The Lessor Shall Pay All Ad Valorem Taxes Assessed Against the Leased Property Form

What is the lessor shall pay all ad valorem taxes assessed against the leased property?

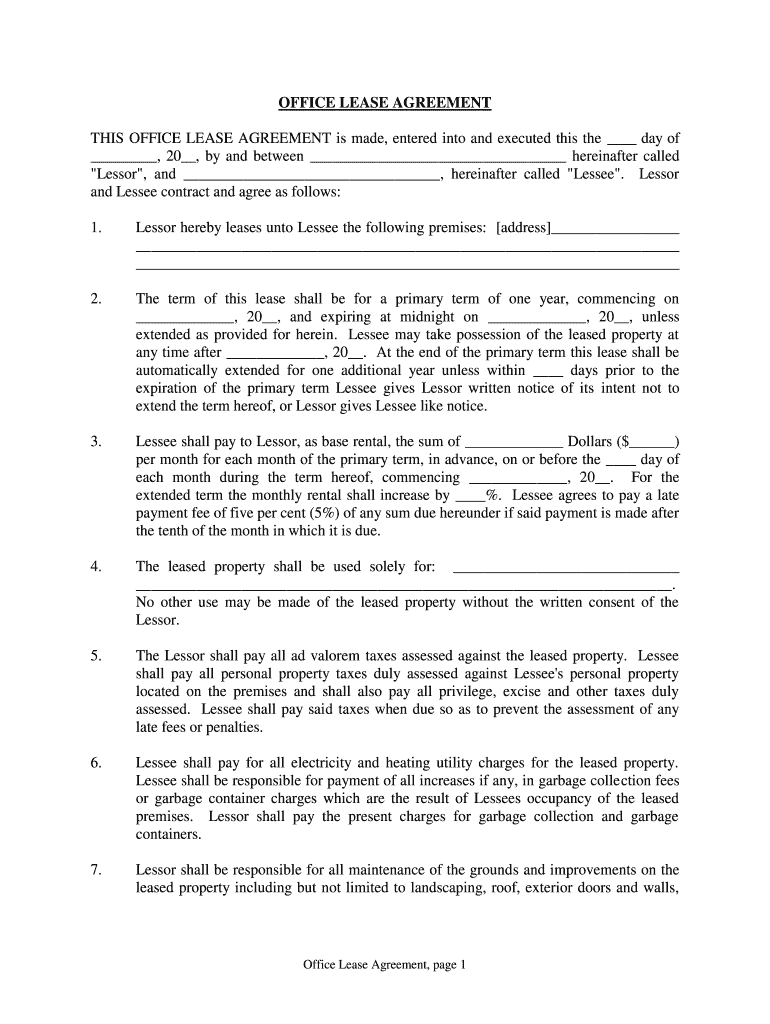

The lessor shall pay all ad valorem taxes assessed against the leased property is a clause typically found in lease agreements. This provision outlines the responsibility of the lessor, or landlord, to cover any property taxes imposed by local or state governments on the leased property. Ad valorem taxes are based on the assessed value of the property and can vary significantly depending on the location and type of property. By including this clause, the lessee, or tenant, is protected from unexpected tax liabilities during the lease term.

Key elements of the lessor shall pay all ad valorem taxes assessed against the leased property

Several key elements are essential for understanding this clause:

- Responsibility: The lessor is explicitly responsible for paying property taxes, ensuring that the lessee is not burdened by these costs.

- Assessment process: The local government assesses the property value, which determines the tax amount owed.

- Lease duration: The clause typically remains in effect for the duration of the lease, providing financial clarity for both parties.

- Compliance: The lessor must ensure timely payment to avoid penalties or liens against the property.

Steps to complete the lessor shall pay all ad valorem taxes assessed against the leased property

Completing the necessary documentation related to this clause involves several steps:

- Review the lease agreement: Ensure that the clause is included and clearly states the lessor's responsibility.

- Verify property assessments: Check local government records for property tax assessments to understand potential costs.

- Maintain communication: Establish a line of communication between the lessor and lessee regarding tax payments and any potential changes in assessments.

- Document payments: Keep records of all tax payments made by the lessor to ensure compliance and transparency.

Legal use of the lessor shall pay all ad valorem taxes assessed against the leased property

This clause is legally binding when included in a lease agreement, provided that it complies with local laws and regulations. It is essential for both parties to understand their rights and responsibilities regarding property taxes. Legal enforceability may vary based on state laws, so consulting with a legal professional is advisable to ensure that the lease agreement is valid and protects the interests of both the lessor and lessee.

State-specific rules for the lessor shall pay all ad valorem taxes assessed against the leased property

Each state in the U.S. may have specific regulations regarding property taxes and lease agreements. It is crucial for both lessors and lessees to familiarize themselves with local laws governing ad valorem taxes. This knowledge can help avoid disputes and ensure proper compliance with tax obligations. Additionally, some states may have exemptions or special provisions that could affect the tax liability of the lessor, making it essential to consult state tax codes or legal experts.

Examples of using the lessor shall pay all ad valorem taxes assessed against the leased property

Practical examples of this clause in action can illustrate its importance:

- A commercial lease agreement includes this clause, ensuring that the landlord pays property taxes, allowing the tenant to focus on business operations without worrying about unexpected tax bills.

- A residential lease specifies that the lessor is responsible for ad valorem taxes, providing peace of mind to the tenant that their rent will not increase unexpectedly due to tax assessments.

Quick guide on how to complete the lessor shall pay all ad valorem taxes assessed against the leased property

Complete The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property effortlessly on any gadget

Managing documents online has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to locate the right template and securely archive it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without interruptions. Manage The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property effortlessly

- Locate The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Edit and eSign The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property' mean?

'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property' refers to the obligation of the lessor to cover all property taxes assessed on the leased area. This ensures that the lessee will not incur the financial burden of property taxes during the lease period, providing peace of mind.

-

How does airSlate SignNow simplify the lease document process?

With airSlate SignNow, businesses can quickly draft, send, and eSign lease documents that include stipulations like 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property.' This simplifies the administration of lease agreements by ensuring clarity and compliance.

-

Can I customize templates for leases in airSlate SignNow?

Yes, airSlate SignNow allows you to customize lease templates. You can include specific clauses such as 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property' to tailor the document to your needs while ensuring it meets all legal requirements.

-

Are there any costs associated with using airSlate SignNow?

Yes, while airSlate SignNow is a cost-effective solution, pricing varies based on the features you need. The platform offers plans to accommodate different business sizes, ensuring functionality—including clauses like 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property.'

-

What features does airSlate SignNow offer for managing lease agreements?

airSlate SignNow provides various features for managing lease agreements, including eSigning, document storage, and customizable workflows. These features help ensure that conditions like 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property' are clearly documented.

-

Can I integrate airSlate SignNow with other business applications?

Absolutely! airSlate SignNow supports integrations with many popular business applications. This means you can automate processes and maintain important clauses like 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property' throughout your business operations.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security with robust encryption and compliance measures. Your lease documents, including those that specify 'The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property,' are protected from unauthorized access.

Get more for The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property

- Code of conduct due to legal restrictions it is n form

- Banner permit applicationdepartment of streets form

- 643 quince street mendota ca 93640 form

- Redbook forms 495611469

- Tree bank registration form

- 8 kentucky eye examination form for school en

- Applications and formslake worth texasbuilding permits lake worth beachbuilding permits lake worth beachlake worth texas

- Corporate sponsorship form doc

Find out other The Lessor Shall Pay All Ad Valorem Taxes Assessed Against The Leased Property

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document