Ca Form 589 Year

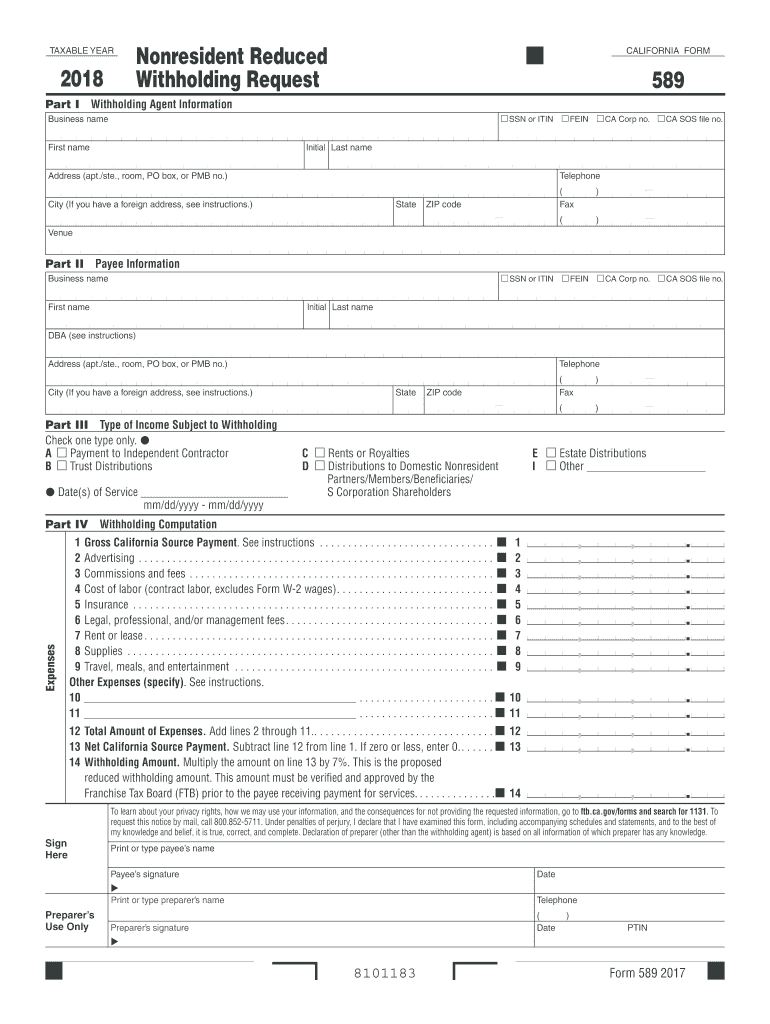

What is the CA Form 589?

The CA Form 589, also known as the California Resident Income Tax Return, is a document used by residents of California to report their income and calculate their state tax obligations. This form is essential for individuals who earn income in California and need to comply with state tax laws. It includes various sections where taxpayers can report their income, claim deductions, and determine their tax liability. Understanding the purpose and requirements of the CA Form 589 is crucial for accurate tax filing and compliance.

Steps to Complete the CA Form 589

Completing the CA Form 589 involves several key steps to ensure accuracy and compliance with state regulations. Here is a simplified process:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include wages, interest, and dividends.

- Claim any applicable deductions, such as standard deductions or itemized deductions.

- Calculate your total tax liability based on the provided tax tables.

- Review the completed form for accuracy before submitting.

Legal Use of the CA Form 589

The CA Form 589 is legally recognized as a valid document for reporting income and calculating taxes owed to the state of California. To ensure its legal standing, it must be completed accurately and submitted by the designated deadlines. The form must be signed, and the information provided must be truthful and complete. Failure to comply with these requirements can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Timely filing of the CA Form 589 is essential to avoid penalties. The general deadline for submitting the form is typically April 15 of each year, aligning with federal tax deadlines. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any specific extensions or changes that may apply in a given tax year.

Form Submission Methods

Taxpayers have several options for submitting the CA Form 589. The form can be filed electronically through approved e-filing services, which often provide a faster processing time and confirmation of receipt. Alternatively, individuals may choose to mail their completed forms to the appropriate state tax office. In-person submissions are also possible at designated tax offices, providing an option for those who prefer direct interaction.

Key Elements of the CA Form 589

The CA Form 589 consists of several key elements that taxpayers must complete to ensure accurate reporting. These include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Total income from various sources.

- Deductions: Applicable deductions that reduce taxable income.

- Tax Calculation: Computation of total tax liability.

- Signature: Required to validate the form.

Quick guide on how to complete ca form 589 year 2012

Effortlessly prepare Ca Form 589 Year on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle Ca Form 589 Year on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Ca Form 589 Year with ease

- Locate Ca Form 589 Year and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ca Form 589 Year while ensuring excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

Can a final year student of B.Tech fill the form of SSC SI CAPF?

Yes, if your final semester result is declared on or before 1 august 2018.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

Create this form in 5 minutes!

How to create an eSignature for the ca form 589 year 2012

How to generate an electronic signature for the Ca Form 589 Year 2012 online

How to create an eSignature for the Ca Form 589 Year 2012 in Google Chrome

How to make an eSignature for signing the Ca Form 589 Year 2012 in Gmail

How to generate an eSignature for the Ca Form 589 Year 2012 straight from your mobile device

How to generate an electronic signature for the Ca Form 589 Year 2012 on iOS devices

How to create an eSignature for the Ca Form 589 Year 2012 on Android

People also ask

-

What is the CA Form 589 Year and why is it important?

The CA Form 589 Year is a crucial document for California residents, used primarily for reporting personal income tax information. Understanding its importance ensures compliance with state tax regulations, helping individuals avoid penalties and make informed financial decisions.

-

How can airSlate SignNow help me with the CA Form 589 Year?

airSlate SignNow simplifies the process of signing and sending the CA Form 589 Year electronically. With our platform, you can easily upload, eSign, and share this form, ensuring a smooth and efficient filing process without the hassle of physical paperwork.

-

What are the pricing options for using airSlate SignNow for the CA Form 589 Year?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses and individuals alike. You can choose from monthly or annual subscriptions that provide unlimited access to eSigning features, making it a cost-effective solution for managing your CA Form 589 Year.

-

Are there any features specifically beneficial for completing the CA Form 589 Year?

Yes, airSlate SignNow includes features like customizable templates, in-app document editing, and multi-party signing, which can greatly enhance your experience when completing the CA Form 589 Year. These features streamline the process, ensuring that you can fill out and submit the form accurately and efficiently.

-

Can I integrate airSlate SignNow with other software to manage the CA Form 589 Year?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems. This allows you to manage your documents, including the CA Form 589 Year, directly from your preferred platforms, enhancing workflow efficiency.

-

Is airSlate SignNow secure for handling the CA Form 589 Year?

Yes, security is a top priority at airSlate SignNow. Our platform uses advanced encryption and secure cloud storage to protect your documents, including sensitive information on the CA Form 589 Year, ensuring that your data remains safe and confidential.

-

How do I get started with airSlate SignNow for the CA Form 589 Year?

Getting started with airSlate SignNow is simple. Just sign up for an account, choose a pricing plan, and you can begin uploading and eSigning your CA Form 589 Year immediately. Our user-friendly interface makes it easy for anyone to navigate the process.

Get more for Ca Form 589 Year

- Commercialnon residential account contract dte energy form

- Naic purchasing group notice form

- Schedule 3k 1 massgov mass form

- Do i qualify for in state tuition towson university towson form

- Tdf 3 oklahoma corporation commission form

- City of peoria az fillable business license form

- Dst 8 form

- Form 760 e2

Find out other Ca Form 589 Year

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile