Effect to the Prepayments of Principal so that Interest Shall Be Paid Only on the Principal Balance Form

What is the effect to the prepayments of principal so that interest shall be paid only on the principal balance?

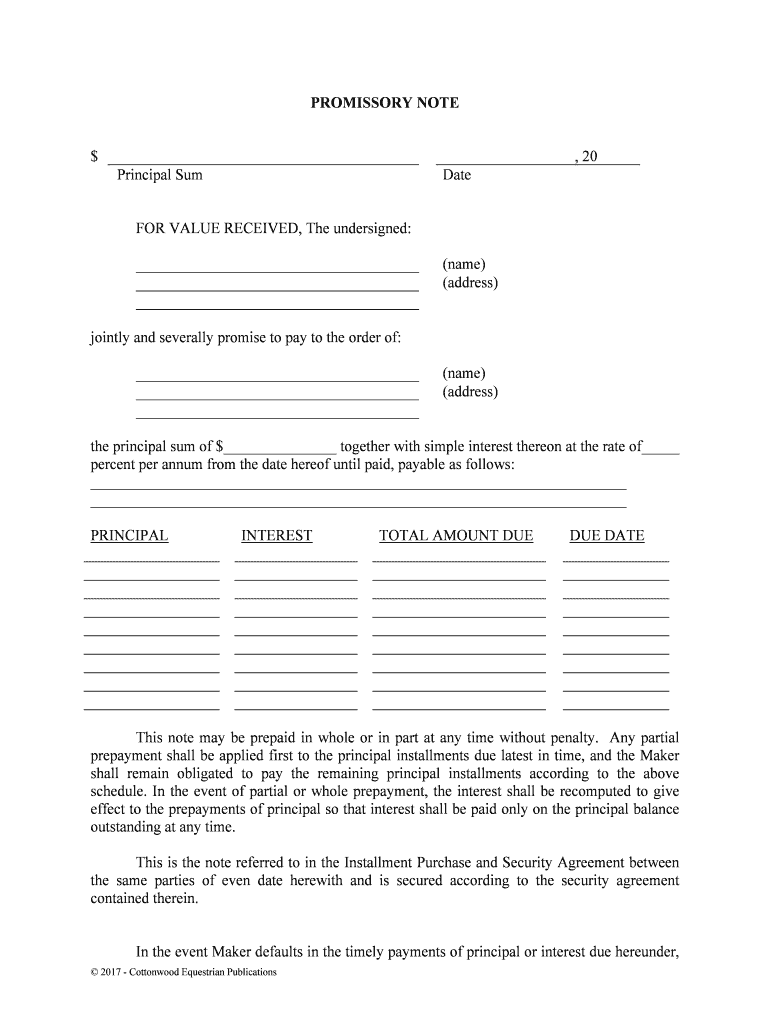

The effect to the prepayments of principal so that interest shall be paid only on the principal balance is a financial arrangement that allows borrowers to make early payments on the principal of a loan. This arrangement ensures that the interest charged is calculated solely on the remaining principal balance after these prepayments. This can lead to significant savings over the life of the loan, as the total interest paid decreases. Understanding this effect is crucial for borrowers looking to manage their debt effectively and minimize interest costs.

How to use the effect to the prepayments of principal so that interest shall be paid only on the principal balance

To effectively utilize the effect to the prepayments of principal, borrowers should first review their loan agreements to confirm if prepayments are allowed without penalties. Once confirmed, borrowers can make additional payments towards the principal at any time. It is advisable to specify that these payments are to be applied to the principal balance rather than future interest. This practice can accelerate the reduction of the overall debt and result in lower interest payments over time.

Steps to complete the effect to the prepayments of principal so that interest shall be paid only on the principal balance

Completing the effect to the prepayments of principal involves several key steps:

- Review your loan agreement for prepayment terms.

- Determine the amount you wish to prepay towards the principal.

- Contact your lender to confirm the process for submitting a prepayment.

- Make the payment and specify that it is for the principal balance.

- Keep a record of the transaction for your financial records.

Legal use of the effect to the prepayments of principal so that interest shall be paid only on the principal balance

The legal use of the effect to the prepayments of principal is governed by the terms outlined in the loan agreement and applicable state laws. Borrowers should ensure that their loan documents explicitly allow for prepayments without penalties. Additionally, understanding the legal implications of prepayments can help avoid potential disputes with lenders. It is advisable to consult with a financial advisor or legal expert if there are any uncertainties regarding the terms of the loan.

Key elements of the effect to the prepayments of principal so that interest shall be paid only on the principal balance

Key elements of this financial arrangement include:

- Prepayment terms specified in the loan agreement.

- The method of applying prepayments to the principal balance.

- Potential penalties or fees associated with early repayment.

- The overall impact on the loan's interest calculation.

- Documentation and record-keeping of all transactions.

Examples of using the effect to the prepayments of principal so that interest shall be paid only on the principal balance

Examples of utilizing the effect to the prepayments of principal include:

- A homeowner making extra payments on their mortgage to reduce the principal faster, thereby lowering future interest payments.

- A business owner applying surplus cash flow to pay down a business loan's principal, which can improve cash flow and reduce interest costs.

- An individual making a lump-sum payment towards their student loan principal to decrease the total interest accrued over the loan's life.

Quick guide on how to complete effect to the prepayments of principal so that interest shall be paid only on the principal balance

Complete Effect To The Prepayments Of Principal So That Interest Shall Be Paid Only On The Principal Balance seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a fantastic eco-friendly option compared to conventional printed and signed papers, allowing you to obtain the right form and securely save it online. airSlate SignNow equips you with all the features necessary to create, edit, and eSign your documents promptly without any holdups. Manage Effect To The Prepayments Of Principal So That Interest Shall Be Paid Only On The Principal Balance on any platform with airSlate SignNow Android or iOS applications and streamline any document-driven process today.

How to edit and eSign Effect To The Prepayments Of Principal So That Interest Shall Be Paid Only On The Principal Balance effortlessly

- Obtain Effect To The Prepayments Of Principal So That Interest Shall Be Paid Only On The Principal Balance and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize key sections of your documents or conceal sensitive details using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Effect To The Prepayments Of Principal So That Interest Shall Be Paid Only On The Principal Balance and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the effect to the prepayments of principal regarding interest payments?

The effect to the prepayments of principal ensures that interest shall be paid only on the principal balance. By making prepayments, borrowers can reduce their overall interest costs, leading to more savings over time. Understanding this concept can help you manage your finances effectively.

-

How can airSlate SignNow assist in managing prepayments?

With airSlate SignNow, you can easily send and eSign financial documents that detail prepayment schedules. This helps ensure clarity in your agreements, including the effect to the prepayments of principal so that interest shall be paid only on the principal balance. Our platform simplifies document management for businesses.

-

Are there any costs associated with processing prepayments through airSlate SignNow?

AirSlate SignNow offers a cost-effective solution for handling all your eSigning needs, including prepayments. There might be varying pricing tiers based on features, but the value you receive in managing the effect to the prepayments of principal so that interest shall be paid only on the principal balance is signNow.

-

What features does airSlate SignNow provide for document management?

AirSlate SignNow includes robust features like document templates, advanced sharing options, and audit trails to track adjustments such as prepayments. These features facilitate understanding the effect to the prepayments of principal so that interest shall be paid only on the principal balance, ensuring transparency in your transactions.

-

Can airSlate SignNow integrate with other financial software?

Yes, airSlate SignNow seamlessly integrates with various financial and accounting software. This integration simplifies the process of managing the effect to the prepayments of principal so that interest shall be paid only on the principal balance, allowing you to maintain accurate financial records.

-

What are the benefits of keeping track of prepayments?

Tracking prepayments can signNowly affect your interest expenses. With the right tools like airSlate SignNow, you can easily manage the effect to the prepayments of principal so that interest shall be paid only on the principal balance, ultimately leading to cost savings and better cash flow management.

-

Is there customer support available for airSlate SignNow users?

Absolutely! AirSlate SignNow provides comprehensive customer support to assist users with any questions regarding features or issues, including understanding the effect to the prepayments of principal so that interest shall be paid only on the principal balance. Our team is ready to help ensure you maximize our platform's benefits.

Get more for Effect To The Prepayments Of Principal So That Interest Shall Be Paid Only On The Principal Balance

- Headache disability index 348562371 form

- State of alaska residential real property transfer disclosure statement form

- Sc dhec bureau of financial management form

- Verification of license collection agency hawaii hawaii form

- Usbr design standards form

- C lim download form

- Mini salonshop employee and independent contractor list tdlr form

- Maine electronic filing payment services form

Find out other Effect To The Prepayments Of Principal So That Interest Shall Be Paid Only On The Principal Balance

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format