Prior Work Experience Collection Form St Cloud

What is the experience collection form printable?

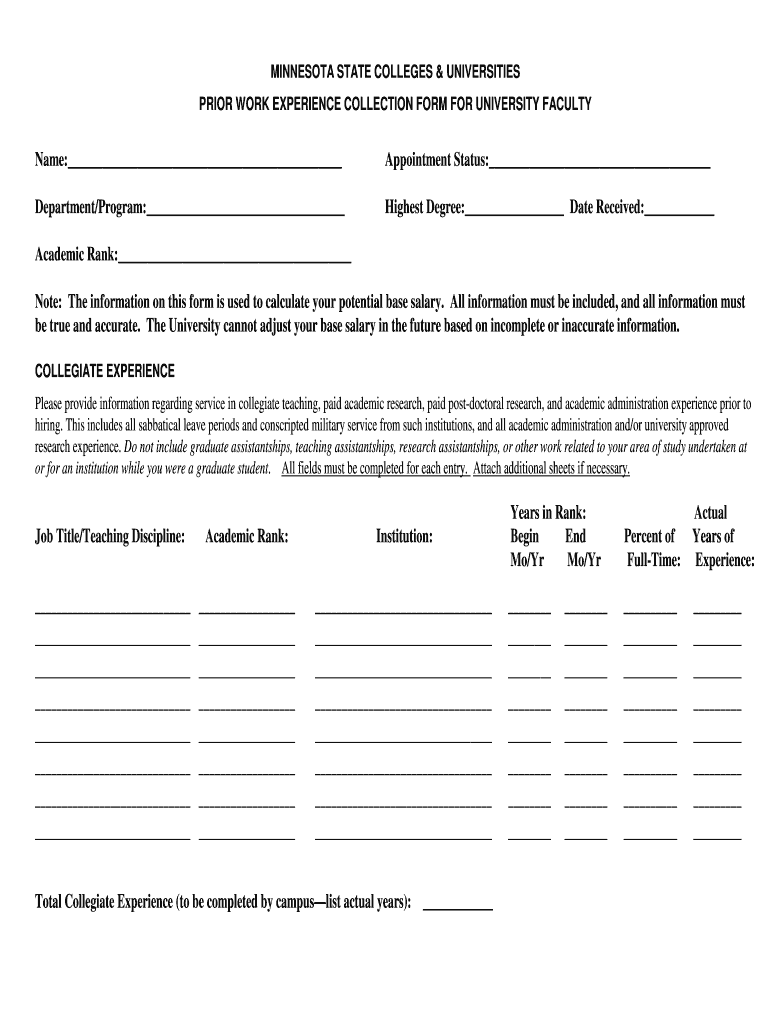

The experience collection form printable is a standardized document used to gather information about an individual's prior work experience. This form is essential for various purposes, such as job applications, educational programs, or professional licensing. It typically includes sections for personal details, employment history, job titles, responsibilities, and dates of employment. By providing a clear and organized format, the form helps employers or institutions evaluate a candidate's qualifications and background effectively.

How to use the experience collection form printable

Using the experience collection form printable involves several straightforward steps. First, download and print the form, ensuring you have the latest version. Next, fill in your personal information, including your name, contact details, and any relevant identification numbers. Proceed to list your previous jobs chronologically, detailing your job titles, the names of employers, and the duration of your employment. Be sure to highlight your key responsibilities and achievements in each role. After completing the form, review it for accuracy and completeness before submitting it as required.

Steps to complete the experience collection form printable

Completing the experience collection form printable requires attention to detail. Follow these steps for a thorough submission:

- Begin by entering your full name and contact information at the top of the form.

- List your work history in reverse chronological order, starting with your most recent job.

- For each position, include the job title, employer's name, location, and dates of employment.

- Detail your primary responsibilities and any notable achievements for each role.

- Double-check all entries for accuracy, ensuring there are no typos or missing information.

- Sign and date the form to verify that the information provided is true and complete.

Legal use of the experience collection form printable

The experience collection form printable is legally recognized when completed accurately and honestly. It serves as a formal declaration of your work history, which may be used in legal contexts, such as employment verification or background checks. To ensure its legal validity, it is important to provide truthful information and to sign the document. Misrepresentation or falsification of details can lead to serious consequences, including job termination or legal action.

State-specific rules for the experience collection form printable

Different states may have specific rules regarding the use of the experience collection form printable. It is essential to be aware of any local regulations that may affect how the form is completed or submitted. For example, some states may require additional documentation or have specific guidelines for verifying employment history. Familiarizing yourself with these requirements can help ensure compliance and enhance the credibility of your submission.

Examples of using the experience collection form printable

The experience collection form printable can be utilized in various scenarios. For instance, job seekers may use it to present their work history to potential employers during the application process. Educational institutions may require it for admissions into programs that assess prior work experience as part of their criteria. Additionally, professionals seeking licensing or certification in certain fields may need to submit this form to demonstrate their qualifications. Each of these examples highlights the form's versatility and importance in various professional contexts.

Quick guide on how to complete prior work experience collection form st cloud

Easily Prepare Prior Work Experience Collection Form St Cloud on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a sustainable alternative to traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Prior Work Experience Collection Form St Cloud on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to Edit and Electronically Sign Prior Work Experience Collection Form St Cloud Effortlessly

- Find Prior Work Experience Collection Form St Cloud and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Prior Work Experience Collection Form St Cloud to ensure effective communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What forms do I need to fill out to sue a police officer for civil rights violations? Where do I collect these forms, which court do I submit them to, and how do I actually submit those forms? If relevant, the state is Virginia.

What is relevant, is that you need a lawyer to do this successfully. Civil rights is an area of law that for practical purposes cannot be understood without training. The police officer will have several experts defending if you sue. Unless you have a lawyer you will be out of luck. If you post details on line, the LEO's lawyers will be able to use this for their purpose. You need a lawyer who knows civil rights in your jurisdiction.Don't try this by yourself.Get a lawyer. Most of the time initial consultations are free.

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the prior work experience collection form st cloud

How to generate an eSignature for the Prior Work Experience Collection Form St Cloud in the online mode

How to make an eSignature for the Prior Work Experience Collection Form St Cloud in Chrome

How to create an eSignature for signing the Prior Work Experience Collection Form St Cloud in Gmail

How to make an electronic signature for the Prior Work Experience Collection Form St Cloud from your smart phone

How to make an electronic signature for the Prior Work Experience Collection Form St Cloud on iOS devices

How to create an eSignature for the Prior Work Experience Collection Form St Cloud on Android devices

People also ask

-

What is the Prior Work Experience Collection Form St Cloud?

The Prior Work Experience Collection Form St Cloud is a customizable document designed to gather information about a candidate's previous employment. Utilizing airSlate SignNow, you can easily create, send, and eSign this form, streamlining your hiring process. This form helps ensure you have all necessary details about a candidate's work history efficiently.

-

How can airSlate SignNow help with the Prior Work Experience Collection Form St Cloud?

With airSlate SignNow, you can effortlessly create the Prior Work Experience Collection Form St Cloud, allowing for quick customization to fit your needs. The platform provides user-friendly tools for document management, making it simple to send for signatures and track responses. This enhances your hiring efficiency and ensures a professional approach.

-

Is there a cost associated with using the Prior Work Experience Collection Form St Cloud?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, including the use of the Prior Work Experience Collection Form St Cloud. You can choose a plan that best fits your budget and requirements, allowing you to manage and eSign documents cost-effectively. Check our pricing page for detailed information on subscription options.

-

Can I integrate the Prior Work Experience Collection Form St Cloud with other tools?

Yes, airSlate SignNow allows seamless integration with various third-party applications, enhancing the functionality of the Prior Work Experience Collection Form St Cloud. You can connect it with your HR software, CRM, or productivity tools, ensuring a smooth workflow and efficient data management. This integration boosts overall productivity for your hiring process.

-

What are the benefits of using the Prior Work Experience Collection Form St Cloud?

Using the Prior Work Experience Collection Form St Cloud simplifies the recruitment process by ensuring all candidate information is collected in a standardized manner. This form, facilitated by airSlate SignNow, reduces paperwork and speeds up the hiring timeline. Additionally, eSigning enhances security and compliance, making your recruitment process more reliable.

-

How secure is the Prior Work Experience Collection Form St Cloud?

The Prior Work Experience Collection Form St Cloud created with airSlate SignNow is designed with security in mind. The platform employs advanced encryption and authentication measures to protect your sensitive data throughout the signing process. This ensures that both your candidates' information and your organization's compliance needs are met.

-

Can I customize the Prior Work Experience Collection Form St Cloud?

Absolutely! The Prior Work Experience Collection Form St Cloud is fully customizable within the airSlate SignNow platform. You can modify fields, add company branding, and tailor the content to meet your specific hiring needs, ensuring that the form aligns with your organizational requirements and standards.

Get more for Prior Work Experience Collection Form St Cloud

- A guide to paying federal taxes electronically for tax form

- Irs publication 3598 form

- Instrucciones i 9 form

- Instrucciones para la verificacin de elegibilidad de form

- Trial notebook for child welfare attorneys in georgias form

- Circuit court orphans court for form

- 2016 form 8453 pe us partnership declaration for an irs e file return irs

- 8453 pe 2020 form

Find out other Prior Work Experience Collection Form St Cloud

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form