IA DO 1 Form

What is the IA DO 1

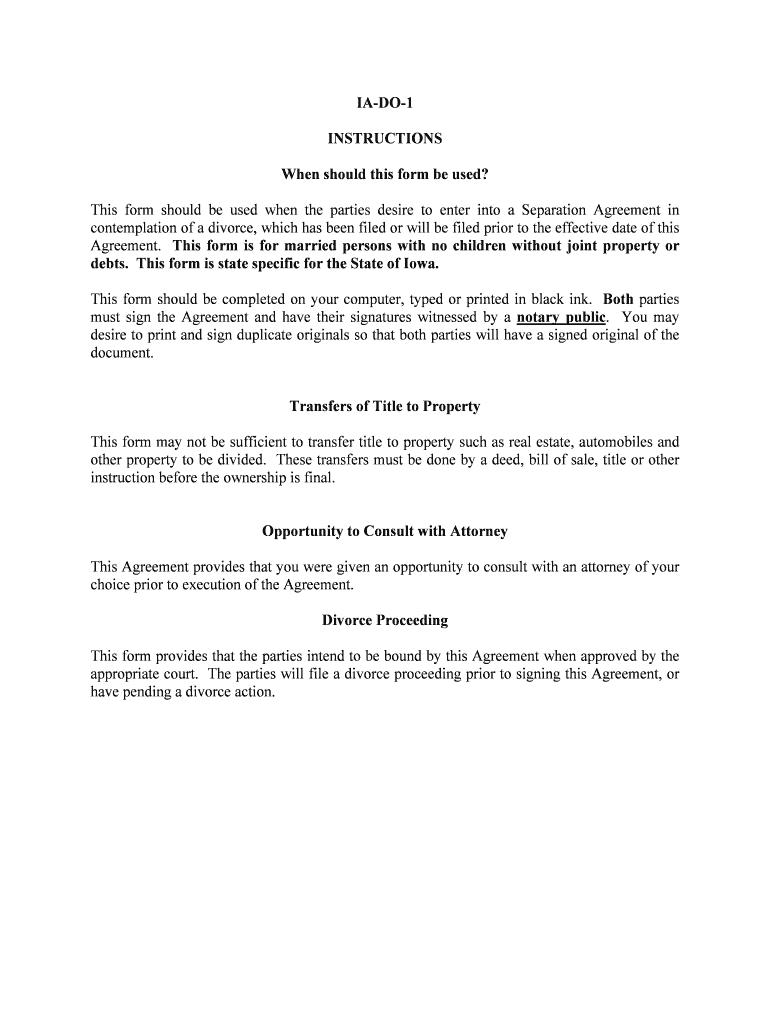

The IA DO 1 form is a crucial document used for reporting income and determining tax obligations in the United States. It is specifically designed for individuals and entities to disclose their income accurately to the Internal Revenue Service (IRS). This form plays a significant role in ensuring compliance with federal tax regulations and helps taxpayers understand their financial responsibilities. The IA DO 1 is essential for various taxpayer scenarios, including self-employed individuals, business owners, and employees with additional income streams.

How to use the IA DO 1

Using the IA DO 1 form involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, complete the form by entering your personal information, including name, address, and Social Security number. Follow the instructions carefully to report your income from various sources accurately. After completing the form, review it for any errors before submitting it to the IRS. Utilizing electronic signature solutions can streamline this process, ensuring that your submission is both secure and compliant.

Steps to complete the IA DO 1

Completing the IA DO 1 form can be straightforward if you follow these steps:

- Gather Documentation: Collect all relevant income statements, including W-2s and 1099s.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Accurately list all sources of income as instructed on the form.

- Review for Accuracy: Check all entries for completeness and correctness.

- Sign and Date: Ensure you sign the form electronically or manually as required.

- Submit the Form: Send the completed form to the IRS using your preferred submission method.

Legal use of the IA DO 1

The IA DO 1 form must be used in compliance with IRS regulations to ensure its legal standing. This includes adhering to deadlines for submission and accurately reporting all income. When completed correctly, the form serves as a legally binding document that can be used in case of audits or disputes. Utilizing a reliable electronic signature solution can enhance the legal validity of your submission by providing an audit trail and ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the IA DO 1 form are critical to avoid penalties. Typically, the form must be submitted by April 15 of each year for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in deadlines, as the IRS may announce extensions or adjustments based on specific circumstances.

Required Documents

To complete the IA DO 1 form, several documents are necessary. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any additional income, such as rental income or dividends

- Documentation of deductions or credits that may apply

Having these documents ready will facilitate a smoother completion process and ensure accurate reporting.

Quick guide on how to complete ia do 1

Effortlessly Prepare IA DO 1 on Any Device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without any holdups. Handle IA DO 1 on any device with the airSlate SignNow apps for Android or iOS, and streamline your document-related tasks today.

How to Edit and eSign IA DO 1 with Ease

- Find IA DO 1 and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark pertinent sections of your documents or obscure sensitive information with the features airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you would like to send your form, either via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign IA DO 1 to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is IA DO 1 and how does it relate to airSlate SignNow?

IA DO 1 is a key term that signifies an integrated approach to digital document management. At airSlate SignNow, we leverage IA DO 1 to provide a seamless platform for sending and eSigning important documents, ensuring your business operates efficiently in the digital landscape.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow is designed to be budget-friendly, catering to businesses of all sizes. With IA DO 1 as our framework, we offer various subscription plans that can scale with your needs, ensuring you receive the best value for your document signing capabilities.

-

What features does airSlate SignNow offer under the IA DO 1 framework?

Under the IA DO 1 framework, airSlate SignNow includes essential features like secure eSigning, document templates, and real-time tracking. These features are designed to enhance your document workflow and improve collaboration within your team.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow supports integration with numerous business applications to enhance your document management workflow. Leveraging IA DO 1, you can seamlessly connect with tools like CRM systems, file storage solutions, and more to streamline your processes.

-

What are the benefits of using IA DO 1 with airSlate SignNow?

Using IA DO 1 with airSlate SignNow not only simplifies your document signing process but also increases overall productivity. This integration allows for automated workflows and better data management, enabling your team to focus on more critical tasks.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes security and uses advanced encryption methods to protect your documents. By utilizing the IA DO 1 framework, we ensure your sensitive information remains confidential and secure throughout the signing process.

-

How can IA DO 1 improve my business's document workflow?

IA DO 1 enhances your business's document workflow by providing an organized and efficient method for sending and signing documents digitally. With airSlate SignNow, you can reduce turnaround times and eliminate the hassles associated with manual paperwork.

Get more for IA DO 1

- Fair market valuation form advanta ira

- Nycers 310 form

- Aaron mcemrys form

- Name probability introduction 1 date class prealgebra the spinner shown is spun once sewanhaka k12 ny form

- Fidelity national title forms

- Certificate of insurance form

- Washington dc scavenger hunt pdf form

- Hotel lease agreement template form

Find out other IA DO 1

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement