Get Form to begin.

- Make use of the features we provide to complete your document.

- Emphasize crucial sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Edit and electronically sign Excel W2 Template and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

What is the guidance to fill out a W2 form for an S Corp?

You can fill in the W2 form here W-2 Form: Fillable & Printable IRS Template Online | signNowThe W-2 form is one of the most frequently used forms by taxpayers.

-

How do I create a W2 template in Excel?

See if this helps: W2FormTemplate | Free W-2 Forms & Filing ServiceJagjit.

-

Is it legal to ask you to fill out a W2 form for a trial before actually being hired?

You don’t fill out W2 forms, employers issue them to employees in January to report earnings and withholding. I assume you mean the W4, which tells the employer how much to withhold. There is no reason to fill one out before being hired, particularly since it includes your SSN which you shouldn’t divulge to anyone unless necessary

-

My employer sent me a W2 C form. Isn’t it their job to fill it out since they made the mistake?

The W2c is supposed to be filled out by the employer. If you got a blank one then something went seriously wrong. Unless you do your employers tax forms there is no reason for you to have a W2c that is blank.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

What are the exemptions for a W2 form? How do you fill one in?

Send it to your employees as well as governmental and state institutions by US mail or by electronic mail. It is also possible to complete the sample electronically and print it on a blank piece of paper.Those who have many employees, more than two hundred and twenty, are required to file the form digitally, as it is much easier for the IRS to process numerous electronic documents than paper copies. Additionally, e-filing will save you time and the templates are easy to review thanks to the printed text format. With this printable sample, W-2 submission form will be generated automatically by the Social Security Administration.More info: http://bit.ly/2NjjlJi

Create this form in 5 minutes!

How to create an eSignature for the w2 excel template form

How to generate an eSignature for your W2 Excel Template Form in the online mode

How to make an electronic signature for your W2 Excel Template Form in Google Chrome

How to make an eSignature for putting it on the W2 Excel Template Form in Gmail

How to make an eSignature for the W2 Excel Template Form from your mobile device

How to create an eSignature for the W2 Excel Template Form on iOS

How to create an eSignature for the W2 Excel Template Form on Android OS

People also ask

-

What is an Excel W2 Template and why do I need one?

An Excel W2 Template is a pre-formatted spreadsheet that helps you create W-2 tax forms for employees. It's essential for businesses to accurately report wages and taxes withheld, ensuring compliance with IRS regulations. Using an Excel W2 Template simplifies the process, making it easier to manage payroll documentation.

-

How does airSlate SignNow enhance the use of an Excel W2 Template?

With airSlate SignNow, you can easily upload your Excel W2 Template to streamline the document signing process. Our platform allows you to eSign and send W-2 forms securely, ensuring that your employees receive their tax documents promptly. This integration simplifies your workflow and enhances compliance.

-

Is there a cost associated with using the Excel W2 Template through airSlate SignNow?

AirSlate SignNow offers various pricing plans to accommodate different business needs. While the Excel W2 Template itself is free to download, using our platform for eSigning and document management may involve a subscription fee. However, the cost is often outweighed by the efficiency and time savings it provides.

-

Can I customize my Excel W2 Template before sending it for signing?

Yes, you can customize your Excel W2 Template in airSlate SignNow to include your company logo, employee details, and any specific information needed. This personalization ensures that your W-2 forms are professional and meet your organization's branding requirements before being sent out for eSignature.

-

What features does airSlate SignNow provide for eSigning my Excel W2 Template?

AirSlate SignNow offers a user-friendly interface that allows you to eSign your Excel W2 Template quickly and securely. Features include drag-and-drop functionality, automatic reminders for signers, and the ability to track document status in real-time. These tools enhance the efficiency of your document management process.

-

Are there any integrations available with airSlate SignNow for managing my Excel W2 Template?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications, including accounting, HR, and payroll systems. These integrations allow you to import your Excel W2 Template directly, enhancing your operational efficiency and ensuring that all employee data is accurately reflected.

-

How secure is my data when using the Excel W2 Template with airSlate SignNow?

Data security is a top priority at airSlate SignNow. When using our platform with your Excel W2 Template, your documents are encrypted, and we comply with industry-standard security protocols. This ensures that your sensitive information remains protected throughout the eSigning process.

Get more for Excel W2 Template

- 2019 2021 form il dsd tvdl 7 fill online printable

- Enhanced vehicle safety inspection penndot home form

- Abandoned vehicle affidavit of sale form for registered tow truck operators rtto to use as an affidavit of sale of an abandoned

- Itdidahogovwp contentuploadsindemnifying affidavit itd idaho transportation department form

- Request to re issue a bureau of motor vehicles division of form

- 2021 form ok repackager license application fill online

- Health information privacy statement

- Bureau of infectious disease control nh covid 19 employer form

Find out other Excel W2 Template

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA