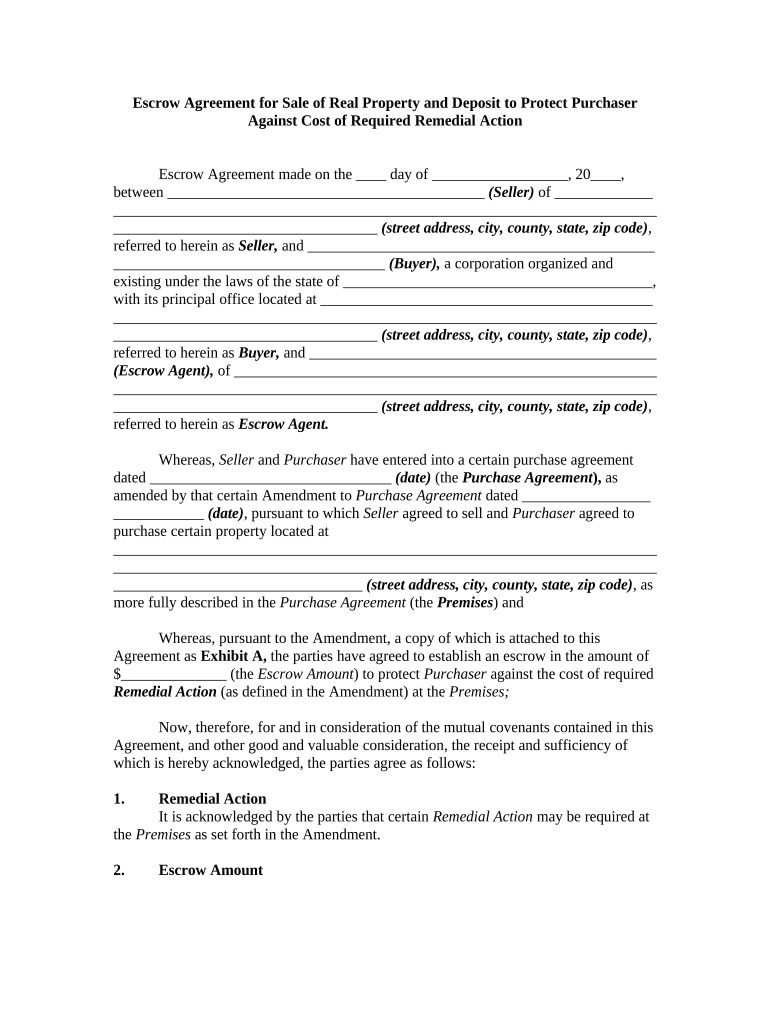

Escrow Agreement Form

What is the escrow agreement?

An escrow agreement is a legally binding contract that details the terms and conditions under which a neutral third party holds funds or assets during a transaction. This arrangement ensures that both the buyer and seller fulfill their obligations before the transfer of ownership occurs. In the context of a real estate transaction, for instance, the escrow agreement outlines how the sale deposit will be handled and specifies the conditions that must be met for the sale to proceed. The use of an escrow agreement provides a layer of security for both parties involved in the transaction.

Key elements of the escrow agreement

Understanding the key elements of an escrow agreement is essential for both buyers and sellers. The primary components typically include:

- Parties involved: Clearly identifies the buyer, seller, and escrow agent.

- Deposit amount: Specifies the sale deposit amount to be held in escrow.

- Conditions for release: Outlines the specific conditions that must be met for the funds or assets to be released from escrow.

- Timeline: Establishes a timeline for the transaction, including deadlines for fulfilling conditions.

- Dispute resolution: Details the process for resolving any disputes that may arise during the transaction.

Steps to complete the escrow agreement

Completing an escrow agreement involves several important steps. First, both parties must agree on the terms and conditions outlined in the agreement. Next, they should select a reputable escrow agent who will manage the transaction. Once the escrow agent is chosen, the buyer typically submits the sale deposit, which is held securely until the conditions of the agreement are met. Throughout the process, both parties should maintain open communication with the escrow agent to ensure a smooth transaction. Finally, once all conditions are satisfied, the escrow agent will release the funds or assets to the appropriate party.

Legal use of the escrow agreement

The legal use of an escrow agreement is governed by various laws and regulations that vary by state. In the United States, the agreement must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) to ensure that electronic signatures are recognized as valid. It is crucial for all parties involved to understand their rights and responsibilities under the agreement to avoid potential legal issues. Consulting with a legal professional can provide additional clarity on how to navigate these regulations effectively.

How to use the escrow agreement

Using an escrow agreement effectively requires a clear understanding of its purpose and the responsibilities of each party. The buyer and seller should first review the agreement to ensure that all terms are acceptable. Once agreed upon, the buyer submits the sale deposit to the escrow agent, who will hold it until the transaction is complete. Throughout the process, both parties should fulfill their obligations as outlined in the agreement. If any issues arise, they should communicate with the escrow agent to resolve them promptly, ensuring that the transaction remains on track.

Required documents for the escrow agreement

When preparing to enter into an escrow agreement, several documents are typically required. These may include:

- Identification: Valid identification for all parties involved.

- Purchase agreement: A signed purchase agreement detailing the terms of the sale.

- Sale deposit form: Documentation of the sale deposit amount being placed in escrow.

- Additional disclosures: Any necessary disclosures related to the property or transaction.

Quick guide on how to complete escrow agreement

Easily Prepare Escrow Agreement on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and electronically sign your documents quickly without delays. Manage Escrow Agreement on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

How to Edit and Electronically Sign Escrow Agreement Effortlessly

- Obtain Escrow Agreement and click Get Form to begin.

- Utilize the tools available to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how to send your form, either by email, text message (SMS), invite link, or download it to your computer.

No more concerns about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Escrow Agreement and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an escrow sale?

An escrow sale is a transaction where a third party holds the funds or documents until all conditions of the sale are met. This ensures both the buyer and seller fulfill their obligations before the transfer is complete. It's a secure way to conduct transactions, signNowly reducing the risk of fraud.

-

How does airSlate SignNow facilitate an escrow sale?

airSlate SignNow provides an easy-to-use platform that allows businesses to send and eSign documents associated with an escrow sale. Our solution streamlines the signing process, ensuring that all parties can access and complete documents securely. This not only saves time but also enhances the overall efficiency of the transaction.

-

What are the benefits of using airSlate SignNow for escrow sales?

Using airSlate SignNow for escrow sales offers several benefits, including increased security, improved compliance, and convenience. Our cost-effective solution allows for seamless document management, ensuring that all necessary paperwork is completed promptly. This helps expedite the escrow process, providing peace of mind to both buyers and sellers.

-

Can airSlate SignNow integrate with other escrow management tools?

Yes, airSlate SignNow can easily integrate with various escrow management tools. This allows users to enhance their workflow by combining our eSigning capabilities with the features of their preferred escrow software. Such integrations ensure that all necessary actions are streamlined, making escrow sales more efficient.

-

What pricing plans does airSlate SignNow offer for businesses handling escrow sales?

airSlate SignNow offers a range of pricing plans tailored to meet the needs of businesses managing escrow sales. Our plans are designed to be cost-effective, providing excellent value for companies of varying sizes. By choosing the right plan, you can maximize efficiency while keeping costs in check.

-

How secure is the airSlate SignNow platform for escrow sales?

The airSlate SignNow platform prioritizes security, utilizing advanced encryption protocols to protect sensitive data during escrow sales. We ensure that all eSigned documents are securely stored and accessible only to authorized parties. This commitment to security helps build trust between buyers and sellers.

-

What features make airSlate SignNow ideal for escrow transactions?

airSlate SignNow offers a variety of features that make it ideal for escrow transactions, including customizable workflows, secure eSigning, and real-time tracking of document status. These tools facilitate the smooth execution of an escrow sale, ensuring that all parties can stay updated throughout the process. Our user-friendly interface also enhances the overall experience.

Get more for Escrow Agreement

Find out other Escrow Agreement

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter