Garnishment Calculation Worksheet Judiciary Form

What is the Garnishment Calculation Worksheet Judiciary

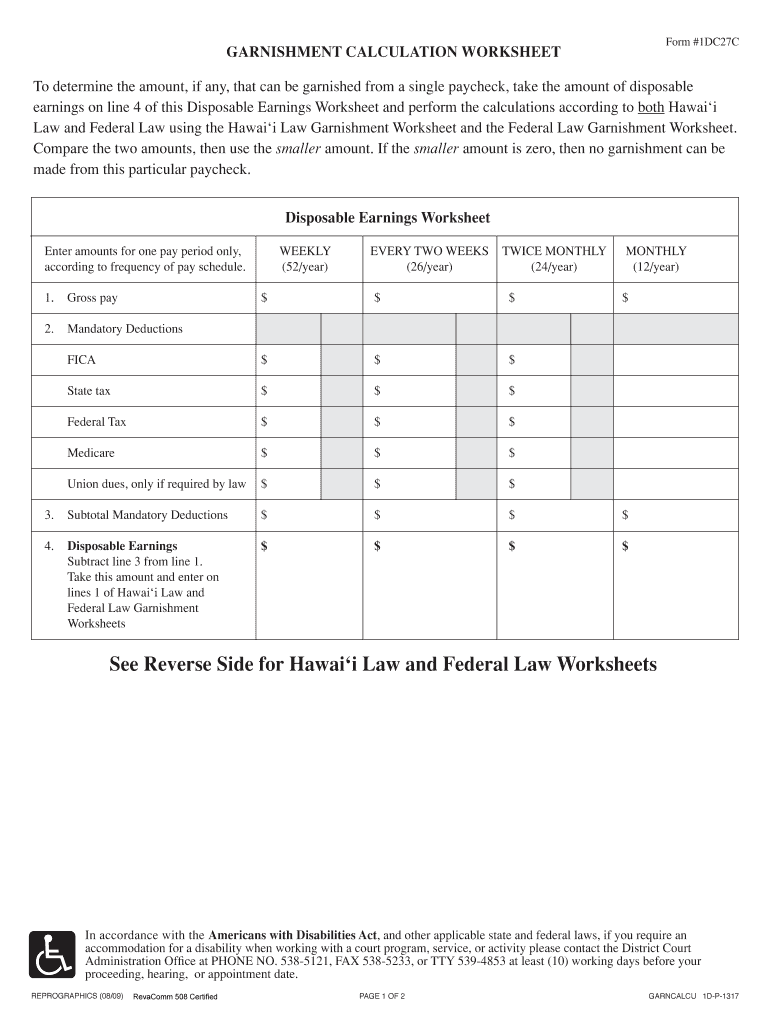

The Garnishment Calculation Worksheet Judiciary is a legal document used to determine the amount of an employee's wages that can be garnished for debt repayment. This form is crucial in ensuring compliance with federal and state laws regarding wage garnishment. It outlines the necessary calculations to ascertain the disposable income available for garnishment after accounting for mandatory deductions such as taxes, Social Security, and health insurance. Understanding this worksheet is essential for both employers and employees involved in wage garnishment scenarios.

How to Use the Garnishment Calculation Worksheet Judiciary

Using the Garnishment Calculation Worksheet Judiciary involves several steps to ensure accurate calculations. First, gather all necessary financial information, including gross wages and deductions. Next, input the gross income into the worksheet. Subtract mandatory deductions to find the disposable income. The worksheet will guide you through the calculations, ensuring that the correct percentage of income is applied based on legal limits. It is important to follow the instructions carefully to avoid errors that could lead to legal complications.

Steps to Complete the Garnishment Calculation Worksheet Judiciary

Completing the Garnishment Calculation Worksheet Judiciary requires a systematic approach:

- Gather relevant financial documents, including pay stubs and deduction information.

- Calculate the total gross income for the pay period.

- Identify and list all mandatory deductions, such as federal taxes and Social Security.

- Subtract total deductions from gross income to determine disposable income.

- Apply the appropriate garnishment percentage based on the type of debt and state laws.

- Document the final garnishment amount on the worksheet for record-keeping.

Key Elements of the Garnishment Calculation Worksheet Judiciary

The Garnishment Calculation Worksheet Judiciary contains several key elements that are essential for accurate calculations:

- Gross Income: The total earnings before any deductions.

- Mandatory Deductions: Required deductions such as taxes, Social Security, and health insurance.

- Disposable Income: The income remaining after mandatory deductions, which is subject to garnishment.

- Garnishment Rate: The percentage of disposable income that can be garnished, which varies by state and type of debt.

- Final Garnishment Amount: The calculated amount that will be withheld from wages.

Legal Use of the Garnishment Calculation Worksheet Judiciary

The legal use of the Garnishment Calculation Worksheet Judiciary is governed by federal and state laws. Employers must use this worksheet to ensure that they are withholding the correct amount from an employee's wages in compliance with legal limits. Failure to adhere to these guidelines can result in penalties for employers, including fines and legal action. Additionally, employees have the right to challenge incorrect garnishment amounts, making the accurate completion of this worksheet vital for both parties.

State-Specific Rules for the Garnishment Calculation Worksheet Judiciary

State-specific rules play a significant role in the garnishment process. Each state has its own laws governing the maximum percentage of wages that can be garnished, as well as the types of debts that are subject to garnishment. It is essential to be aware of these regulations to ensure compliance. Employers and employees should consult their state's guidelines or legal resources to understand the specific requirements applicable to their situation, as failing to follow state laws can lead to complications and disputes.

Quick guide on how to complete garnishment calculation worksheet judiciary

Prepare Garnishment Calculation Worksheet Judiciary easily on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Garnishment Calculation Worksheet Judiciary on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and electronically sign Garnishment Calculation Worksheet Judiciary effortlessly

- Obtain Garnishment Calculation Worksheet Judiciary and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Garnishment Calculation Worksheet Judiciary to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Garnishment Calculation Worksheet Judiciary?

A Garnishment Calculation Worksheet Judiciary is a document used to determine the appropriate amounts for wage garnishments following legal guidelines. It ensures compliance with judicial requirements and accurately calculates deductions from employee wages. This worksheet helps employers navigate complex garnishment laws effectively.

-

How does the airSlate SignNow solution assist with fillable Garnishment Calculation Worksheets?

airSlate SignNow provides an easy-to-use platform to create and fill out Garnishment Calculation Worksheets Judiciary electronically. With our intuitive interface, you can quickly input data, generate worksheets, and enhance the accuracy of your calculations. This solution streamlines the entire process, ensuring compliance and efficiency.

-

Is airSlate SignNow cost-effective for managing Garnishment Calculation Worksheets Judiciary?

Yes, airSlate SignNow offers a budget-friendly solution for managing Garnishment Calculation Worksheets Judiciary. Our plans are designed to accommodate businesses of all sizes, providing robust features at a competitive price point. This ensures that you can manage garnishments without straining your financial resources.

-

What features does airSlate SignNow offer for Garnishment Calculation Worksheets Judiciary?

Our platform includes features like customizable templates, electronic signatures, and secure document storage, all tailored for Garnishment Calculation Worksheets Judiciary. These functionalities enhance workflow efficiency, reduce errors, and maintain compliance with legal standards. With airSlate SignNow, you can simplify your garnishment processes signNowly.

-

Can airSlate SignNow integrate with existing payroll systems for Garnishment Calculation Worksheets Judiciary?

Absolutely! airSlate SignNow offers seamless integrations with various payroll and HR software systems, allowing for an efficient management of Garnishment Calculation Worksheets Judiciary. This integration ensures that data flows smoothly, reducing redundancy and enhancing the accuracy of garnishment calculations.

-

What are the benefits of using airSlate SignNow for Garnishment Calculation Worksheets Judiciary?

Using airSlate SignNow for Garnishment Calculation Worksheets Judiciary helps businesses save time and reduce errors in calculating wage garnishments. Our solution enhances compliance with judicial requirements while providing a secure and efficient platform for document management. You’ll also benefit from an improved workflow and faster processing times.

-

How can I get started with airSlate SignNow for my Garnishment Calculation Worksheets Judiciary?

Getting started with airSlate SignNow is easy! Simply visit our website, sign up for a free trial, and gain immediate access to our tools for creating Garnishment Calculation Worksheets Judiciary. Once registered, you can explore the intuitive features that help you manage and eSign documents with ease.

Get more for Garnishment Calculation Worksheet Judiciary

- 402 name education course date bates box school host teacher cms content bates form

- Il486 1856 form

- Bestelbon cambio kaart cambio carsharing form

- Hdb form b1

- Student demographic update asu form

- Financial assistance application intermountain healthcare intermountainhealthcare form

- Early head start transition plan form

- Technical sop agreement template form

Find out other Garnishment Calculation Worksheet Judiciary

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free