Tax Year 502X Amended Tax Return Tax Year 502X Amended Tax Return 2023-2026

Understanding the 2023 Form 502X Amended Tax Return

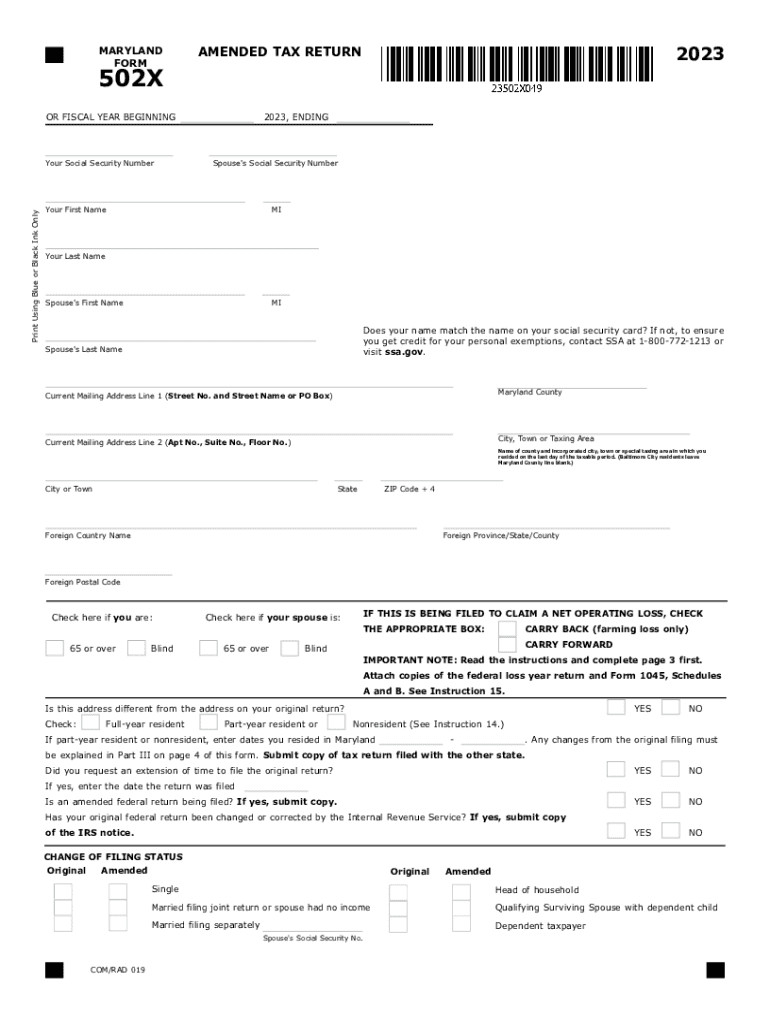

The 2023 Form 502X is the official Maryland Amended Income Tax Return. Taxpayers use this form to correct errors or make changes to their previously filed Maryland tax returns for the tax year 2023. This form is essential for ensuring that your tax records are accurate and up-to-date, potentially affecting your tax liability or refund status.

Common reasons for filing the 2023 Maryland amended return include correcting income, claiming additional deductions or credits, or addressing changes in filing status. It is important to file this form to avoid any penalties or issues with the Maryland Comptroller's office.

Steps to Complete the 2023 Form 502X

Completing the 2023 Form 502X involves several key steps to ensure accuracy and compliance with Maryland tax regulations:

- Gather your original tax return and any relevant documents that support your amendments.

- Clearly indicate the changes you are making on the form, including the correct figures and any explanations for the adjustments.

- Complete all required sections of the form, ensuring that you provide accurate information for each line item.

- Sign and date the form to certify that the information is true and complete.

- Submit the form either electronically or by mail, following the specific submission guidelines provided by the Maryland Comptroller.

Required Documents for Filing the 2023 Form 502X

When filing the 2023 Maryland amended tax return, you need to include certain documents to support your amendments. These may include:

- Your original Maryland tax return for the year being amended.

- Any W-2s, 1099s, or other income statements that reflect the changes.

- Documentation for any additional deductions or credits being claimed.

- Any correspondence from the Maryland Comptroller's office regarding your original return.

Having these documents ready will facilitate a smoother filing process and help resolve any discrepancies quickly.

Filing Deadlines for the 2023 Form 502X

It is crucial to be aware of the filing deadlines for the 2023 Form 502X to avoid penalties. Generally, you should file your amended return within three years from the original due date of the return or within two years from the date you paid the tax, whichever is later. For the 2023 tax year, the deadline typically aligns with the standard tax filing deadlines, so it's advisable to check the Maryland Comptroller's website for specific dates.

Submission Methods for the 2023 Form 502X

You can submit the 2023 Form 502X through various methods:

- Online: If you are using tax preparation software that supports Maryland forms, you may be able to file electronically.

- By Mail: Print the completed form and send it to the appropriate address provided by the Maryland Comptroller.

- In-Person: You may also visit a local Comptroller office to submit your amended return directly.

Choosing the right submission method can help expedite the processing of your amended return.

Common Scenarios for Filing the 2023 Form 502X

Taxpayers may find themselves needing to file the 2023 Form 502X under various circumstances:

- If you realized that you omitted income that should have been reported.

- When you discover that you are eligible for a tax credit that was not claimed on your original return.

- If there were changes in your filing status that affect your tax liability.

Understanding these scenarios can help you determine whether filing an amended return is necessary and beneficial for your tax situation.

Quick guide on how to complete tax year 502x amended tax return tax year 502x amended tax return

Effortlessly Prepare Tax Year 502X Amended Tax Return Tax Year 502X Amended Tax Return on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly solution to conventional printed and signed paperwork, allowing you to access the right form and securely archive it online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and electronically sign your documents without delays. Manage Tax Year 502X Amended Tax Return Tax Year 502X Amended Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

Efficiently Edit and Electronically Sign Tax Year 502X Amended Tax Return Tax Year 502X Amended Tax Return with Ease

- Obtain Tax Year 502X Amended Tax Return Tax Year 502X Amended Tax Return and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for these tasks.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal authority as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Tax Year 502X Amended Tax Return Tax Year 502X Amended Tax Return to ensure exceptional communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year 502x amended tax return tax year 502x amended tax return

Create this form in 5 minutes!

How to create an eSignature for the tax year 502x amended tax return tax year 502x amended tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to amend a Maryland tax return?

Amending a Maryland tax return means making corrections or changes to a previously filed return. This can be necessary for various reasons, such as correcting errors, claiming forgotten deductions, or reporting additional income. It's important to accurately amend your Maryland tax return to ensure compliance and possibly maximize your refund.

-

How can airSlate SignNow help me amend my Maryland tax return?

airSlate SignNow simplifies the process of amending your Maryland tax return by allowing you to easily prepare, send, and eSign your documents online. With its user-friendly interface, you can quickly make necessary adjustments and ensure that all amendments are properly documented. This streamlines your tax amendment process and helps you stay organized.

-

Is there a cost to amend my Maryland tax return using airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include features for eSigning and managing documents, including amending a Maryland tax return. The cost can vary based on the plan you choose, but it remains a cost-effective solution for individuals and businesses alike. It's advisable to check our pricing page for the most accurate information.

-

How long does it take to amend my Maryland tax return with airSlate SignNow?

Using airSlate SignNow, you can amend your Maryland tax return quickly and efficiently. The time it takes to complete your amendment largely depends on the complexity of the changes you are making, but our platform enables you to prepare and send documents within minutes. Expedite your tax amendment process with our streamlined tools and features.

-

What features does airSlate SignNow offer for amending Maryland tax returns?

airSlate SignNow provides several features that can assist you in amending your Maryland tax return, such as customizable templates, easy document sharing, and secure eSigning. These tools are designed to enhance your experience and ensure that your amendments are recorded accurately. You can also track the status of your documents in real-time.

-

Can I use airSlate SignNow on my mobile device to amend my Maryland tax return?

Yes, airSlate SignNow is compatible with mobile devices, allowing you to amend your Maryland tax return on the go. Whether you're at home or traveling, you can access your documents, make necessary changes, and eSign them easily from your smartphone or tablet. Our mobile-friendly platform ensures you stay productive anytime, anywhere.

-

What are the benefits of using airSlate SignNow to amend my Maryland tax return?

Using airSlate SignNow to amend your Maryland tax return comes with numerous benefits, including enhanced efficiency, ease of use, and secure document handling. You can reduce the risk of errors and save time with our intuitive tools designed for tax amendments. Additionally, our platform powers better collaboration among stakeholders involved in the amendment process.

Get more for Tax Year 502X Amended Tax Return Tax Year 502X Amended Tax Return

- Control number ks p020 pkg form

- Control number ks p022 pkg form

- I being of sound mind willfully and voluntarily make this form

- Having executed a declaration on the day of 20 form

- A 65 3220 et seq form

- Kansas city severance reviewhkm employment attorneys form

- Control number ks p027 pkg form

- Control number ks p023 pkg form

Find out other Tax Year 502X Amended Tax Return Tax Year 502X Amended Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors