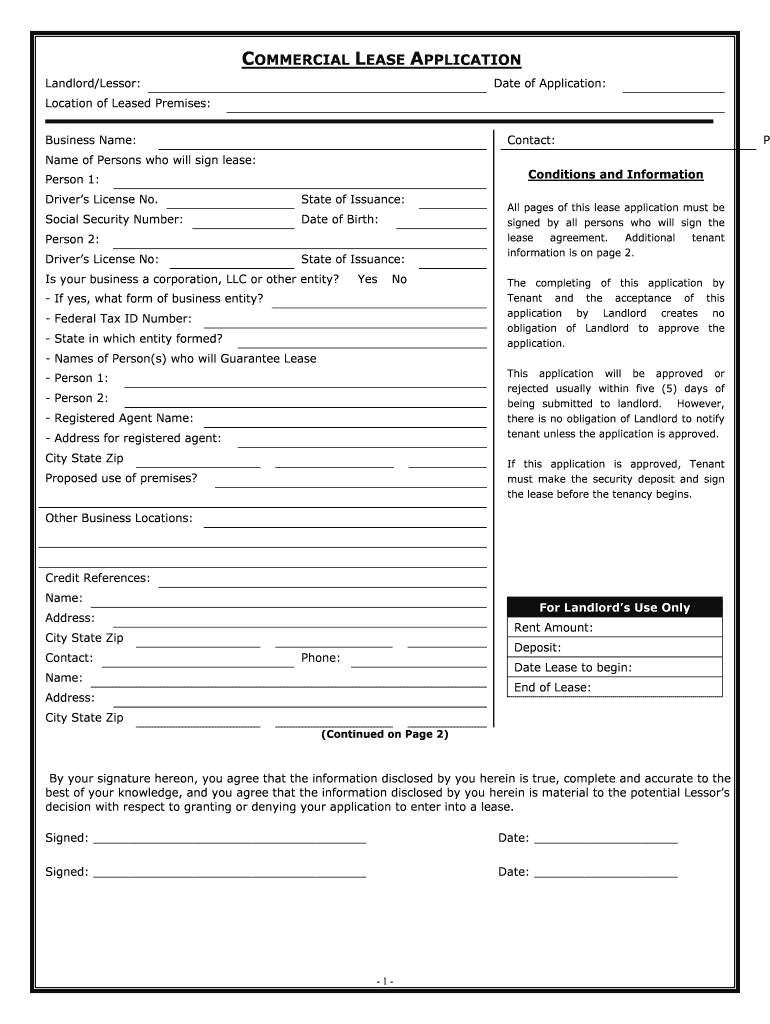

Federal Tax ID Number Form

What is the Federal Tax ID Number

The federal tax ID number, also known as the Employer Identification Number (EIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses for tax purposes. This number is essential for various activities, including filing tax returns, opening bank accounts, and hiring employees. It serves as a business's identification in the eyes of the federal government, similar to how a Social Security number identifies an individual.

How to Obtain the Federal Tax ID Number

To obtain a federal tax ID number, businesses must complete an application through the IRS. This can be done online, by mail, or by fax. The online application process is typically the fastest, allowing businesses to receive their EIN immediately upon completion. The application requires basic information about the business, such as its legal structure, the reason for applying, and the name and Social Security number of the responsible party.

Legal Use of the Federal Tax ID Number

The federal tax ID number is legally required for various business activities. It is used for reporting taxes, applying for business licenses, and opening business bank accounts. Additionally, it is necessary for filing employment tax returns and for businesses that operate as partnerships or corporations. Proper use of this number ensures compliance with federal regulations and helps avoid potential legal issues.

Steps to Complete the Federal Tax ID Number Form

Completing the application for a federal tax ID number involves several key steps:

- Determine the legal structure of your business (e.g., sole proprietorship, partnership, corporation).

- Gather necessary information, including the business name, address, and the Social Security number of the responsible party.

- Choose the method of application: online, by mail, or by fax.

- If applying online, visit the IRS website and follow the prompts to fill out the application.

- Review the completed application for accuracy before submitting it.

Examples of Using the Federal Tax ID Number

Businesses utilize the federal tax ID number in various scenarios. For instance:

- When hiring employees, the EIN is required for payroll tax reporting.

- Businesses must provide their EIN when filing annual tax returns.

- It is necessary for opening a business bank account, which helps separate personal and business finances.

Required Documents

When applying for a federal tax ID number, certain documents may be required to verify the business's identity and legal structure. Commonly needed documents include:

- Articles of incorporation or organization for corporations and LLCs.

- Partnership agreements for partnerships.

- Proof of identity for the responsible party, such as a driver's license or Social Security card.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for maintaining compliance. Businesses must be aware of specific dates related to tax filings and payments, including:

- Quarterly estimated tax payment deadlines.

- Annual tax return due dates, typically April fifteenth for most businesses.

- Deadlines for filing employment tax returns, which vary based on the business's payroll schedule.

Quick guide on how to complete federal tax id number

Complete Federal Tax ID Number effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Federal Tax ID Number on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and electronically sign Federal Tax ID Number without hassle

- Find Federal Tax ID Number and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes moments and has the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Federal Tax ID Number and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a federal tax id number and why do I need one?

A federal tax id number, also known as an Employer Identification Number (EIN), is essential for businesses when filing taxes, hiring employees, and opening bank accounts. It uniquely identifies your business entity and is necessary to operate legally in the United States. If you're using airSlate SignNow for document signing, having a federal tax id number helps streamline the tax-related processes.

-

How can airSlate SignNow help me manage my federal tax id number?

airSlate SignNow allows you to securely send and eSign documents that require your federal tax id number, ensuring compliance with IRS regulations. Our easy-to-use platform makes it simple to manage crucial documents related to your EIN without the hassle of printing and mailing. Additionally, you can easily track who has access to your sensitive information.

-

What features does airSlate SignNow offer for eSigning documents related to federal tax id numbers?

airSlate SignNow offers features such as customizable templates, in-app signing, and secure document storage specifically designed for managing documents requiring a federal tax id number. You can easily invite signers, set signing orders, and receive notifications once documents are signed. This streamlines your workflow and enhances productivity when dealing with important tax documents.

-

Is airSlate SignNow cost-effective for businesses needing a federal tax id number?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to eSign documents that include a federal tax id number. With various pricing plans, you can choose one that fits your budget while still accessing all the features you need. This way, you can save money on printing and mailing costs associated with traditional document handling.

-

Can I integrate airSlate SignNow with other software when managing federal tax id numbers?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easier to manage documents requiring a federal tax id number alongside your existing systems. Whether you use accounting software, CRM platforms, or cloud storage solutions, our integration capabilities enhance your overall efficiency and document management workflow.

-

What types of businesses need a federal tax id number?

Most businesses, including sole proprietorships, partnerships, and corporations, require a federal tax id number for tax purposes. If you plan to hire employees or operate as a partnership or corporation while using airSlate SignNow, obtaining an EIN is vital. It's an important step to ensure your business meets federal regulations.

-

How do I apply for a federal tax id number?

You can apply for a federal tax id number online through the IRS website, by mail, or by phone. The online application is the fastest method and allows you to receive your EIN immediately. Once you have your federal tax id number, you can use airSlate SignNow to manage documents that require this identification number effectively.

Get more for Federal Tax ID Number

- Nis trinidad 211441069 form

- Privacy act waiver form

- Bank of baroda ppf form pdf download

- Claim your tuition reduction penn state world campus form

- Sealed air ceo introduction communication plan at a glance form

- Application for renewal of certification as a motor vehicle inspector form

- Cameron cougar gear pre order form

- Restricted stock purchase agreement template form

Find out other Federal Tax ID Number

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple