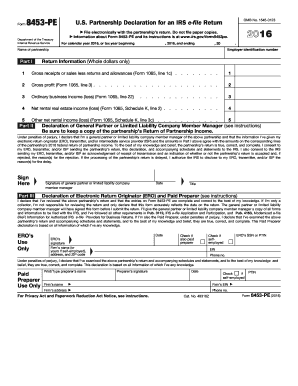

Form 8453 PE U S Partnership Declaration for an IRS E File Return Irs 2016

What is the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs

The Form 8453 PE U S Partnership Declaration for an IRS e-file return is a crucial document for partnerships filing their tax returns electronically. This form serves as a declaration that the partnership's electronic return is complete and accurate. It must be signed by an authorized partner and submitted to the IRS as part of the e-filing process. The form helps ensure that the IRS has a record of the partnership's intent to file electronically, thereby streamlining the filing process and reducing the likelihood of errors.

Steps to Complete the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs

Completing the Form 8453 PE involves several key steps. First, gather all necessary information regarding the partnership, including the partnership's name, address, and Employer Identification Number (EIN). Next, ensure that the electronic return is prepared and ready for submission. The authorized partner must then review the return for accuracy before signing the form. After signing, the form should be submitted along with the electronic return to the IRS. It is important to retain a copy of the signed form for your records.

Legal Use of the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs

The legal use of the Form 8453 PE is essential for the validity of the e-filed return. This form acts as a declaration that the electronic submission is accurate and complete, and it must be signed by an authorized partner. The IRS recognizes e-signatures as legally binding, provided they comply with federal regulations. Utilizing a secure e-signature platform ensures that the form is executed in accordance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws.

Key Elements of the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs

The key elements of the Form 8453 PE include the partnership's identification information, the signature of an authorized partner, and a declaration of the accuracy of the electronic return. Additionally, the form requires the date of signature and may include information about the preparer if applicable. These elements are crucial for confirming the legitimacy of the e-filed return and ensuring compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8453 PE. These guidelines outline the necessary information required on the form, the process for signing electronically, and the importance of maintaining records of the submission. It is essential for partnerships to adhere to these guidelines to avoid potential penalties and ensure a smooth filing process. Familiarizing oneself with the IRS instructions can help clarify any uncertainties regarding the form's requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8453 PE align with the deadlines for submitting the partnership's tax return. Generally, partnerships must file their tax returns by the fifteenth day of the third month following the end of their tax year. For partnerships operating on a calendar year, this means the deadline is March 15. It is crucial to submit the Form 8453 PE and the associated electronic return by this date to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 8453 PE must be submitted electronically along with the partnership's e-filed tax return. While the form itself is part of the electronic submission process, partnerships must ensure that all components of their return are filed according to IRS guidelines. Unlike paper forms, the e-filed return and the Form 8453 PE do not require separate mailing or in-person submission, streamlining the overall filing process.

Quick guide on how to complete 2016 form 8453 pe us partnership declaration for an irs e file return irs

Complete Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs with ease

- Obtain Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to deliver your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misfiled documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 8453 pe us partnership declaration for an irs e file return irs

Create this form in 5 minutes!

People also ask

-

What is the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs?

The Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs is a declaration form that partnerships must file to confirm their electronic tax return submission. This form serves as an affirmation of accuracy and compliance with IRS regulations regarding e-filing. Completing this form accurately ensures that your partnership’s tax obligations are correctly reported.

-

How can airSlate SignNow help with the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs?

airSlate SignNow simplifies the process of completing and eSigning the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs. Our platform provides user-friendly features that streamline document preparation, signing, and submission. This helps ensure timely compliance with the IRS requirements without the hassle of manual paperwork.

-

What are the pricing options for using airSlate SignNow for IRS forms?

airSlate SignNow offers a variety of pricing plans tailored to fit different business needs. Our plans provide access to essential features for handling documents like the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs at competitive rates. By choosing the right plan, you can ensure cost-effective management of your eSigning and document workflow needs.

-

Are there integrations available for using the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs?

Yes, airSlate SignNow integrates seamlessly with various platforms to enhance your workflow. You can connect our solution with accounting software, CRMs, and other business tools, making it more efficient to manage the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs. These integrations save time and reduce the likelihood of errors during the filing process.

-

What features does airSlate SignNow offer for handling IRS forms?

airSlate SignNow includes features like secure eSigning, document templates, and real-time tracking for IRS forms, including the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs. You can store your documents securely and access them anytime, ensuring that you have everything you need at your fingertips. These features improve efficiency and compliance for your tax filing processes.

-

What are the benefits of using airSlate SignNow for eFiling tax forms?

Using airSlate SignNow for eFiling tax forms like the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs offers numerous benefits. It reduces paperwork, enhances security through encrypted connections, and provides an audit trail for accountability. Additionally, our user-friendly platform accelerates the signing process, allowing for quicker submissions to the IRS.

-

Is there customer support available for assistance with IRS form submissions?

Yes, airSlate SignNow provides dedicated customer support to assist users with their IRS form submissions, including the Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs. Our support team is available through various channels, ensuring that you receive help whenever you need it. Whether you have questions about eSigning or document management, we're here to guide you.

Get more for Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs

Find out other Form 8453 PE U S Partnership Declaration For An IRS E file Return Irs

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word