Annual Pay Form

What is the Annual Pay

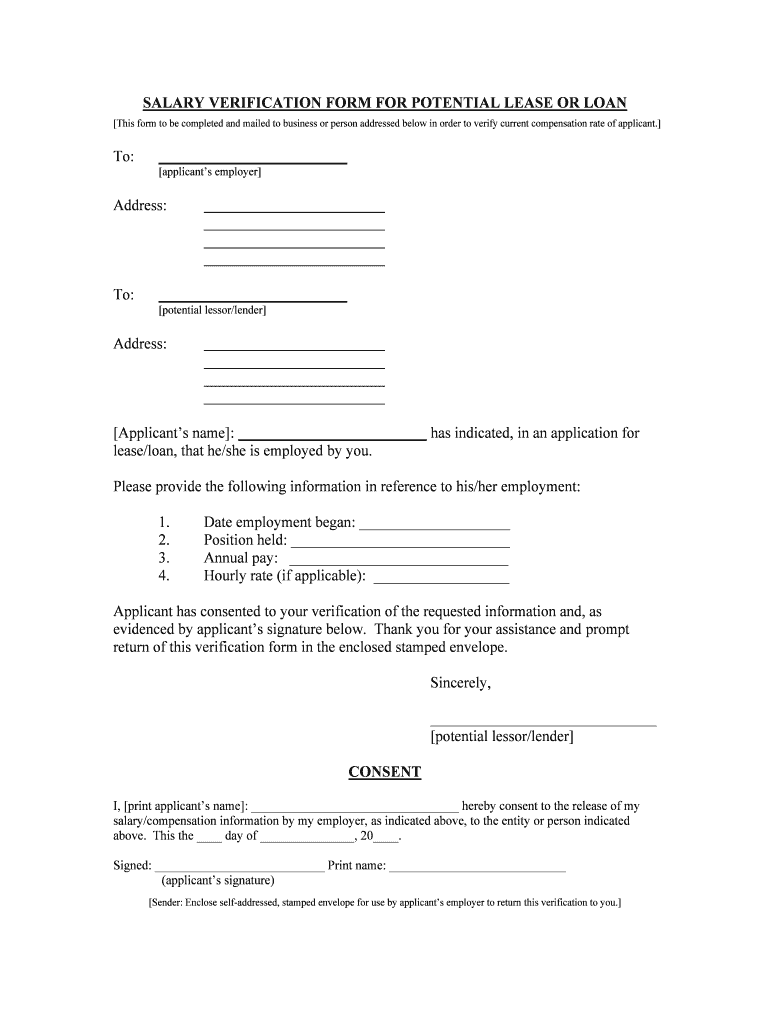

The annual pay form is a crucial document used by employers to report an employee's total earnings over the course of a year. This form typically includes details such as gross income, deductions, and net pay. It serves as an official record for both the employer and employee, ensuring transparency in financial transactions. Understanding this form is essential for accurate tax reporting and compliance with federal and state regulations.

How to use the Annual Pay

Using the annual pay form involves several steps to ensure accuracy and compliance. First, gather all necessary financial information, including total earnings, taxes withheld, and any deductions. Next, fill out the form carefully, ensuring that all figures are correct and reflect the employee's actual compensation. Once completed, the form should be submitted to the appropriate tax authorities or provided to the employee for their records. Utilizing electronic signature solutions can streamline this process, making it easier to complete and submit the form securely.

Steps to complete the Annual Pay

Completing the annual pay form involves a systematic approach:

- Collect all relevant financial documents, such as pay stubs and tax withholding statements.

- Input the employee's total earnings for the year, ensuring accuracy.

- Detail any deductions, including retirement contributions and health insurance premiums.

- Review the form for any errors before finalizing it.

- Submit the form electronically or via mail, depending on the requirements of the tax authority.

Legal use of the Annual Pay

The annual pay form must be completed in accordance with federal and state laws to be considered legally binding. Compliance with the Internal Revenue Service (IRS) guidelines is essential, as improper completion can lead to penalties. Additionally, both employers and employees should keep copies of the form for their records, as it may be required for future reference during audits or tax filings.

Key elements of the Annual Pay

Key elements of the annual pay form include:

- Employee Information: Name, address, and Social Security number.

- Employer Information: Business name, address, and Employer Identification Number (EIN).

- Total Earnings: Gross income before any deductions.

- Deductions: Taxes withheld and other deductions.

- Net Pay: Amount received by the employee after deductions.

Filing Deadlines / Important Dates

Filing deadlines for the annual pay form are critical for compliance. Typically, employers must provide this form to employees by January thirty-first of the following year. Additionally, the form must be submitted to the IRS by the end of February if filed by mail, or by the end of March if filed electronically. Missing these deadlines can result in penalties, so it is important to stay informed about these dates each year.

Quick guide on how to complete annual pay

Effortlessly Prepare Annual Pay on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Annual Pay on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The Simplest Way to Edit and eSign Annual Pay without Stress

- Locate Annual Pay and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Mark important sections of the documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tiresome form searches, or errors that require printing new document copies. airSlate SignNow meets all your needs in document management within just a few clicks from your chosen device. Modify and eSign Annual Pay and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Annual Pay in the context of airSlate SignNow?

Annual Pay refers to the yearly subscription cost for using airSlate SignNow services. By opting for Annual Pay, users can enjoy signNow savings compared to monthly payments while gaining full access to the e-signature platform's features.

-

What features are included in the Annual Pay subscription?

The Annual Pay subscription grants users access to all essential features of airSlate SignNow, including document e-signing, templates, in-person signing, and integrations with third-party applications. This comprehensive package ensures users can effectively manage their e-signature needs year-round.

-

Is there a trial period for the Annual Pay option?

Yes, airSlate SignNow offers a free trial period for potential customers considering Annual Pay. This allows users to explore the platform's functionalities and determine if it suits their business requirements before committing to a yearly subscription.

-

How does Annual Pay impact business savings?

Choosing Annual Pay can lead to cost savings as it typically lowers the overall price compared to monthly payments. Businesses can allocate their budget more effectively, maximizing their return on investment while benefiting from uninterrupted access to airSlate SignNow's services.

-

Can I change my plan after opting for Annual Pay?

Yes, you can change your plan even after choosing Annual Pay. airSlate SignNow provides flexible options to upgrade or modify your subscription based on your evolving business needs, ensuring you always have access to the features that best support your growth.

-

What integrations does airSlate SignNow support with Annual Pay?

With the Annual Pay subscription, users can seamlessly integrate airSlate SignNow with various applications such as Salesforce, Google Drive, and Dropbox. These integrations enhance the platform’s functionality, making it easier to streamline document management and e-signature processes.

-

How can Annual Pay enhance team collaboration?

Annual Pay enables teams to collaborate more efficiently by providing a shared platform for document management and e-signing. With features like real-time notifications and status tracking, team members can stay updated and work together seamlessly on documents.

Get more for Annual Pay

- Stimmzettel vorlage word form

- Advanced life support in obstetrics pdf download form

- Direct seller application form

- Nasa form 1760

- Nursdoc timesheet 338123481 form

- Tax year 502x amended tax return tax year 502x amended tax return form

- Md w2 and form mw508 creation and upload

- Www irs govpubirs access2021 form 1040 espr irs tax forms

Find out other Annual Pay

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online