KS DO 10 Form

What is the KS DO 10

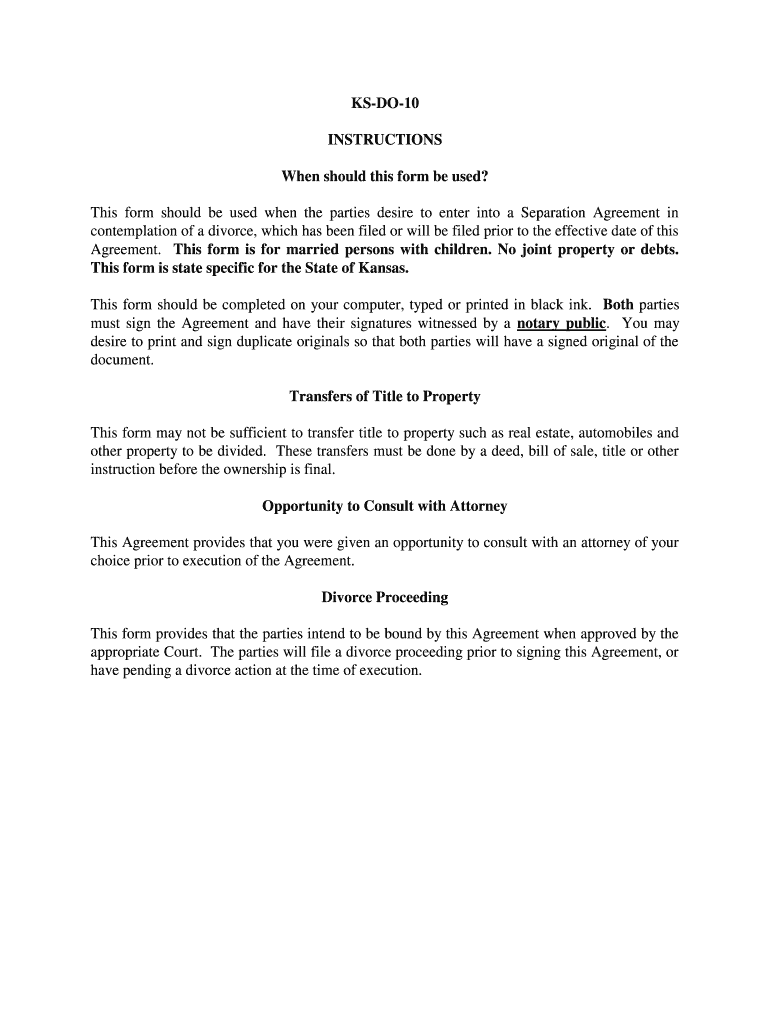

The KS DO 10 form is a document used in the state of Kansas, primarily for reporting and documenting certain financial transactions. It serves as a means for individuals and businesses to comply with state regulations regarding income and tax reporting. Understanding the purpose of the KS DO 10 is essential for ensuring accurate reporting and compliance with state laws.

How to use the KS DO 10

Using the KS DO 10 form involves several key steps. First, gather all necessary financial information relevant to the reporting period. This may include income statements, receipts, and other documentation that supports the figures reported on the form. Next, accurately fill out the form, ensuring that all required fields are completed. After completing the form, review it for accuracy before submission to avoid any potential issues with the state tax authority.

Steps to complete the KS DO 10

Completing the KS DO 10 form involves a systematic approach:

- Gather all necessary financial documents, such as income statements and receipts.

- Fill out the form, ensuring all fields are accurately completed.

- Double-check the information for accuracy and completeness.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal use of the KS DO 10

The KS DO 10 form is legally binding when completed and submitted in accordance with state regulations. It is crucial to ensure that the information provided is truthful and accurate, as discrepancies can lead to penalties or legal repercussions. By using a reliable electronic signature solution, like signNow, individuals can enhance the security and legality of their submissions.

Required Documents

When preparing to complete the KS DO 10 form, certain documents are essential. These include:

- Income statements detailing earnings during the reporting period.

- Receipts for any deductible expenses.

- Previous tax returns, if applicable, for reference.

Having these documents ready will streamline the completion process and ensure all necessary information is accurately reported.

Form Submission Methods

The KS DO 10 form can be submitted through various methods to accommodate different preferences. Options include:

- Online submission via the state tax authority's website.

- Mailing a physical copy to the designated office.

- In-person submission at local tax offices.

Choosing the right submission method can help ensure timely processing and compliance with state regulations.

Quick guide on how to complete ks do 10

Complete KS DO 10 effortlessly on any gadget

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides all the tools necessary to generate, modify, and eSign your files swiftly without delays. Handle KS DO 10 on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to alter and eSign KS DO 10 without any hassle

- Locate KS DO 10 and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your files or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your preference. Edit and eSign KS DO 10 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is KS DO 10 and how does it relate to airSlate SignNow?

KS DO 10 is a powerful feature within airSlate SignNow that enhances document management by enabling quick and secure electronic signatures. This functionality simplifies the signing process, making it easier for businesses to execute documents efficiently. By utilizing KS DO 10, users can streamline their workflow and ensure legal compliance.

-

How much does it cost to use KS DO 10 with airSlate SignNow?

The pricing for KS DO 10 in airSlate SignNow varies based on the features and subscription plan chosen. airSlate SignNow offers affordable tiers tailored for different business needs, allowing users to select a plan that best fits their budget. For detailed pricing, it's best to visit the airSlate SignNow website.

-

What features does KS DO 10 offer for document management?

KS DO 10 provides a range of features including template creation, automated workflows, and real-time tracking of document status. These tools help users manage their documents more effectively and ensure that every step of the signing process is accounted for. This comprehensive functionality enhances productivity and accuracy in document handling.

-

How can KS DO 10 benefit my business?

KS DO 10 can signNowly benefit your business by simplifying the eSigning process and reducing turnaround times for document approvals. By adopting this solution, businesses can eliminate the hassles of paper documents, leading to increased efficiency and reduced operational costs. The convenience of KS DO 10 also improves client satisfaction by providing quicker service.

-

Is it easy to integrate KS DO 10 with other software?

Yes, KS DO 10 is designed to seamlessly integrate with various software applications and platforms. This flexibility allows businesses to connect their existing tools with airSlate SignNow, improving overall workflow without major disruption. You can easily synchronize your data and maintain a cohesive system across your business operations.

-

Can I use KS DO 10 on mobile devices?

Absolutely! KS DO 10 is fully compatible with mobile devices, allowing users to sign documents from anywhere, at any time. The mobile-friendly design of airSlate SignNow ensures that you can manage your document tasks on the go, which is crucial for today's fast-paced business environment.

-

What security measures does KS DO 10 provide for document signing?

KS DO 10 incorporates advanced security measures including encryption and authentication processes to protect your documents during the signing process. airSlate SignNow is committed to ensuring compliance with industry standards, giving users peace of mind while managing sensitive information. These security features help build trust with clients and mitigate risks associated with data bsignNowes.

Get more for KS DO 10

- Adi 3l form 100442101

- City of new berlin fire department fire alarm system test record form newberlin

- Cca form 1496730

- Job performance appraisal form review of optometry

- Medical evaluation form

- Change of contractors town of cary townofcary form

- Radiologic technologist skills checklist 248341082 form

- East valley family physicians authorization to disclose form

Find out other KS DO 10

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple