State Tax Form 214 Mass Gov

What is the State Tax Form 214 Mass gov

The State Tax Form 214 is a specific document used by residents of Massachusetts to report and manage certain tax-related information. This form is essential for individuals and businesses to ensure compliance with state tax laws. It serves various purposes, including reporting income, claiming deductions, and providing necessary information to the Massachusetts Department of Revenue. Understanding the purpose and requirements of this form is crucial for accurate tax filing and avoiding potential penalties.

How to use the State Tax Form 214 Mass gov

Using the State Tax Form 214 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the Massachusetts Department of Revenue.

Steps to complete the State Tax Form 214 Mass gov

Completing the State Tax Form 214 requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all relevant financial documents, such as W-2 forms, 1099s, and any documentation for deductions.

- Access the State Tax Form 214 from the Massachusetts Department of Revenue website or through authorized platforms.

- Fill out the form carefully, ensuring that all required fields are completed.

- Double-check your entries for accuracy, including names, Social Security numbers, and financial figures.

- Submit the completed form electronically or print it for mailing, following the submission guidelines provided.

Legal use of the State Tax Form 214 Mass gov

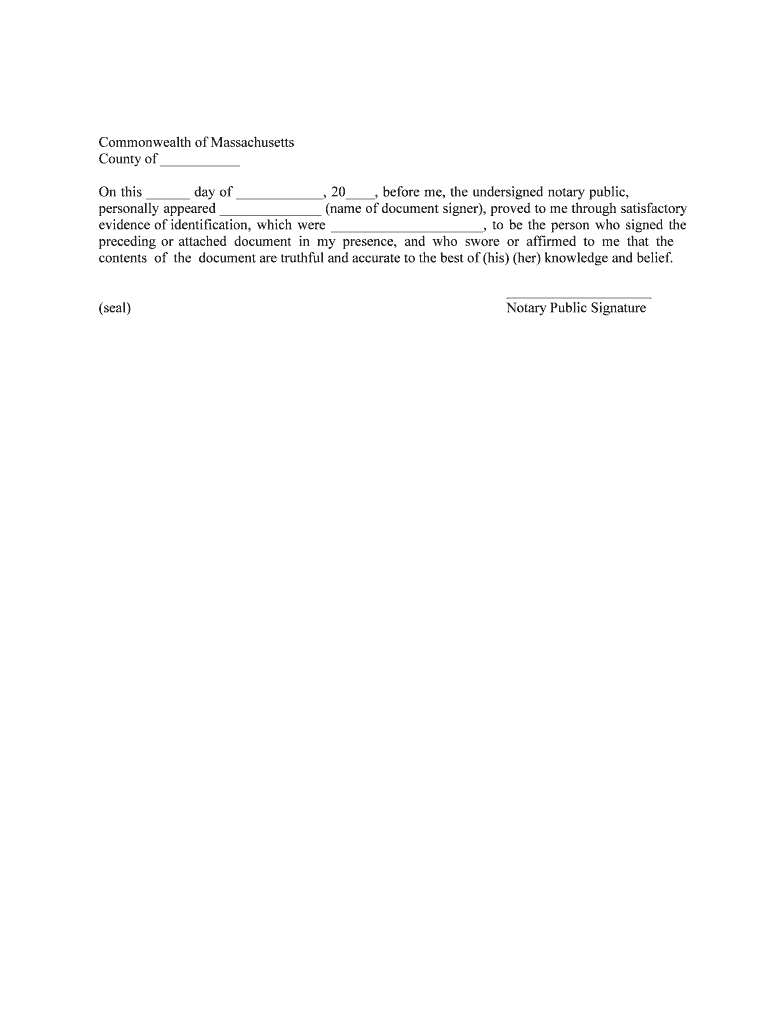

The State Tax Form 214 is legally binding when completed and submitted according to the regulations set forth by the Massachusetts Department of Revenue. To ensure its legal validity, it is essential to provide accurate information and adhere to the filing deadlines. Additionally, using a reliable electronic signature solution can enhance the form's legal standing, as it complies with federal and state eSignature laws. Properly executed, this form can serve as a key document in tax compliance and legal matters.

Key elements of the State Tax Form 214 Mass gov

Several key elements must be included when filling out the State Tax Form 214. These elements typically consist of:

- Personal identification information, including name, address, and Social Security number.

- Income details, including wages, salaries, and any other sources of income.

- Deductions and credits that the taxpayer is eligible for, which can reduce the overall tax liability.

- Signature and date, confirming the accuracy and completeness of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the State Tax Form 214 are crucial to ensure compliance and avoid penalties. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April 15. However, it is advisable to check for any specific state extensions or changes in deadlines that may apply. Keeping track of these important dates helps taxpayers avoid late fees and ensures timely processing of their tax returns.

Quick guide on how to complete state tax form 214 massgov

Effortlessly Prepare State Tax Form 214 Mass gov on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle State Tax Form 214 Mass gov on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

Effortless Methods to Modify and Electronically Sign State Tax Form 214 Mass gov

- Find State Tax Form 214 Mass gov and click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign State Tax Form 214 Mass gov and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the State Tax Form 214 Mass gov?

The State Tax Form 214 Mass gov is a specific form required by the Massachusetts Department of Revenue for businesses to report certain tax-related information. It is essential for ensuring compliance with state tax regulations and should be completed accurately to avoid penalties.

-

How can airSlate SignNow help with the State Tax Form 214 Mass gov?

airSlate SignNow streamlines the process of filling out and submitting the State Tax Form 214 Mass gov by allowing you to easily eSign documents and manage them online. Our platform ensures that all forms are securely stored and accessible, speeding up the filing process.

-

Is airSlate SignNow cost-effective for small businesses needing the State Tax Form 214 Mass gov?

Yes, airSlate SignNow offers flexible pricing plans that cater to small businesses. With our cost-effective solutions, you can efficiently manage the State Tax Form 214 Mass gov without straining your budget while ensuring compliance with state regulations.

-

What features does airSlate SignNow offer for managing the State Tax Form 214 Mass gov?

airSlate SignNow includes features such as customizable templates, cloud storage, and easy eSignature capabilities, specifically aiding in the completion of the State Tax Form 214 Mass gov. These tools enhance productivity and ensure accurate submissions.

-

Can I integrate airSlate SignNow with other software for the State Tax Form 214 Mass gov?

Absolutely! airSlate SignNow seamlessly integrates with various platforms, such as accounting software and document management systems, to assist in processing the State Tax Form 214 Mass gov. This integration helps automate workflows and keeps all data in sync.

-

What are the benefits of using airSlate SignNow for the State Tax Form 214 Mass gov?

Using airSlate SignNow for the State Tax Form 214 Mass gov offers numerous benefits, including time-saving eSignature capabilities, enhanced document security, and easy access to forms. By simplifying the filing process, businesses can focus more on growth and less on paperwork.

-

Is it easy to get started with airSlate SignNow for the State Tax Form 214 Mass gov?

Yes, getting started with airSlate SignNow is incredibly easy. Simply sign up, explore our user-friendly interface, and you can quickly begin managing your State Tax Form 214 Mass gov along with other important documents without any hassle.

Get more for State Tax Form 214 Mass gov

- Mississippi agreement or contract for deed for sale and purchase of real estate aka land or executory contract form

- J2 ead cover letter form

- 1099 fire form

- Fda form 3480

- Zahtjev za kreditkreditnu karticu sberbank form

- Ithaca college sickle cell trait form ithaca

- Aka1908 form

- Academic records college withdrawal form bhcc mass

Find out other State Tax Form 214 Mass gov

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application