F1120s PDF Form 1120 S U S Income Tax Return for an S 2023

Understanding Form 1120-S: U.S. Income Tax Return for an S Corporation

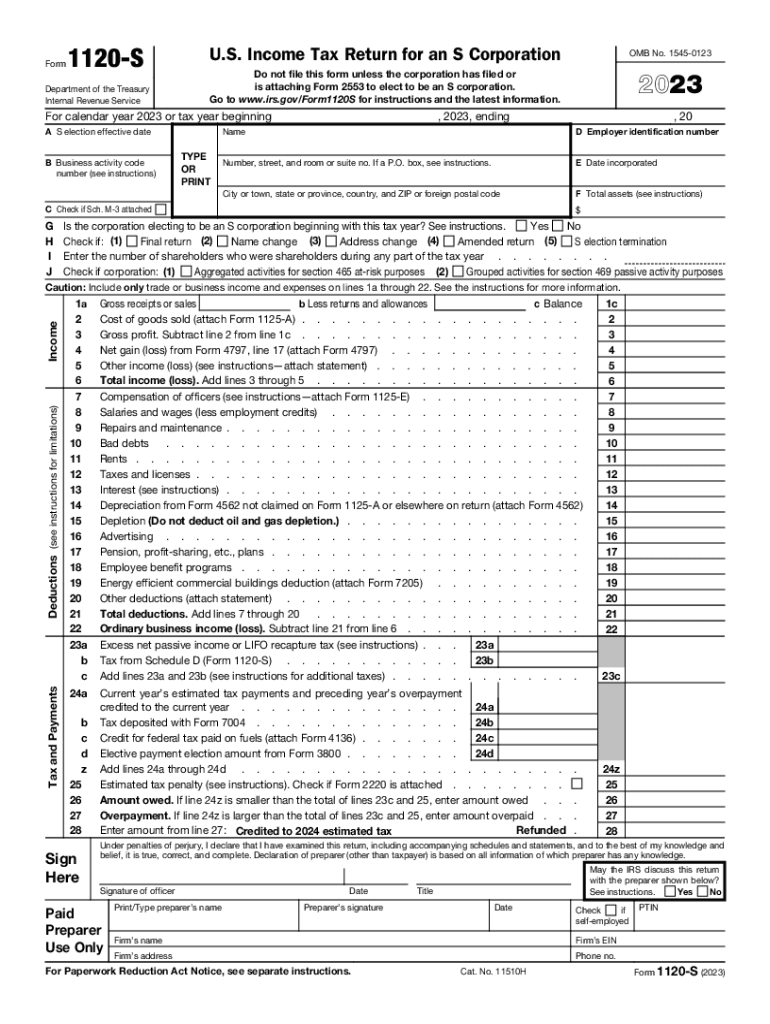

Form 1120-S is the U.S. Income Tax Return specifically designed for S corporations. This form allows S corporations to report income, deductions, gains, losses, and other relevant tax information. Unlike regular corporations, S corporations pass their income directly to shareholders, who then report it on their personal tax returns. This structure helps avoid double taxation, making it a popular choice for small businesses.

Steps to Complete Form 1120-S

Completing Form 1120-S involves several key steps:

- Gather necessary information: Collect all financial statements, including income, expenses, and balance sheets.

- Fill out the form: Start with basic information about the corporation, including its name, address, and Employer Identification Number (EIN).

- Report income: Enter total income from all sources on the appropriate lines.

- Deduct expenses: List all allowable deductions to reduce taxable income.

- Complete schedules: Attach any necessary schedules, such as Schedule K-1, which details each shareholder's share of income.

- Review and sign: Ensure all information is accurate before signing and dating the form.

Key Elements of Form 1120-S

Form 1120-S includes several important sections, each serving a specific purpose:

- Income Section: Reports gross receipts and other income sources.

- Deductions Section: Lists allowable business expenses that can be deducted from income.

- Schedule K: Summarizes the income, deductions, and credits for the S corporation.

- Schedule K-1: Provides each shareholder with their share of the corporation's income, deductions, and credits.

Filing Deadlines for Form 1120-S

The deadline for filing Form 1120-S is typically the 15th day of the third month following the end of the corporation's tax year. For most S corporations operating on a calendar year, this means the due date is March 15. If the deadline falls on a weekend or holiday, it is moved to the next business day. Extensions may be available, but they must be filed before the original due date.

Legal Use of Form 1120-S

Form 1120-S is legally required for S corporations to report their income and pay any applicable taxes. Failure to file this form can result in penalties and interest on any unpaid taxes. Additionally, accurate reporting is essential to maintain S corporation status, as improper filings can lead to the loss of this beneficial tax classification.

Obtaining Form 1120-S

Form 1120-S can be obtained directly from the IRS website or through authorized tax preparation software. Many businesses choose to use digital platforms for ease of access and completion. It is important to ensure that the most current version of the form is used to comply with the latest tax regulations.

Quick guide on how to complete f1120s pdf form 1120 s u s income tax return for an s

Complete F1120s pdf Form 1120 s U s Income Tax Return For An S seamlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without interruptions. Handle F1120s pdf Form 1120 s U s Income Tax Return For An S on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign F1120s pdf Form 1120 s U s Income Tax Return For An S effortlessly

- Locate F1120s pdf Form 1120 s U s Income Tax Return For An S and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you'd like to send your form, either via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign F1120s pdf Form 1120 s U s Income Tax Return For An S to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f1120s pdf form 1120 s u s income tax return for an s

Create this form in 5 minutes!

How to create an eSignature for the f1120s pdf form 1120 s u s income tax return for an s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to tax forms?

airSlate SignNow is a comprehensive e-signature solution that enables businesses to send, sign, and manage documents online. With our user-friendly platform, you can easily prepare and send tax form s for electronic signatures, streamlining your tax filing processes.

-

How much does airSlate SignNow cost for handling tax forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our plans are cost-effective and designed to provide value, especially for those managing multiple tax form s throughout the year.

-

Can I integrate airSlate SignNow with my accounting software for tax forms?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions. This allows you to easily manage your tax form s and maintain a cohesive workflow, ensuring your documents are always up-to-date.

-

What features does airSlate SignNow offer for managing tax forms?

Our platform includes a range of features for managing tax form s, such as template creation, customizable workflows, and status tracking. These tools simplify the process of preparing and obtaining signatures on your tax documents.

-

How secure is the process of signing tax forms with airSlate SignNow?

airSlate SignNow prioritizes security, providing end-to-end encryption for all signed tax form s and documents. Our rigorous security measures ensure that your sensitive information remains protected throughout the signing process.

-

Is it easy to send tax forms for signature with airSlate SignNow?

Absolutely! Sending tax form s for signature with airSlate SignNow is a straightforward process. Simply upload your document, specify the signers, and we’ll take care of the rest, allowing you to focus on your business.

-

What types of tax forms can I manage using airSlate SignNow?

You can manage a variety of tax form s with airSlate SignNow, including 1040s, W-2s, and many more. Our platform supports all standard tax documents, ensuring that you have the right tools to meet your tax filing needs.

Get more for F1120s pdf Form 1120 s U s Income Tax Return For An S

- 1234 5678 9012 3456 form

- Affidavit for cancellation of registration ma form

- Ll bean order form

- Dam questionnaire gls 113 9 16 form

- To petitioner and respondentnotice of exceptiona form

- Imo crew list vistikhetmaar form

- European certificate of succession form

- Solicitud de declaratoria de nacionalidad mexicana por nacimiento dnn 2 form

Find out other F1120s pdf Form 1120 s U s Income Tax Return For An S

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template