Form C Rev

What is the Form C Rev

The Form C Rev is a specific document used primarily for tax and legal purposes in the United States. It is often associated with the reporting of certain financial information or transactions that require formal acknowledgment by the involved parties. Understanding the purpose and implications of this form is crucial for individuals and businesses alike, as it ensures compliance with applicable laws and regulations.

How to use the Form C Rev

Using the Form C Rev involves several key steps to ensure that it is completed accurately and submitted correctly. First, gather all necessary information required to fill out the form. This may include personal identification details, financial data, or any relevant documentation. Next, carefully complete each section of the form, ensuring that all information is accurate and up to date. Once the form is filled out, it can be submitted electronically or via traditional mail, depending on the specific requirements associated with the form.

Steps to complete the Form C Rev

Completing the Form C Rev involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Review the instructions that accompany the form to understand the requirements.

- Collect all necessary documentation, such as identification and financial records.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check for any errors or omissions before submission.

- Submit the form according to the specified method, whether online or by mail.

Legal use of the Form C Rev

The legal use of the Form C Rev is governed by various regulations that dictate how and when the form should be utilized. For a document to be considered legally binding, it must meet specific criteria, including proper signatures and compliance with eSignature laws. Utilizing a reliable digital platform for signing and submitting the form can enhance its legal standing and ensure that it adheres to relevant legal frameworks.

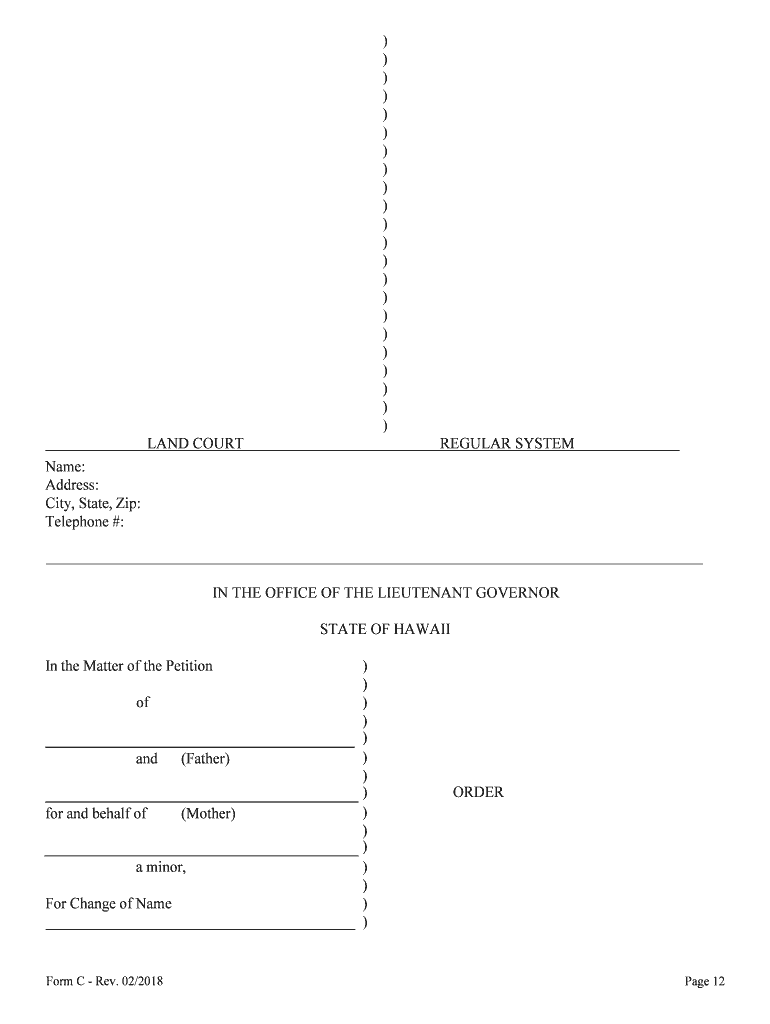

Key elements of the Form C Rev

Several key elements must be included in the Form C Rev for it to be valid. These elements typically encompass:

- Identification information of the parties involved.

- Details of the transaction or information being reported.

- Signatures of the parties, which may require additional verification methods.

- Date of completion and submission to establish a timeline.

Filing Deadlines / Important Dates

Adhering to filing deadlines is critical when dealing with the Form C Rev. Each year, specific dates are set for submission, which can vary based on the nature of the form and the entity involved. It is essential to stay informed about these deadlines to avoid penalties or complications with compliance. Regularly checking official resources or consulting with a tax professional can help ensure timely submission.

Quick guide on how to complete form c rev

Prepare Form C Rev effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the correct form and securely archive it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form C Rev on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form C Rev without any hassle

- Locate Form C Rev and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that function.

- Create your signature with the Sign feature, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Form C Rev to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form C Rev and how does it work with airSlate SignNow?

Form C Rev is a crucial document used for regulatory purposes. With airSlate SignNow, you can easily create, send, and eSign Form C Rev, ensuring compliance and efficiency in your processes. The platform allows for seamless collaboration and real-time tracking, making it a preferred choice for businesses.

-

How much does it cost to use airSlate SignNow for Form C Rev?

airSlate SignNow offers competitive pricing plans tailored to fit different business needs. Depending on your volume of Form C Rev submissions, you can choose a plan that best suits your budget. Additionally, we offer a free trial so you can explore all features before committing to a subscription.

-

What features does airSlate SignNow offer for managing Form C Rev?

airSlate SignNow provides a range of features to simplify the management of Form C Rev. These include customizable templates, secure eSigning, document storage, and automation workflows. This comprehensive set of tools streamlines the entire process from creation to completion.

-

Can I integrate airSlate SignNow with other applications for Form C Rev?

Yes, airSlate SignNow offers integrations with various applications to enhance your workflow for Form C Rev. You can connect with tools like Google Drive, Slack, Salesforce, and more, allowing for a seamless flow of information across platforms. This integration capability boosts productivity and keeps your processes efficient.

-

What are the benefits of using airSlate SignNow for Form C Rev?

Using airSlate SignNow for Form C Rev offers numerous benefits, including time savings, enhanced security, and improved compliance. The platform is designed to simplify the eSigning process, making it easy for all stakeholders to interact with the document. This can signNowly reduce errors and accelerate turnaround times.

-

Is airSlate SignNow user-friendly for completing Form C Rev?

Absolutely! airSlate SignNow is built with an intuitive user interface that simplifies the process of completing Form C Rev. Users can easily navigate the platform to upload, edit, and send documents for eSignature. Training resources and customer support ensure that you can get started quickly and efficiently.

-

How secure is airSlate SignNow when managing Form C Rev?

Security is a top priority at airSlate SignNow, especially for documents like Form C Rev. We use advanced encryption and secure cloud storage to safeguard your sensitive data. Compliance with industry regulations further ensures that your documents are handled with the utmost care and confidentiality.

Get more for Form C Rev

- Letter of authorization to transfer funds or securities form

- Fitt principle eastern ontario health unit form

- Homeowners quote questionnaire bivyb binsuranceb inc form

- Enfamil mixing chart form

- Under the oak tree book 2 form

- Multiple choice geography questions and answers pdf form

- Form 1395

- Saas agreement template form

Find out other Form C Rev

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word