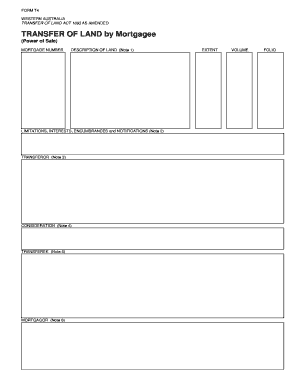

Form T4

What is the Form T4

The Form T4, also known as the Statement of Remuneration Paid, is a tax document used in the United States to report income earned by employees. Employers are required to complete this form to summarize the annual wages paid to employees and the taxes withheld. It plays a crucial role in the tax filing process, as it provides essential information for employees when they prepare their income tax returns. The form includes details such as the employee's name, Social Security number, total earnings, and amounts withheld for federal and state taxes.

How to use the Form T4

Using the Form T4 involves several steps that ensure accurate reporting of income and taxes. First, employers must gather all necessary payroll information for each employee. This includes total wages, tips, and any additional compensation. Next, the employer fills out the form, ensuring that all information is accurate and complete. Once completed, the Form T4 must be distributed to employees and submitted to the IRS by the designated deadlines. Employees will use the information on the form to file their tax returns, ensuring they report their income correctly and claim any applicable deductions.

Steps to complete the Form T4

Completing the Form T4 involves a systematic approach to ensure accuracy. Here are the key steps:

- Gather employee information, including names, Social Security numbers, and total earnings.

- Calculate total wages paid and any additional compensation, such as bonuses or commissions.

- Determine the total amount of federal and state taxes withheld from each employee's pay.

- Fill out the Form T4, ensuring all information is entered correctly.

- Review the completed form for accuracy before distribution.

- Distribute copies to employees and submit the form to the IRS by the deadline.

Legal use of the Form T4

The legal use of the Form T4 is essential for compliance with tax regulations. Employers must accurately report all remuneration paid to employees to avoid penalties. The form must be filed by the deadline set by the IRS, typically by the end of January of the following year. Failure to comply can result in fines and legal consequences for the employer. Additionally, employees rely on the accuracy of the Form T4 to file their taxes correctly, making it a vital document in the tax process.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form T4 is crucial for both employers and employees. The IRS requires that employers provide Form T4 to employees by January thirty-first of each year. Employers must also submit the form to the IRS by the same date. Missing these deadlines can lead to penalties, so it is important to stay organized and ensure timely submission. Employees should be aware of these dates as they prepare their tax returns to ensure they have all necessary documentation.

Who Issues the Form

The Form T4 is issued by employers to their employees. It is the employer's responsibility to ensure that the form is completed accurately and provided to each employee by the required deadline. The IRS also requires employers to submit a copy of the form to them, which helps the agency track income and tax withholdings across the workforce. Accurate issuance of the Form T4 is essential for maintaining compliance with tax laws and ensuring that employees can file their taxes correctly.

Quick guide on how to complete form t4

Prepare Form T4 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Form T4 on any device via airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The easiest method to edit and eSign Form T4 effortlessly

- Obtain Form T4 and then click Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any chosen device. Edit and eSign Form T4 and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form t4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form T4 and why is it important?

A form T4 is a tax document that employers in Canada use to report income earned by employees. It is crucial for employees as it outlines their earnings, tax deductions, and other benefits. Understanding the form T4 helps ensure accurate income reporting during tax season.

-

How can airSlate SignNow help in managing form T4 submissions?

airSlate SignNow provides an efficient way to send and eSign form T4 documents, streamlining the submission and approval process. With its user-friendly platform, employers can quickly prepare the form T4 for distribution to employees, facilitating a seamless experience. This eliminates delays and ensures compliance with tax regulations.

-

What features does airSlate SignNow offer for form T4 processing?

airSlate SignNow features electronic signatures, cloud storage, and customizable templates specifically designed for form T4 processing. These tools enhance workflow efficiency and improve document management. Automating the T4 preparation reduces manual errors and saves signNow time.

-

Is there a cost associated with using airSlate SignNow for form T4?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs for managing form T4 efficiently. The costs are competitive and provide great value for the features offered. You can choose a plan that fits your budget and get started with eSigning form T4 documents today.

-

Can I integrate airSlate SignNow with other applications for form T4?

Absolutely! airSlate SignNow offers integration capabilities with various applications that can help enhance your form T4 management process. You can seamlessly connect with accounting software, CRM systems, and more, making document handling even more efficient. This integration helps maintain a cohesive workflow across your business operations.

-

What are the benefits of using airSlate SignNow for electronic form T4 submissions?

Using airSlate SignNow for electronic form T4 submissions streamlines the entire process, saves time, and reduces paper waste. The platform ensures secure storage and easy access to your documents, making compliance easier. Additionally, electronic signatures provide instant legitimacy to your form T4 submissions.

-

How secure is airSlate SignNow for sending form T4 documents?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect form T4 documents during transmission and storage. This ensures that sensitive employee information is kept confidential. With airSlate SignNow, you can confidently send and manage your form T4 papers securely.

Get more for Form T4

Find out other Form T4

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form