Trustors Are Married and the Parents of the Following Living Child Form

What is the Trustors Are Married And The Parents Of The Following Living Child

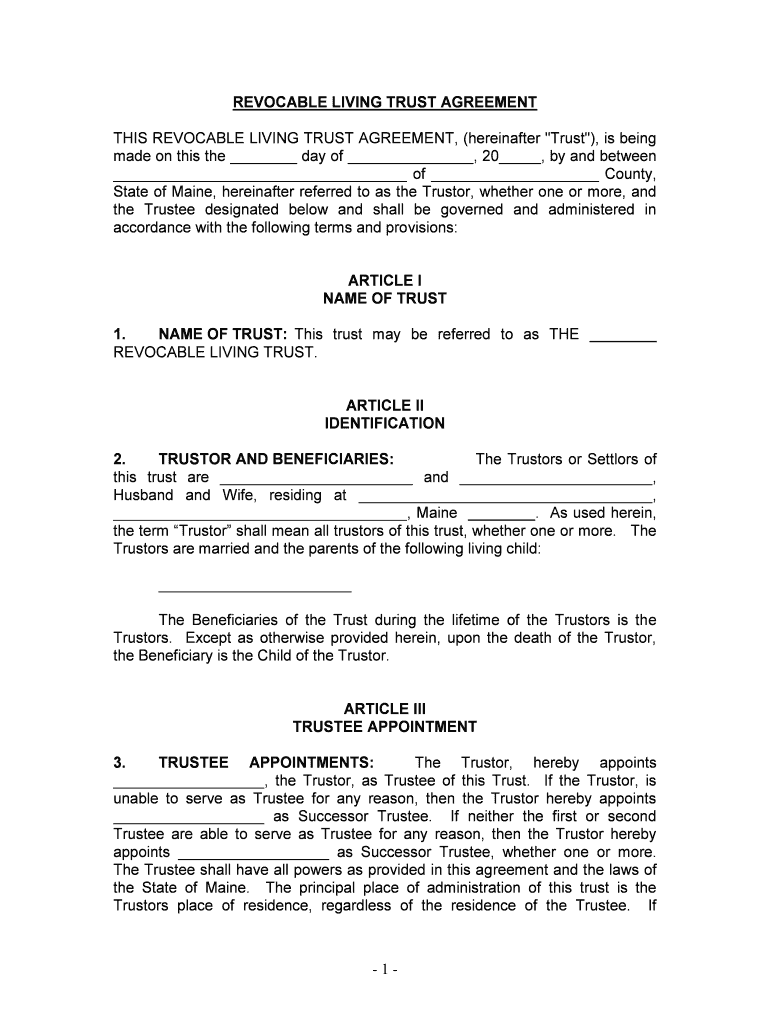

The form titled "Trustors Are Married And The Parents Of The Following Living Child" is a legal document typically used in estate planning. It establishes the trustors as a married couple and identifies their living child. This form is essential for ensuring that the intentions of the trustors regarding their assets and guardianship are clearly documented. By defining the relationship and the beneficiaries, this form helps in the proper management and distribution of the trust upon the trustors' passing or in the event of incapacity.

Steps to complete the Trustors Are Married And The Parents Of The Following Living Child

Completing the "Trustors Are Married And The Parents Of The Following Living Child" form involves several key steps:

- Gather necessary information about both trustors, including full names, addresses, and marital status.

- Identify the living child, providing their full name and any relevant identification details.

- Clearly state the intentions regarding the trust and any specific provisions for the child.

- Review the form for accuracy and completeness before signing.

- Consider having the document notarized to enhance its legal standing.

Legal use of the Trustors Are Married And The Parents Of The Following Living Child

This form serves a critical legal purpose in estate planning. It is recognized by courts as a valid document that outlines the wishes of the trustors regarding their assets and guardianship of their child. To ensure its legal effectiveness, the form must comply with relevant state laws and regulations. Proper execution, including signatures and, if necessary, notarization, is vital for the form to be enforceable in legal contexts.

Key elements of the Trustors Are Married And The Parents Of The Following Living Child

Several key elements must be included in the "Trustors Are Married And The Parents Of The Following Living Child" form:

- The full names of both trustors, confirming their marital status.

- The name of the living child, establishing their relationship to the trustors.

- Details regarding the assets being placed in trust and any specific instructions for their management.

- Signatures of both trustors, affirming their agreement to the terms outlined in the form.

How to use the Trustors Are Married And The Parents Of The Following Living Child

Using the "Trustors Are Married And The Parents Of The Following Living Child" form effectively requires understanding its purpose and how it fits into the broader estate planning process. Once completed, the form should be stored in a secure location, such as with a lawyer or in a safe deposit box. It is advisable to review the form periodically, especially after significant life events, to ensure that it remains up-to-date with the trustors' wishes.

State-specific rules for the Trustors Are Married And The Parents Of The Following Living Child

Each state in the U.S. may have specific rules regarding the execution and validity of the "Trustors Are Married And The Parents Of The Following Living Child" form. It is important for trustors to familiarize themselves with their state's laws, as requirements for notarization, witnesses, and specific language can vary. Consulting with a legal professional can help ensure compliance with state regulations and enhance the document's enforceability.

Quick guide on how to complete trustors are married and the parents of the following living child

Complete Trustors Are Married And The Parents Of The Following Living Child effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can obtain the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Trustors Are Married And The Parents Of The Following Living Child on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Trustors Are Married And The Parents Of The Following Living Child without stress

- Obtain Trustors Are Married And The Parents Of The Following Living Child and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive details using tools specifically offered by airSlate SignNow for that function.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and eSign Trustors Are Married And The Parents Of The Following Living Child and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean when we say 'Trustors Are Married And The Parents Of The Following Living Child'?

The phrase 'Trustors Are Married And The Parents Of The Following Living Child' refers to a legal classification where both trustors are spouses and share children together. This classification impacts the legal documents and estate planning processes, ensuring that their children's rights and inheritance are protected under law.

-

How does airSlate SignNow assist with documents related to trustors who are married and parents?

airSlate SignNow provides an efficient platform for eSigning essential documents that define the roles of 'Trustors Are Married And The Parents Of The Following Living Child.' Our solution makes it easy to create, edit, and finalize documents, ensuring that all legal aspects are properly addressed while saving time.

-

What pricing plans does airSlate SignNow offer for families like 'Trustors Are Married And The Parents Of The Following Living Child'?

airSlate SignNow offers various pricing plans tailored to the needs of families, including those categorically described as 'Trustors Are Married And The Parents Of The Following Living Child.' Our affordable plans allow easy access to all essential features without sacrificing quality.

-

What features does airSlate SignNow provide for creating trusts involving parents?

One of the standout features of airSlate SignNow for trustors is the ability to customize templates that explicitly outline the rights and obligations of 'Trustors Are Married And The Parents Of The Following Living Child.' This ensures that estate planning is thorough and legally sound.

-

Can airSlate SignNow integrate with other tools if we are managing trust documents?

Yes, airSlate SignNow seamlessly integrates with various tools that enhance the management of documents related to 'Trustors Are Married And The Parents Of The Following Living Child.' From cloud storage solutions to CRM systems, our integrations ensure a smooth workflow.

-

What are the benefits of using airSlate SignNow for trust-related documentation?

Using airSlate SignNow for trust-related documents offers signNow benefits, especially for 'Trustors Are Married And The Parents Of The Following Living Child.' These include legal compliance, document security, ease of use, and the ability to quickly execute the necessary agreements with eSignature functionality.

-

Is airSlate SignNow secure for handling sensitive family documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents regarding 'Trustors Are Married And The Parents Of The Following Living Child' are protected with top-notch encryption and secure storage practices. We adhere to strict compliance standards to keep your information safe.

Get more for Trustors Are Married And The Parents Of The Following Living Child

Find out other Trustors Are Married And The Parents Of The Following Living Child

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile